Scott Malpass and Notre Dame: Keeping the faith for 32 years

by charles | Comments are closed03/31/2021

The most notable CIO-centric event of 2020 in the endowment world was undoubtedly the retirement of Scott Malpass as chief investment officer at Notre Dame.

Mr. Malpass was just a dewy 25 years old and relatively inexperienced when Notre Dame recruited him as “assistant investment officer” in 1988.

He was already effectively in charge that year, but decorously waited for his predecessor to retire in 1989 to officially take the CIO title.

In 2020 he punched out as smoothly as he had punched in.

His successor, Michael Donovan, had been Mr. Malpass’ wingman for 20 years. They had been undergraduate classmates (and roommates) in ND’s class of 1984, making them both about 58 in 2020.

Although he is ferociously devoted to his school, Mr. Malpass chose not to hang on until standard retirement age. Instead he passed the baton early enough to leave plenty of career runway for his colleague and successor.

Badly executed successions can be ruinous in institutional investing. The examples have been too notorious to list. This is how the pros do it.

Mr. Malpass had 32 years in harness when he stepped down last year and was the longest-serving endowment CIO we know of, with the prominent exception of Yale’s David Swensen, 35 years and counting.

Longevity is great (at least for the incumbent) but it’s performance that counts. And, although the Yale endowment is far more prominent, Notre Dame’s performance has been remarkably good, and only very slightly behind the top northeastern schools. Casual observers may have missed that.

Mr. Swensen has earned his fame. But we suspect that the attention paid to Yale and the relative inattention to Notre Dame has much to do with the regional chauvinism of the financial press.

For the media, a Catholic college in Indiana will never have quite the cachet of the Ivy League.

Take a look at our 5-year performance numbers below. Allowing for ties, the 5-year return ranking is:

No. 1: Brown (9.8)

No. 2: MIT (9.0)

No. 3: Rockefeller/ Bowdoin (tie) (8.5)

No. 4: Yale/ Dartmouth/ UTIMCO (tie) (7.8)

No. 5: Notre Dame/ Princeton/ Williams (tie) (7.7)

By this reckoning, the recent performance of the Notre Dame Model is just a whisker behind the Yale Model. In fact, Notre Dame beat Yale in 3 of the last 4 years.

This is so interesting that we thought we should reach back to our longer-term Yale versus Notre Dame dataset.

Twenty years is a nice, round number, and we can’t think of any other such pairing that could put the same two long-serving CIOs head to head. But we pushed back 21 years to capture the Dotcom Meltdown beginning in the second half of that fiscal year.

Notre Dame versus Yale endowment performance

FY 2000-2020

Read More »Building the Next OCIO Powerhouse

by charles | Comments are closed02/18/2021

Growing a discretionary asset management or investment advisor business is tough.

We have yet to see an independent Outsourced Chief Investment Officer firm reach $100 Billion AUM through organic growth.

Most of them will never even reach $20 Billion.

Of the thirteen firms managing $50 billion or more on our annual OCIO list, only one – Alan Biller and Associates – launched as a pure-play OCIO and consulting start-up. And they’re just over the $50 Billion line.

|

OCIO Over $100bn AUM |

AUM (as of 6-30-20) |

|

Mercer |

$305.9 |

|

Russell Investments |

$234.7 |

|

BlackRock |

$228.0 |

|

SEI |

$181.0 |

|

Goldman Sachs |

$168.0 |

|

AON Hewitt |

$162.7 |

|

Willis Towers Watson |

$148.0 |

|

State Street Global Advisors |

$145.6 |

|

|

$1,573.9 |

|

OCIO $50bn to $100bn AUM |

AUM (as of 6-30-20) |

|

Northern Trust |

$88.7 |

|

Wilshire Associates |

$73.4 |

|

JP Morgan Asset Mgmt |

$63.3 |

|

Vanguard |

$57.0 |

|

Alan Biller and Associates |

$51.1 |

|

|

$333.5 |

Total OCIO assets have been growing briskly, at more than 15 percent annually (In the 12 months July 2019 to June 2020).Most except Biller began as financial mega-firms long before OCIOs were even invented. Several have roots stretching far back into the nineteenth century. JPM goes all the way back to the 1800s!

Independent OCIOs and RIAs have not been able to grow their way into this select company, and probably never will.

Why is this?

But it’s scattered among dozens of relatively small firms.

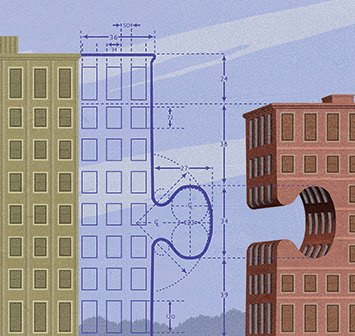

The solution seems obvious: Do it the old-fashioned way. Grow by acquisition and aggregation. Buy, sell, and merge firms. That’s how the mega-financials have done it.

It’s a well-understood historical process. Railways, utilities, steelmakers, banks, brewers, hotels, airlines all grew like this.

The boffins at Harvard Business School call it the Industry Consolidation Lifecycle. (See: https://hbr.org/2002/12/the-consolidation-curve) It’s easy to see after the fact, but much harder when we’re all floundering through it in real time.

And yet, for most OCIOs under $50 Billion, there seems to be a deep aversion to mergin’.

Read More »Northwestern Lands CIO Amy Falls

by charles | Comments are closed02/02/2021

Almost exactly ten years ago we reported with great interest Amy Falls’ move from Chief Investment Officer at Phillips Academy (aka Phillips Andover) to the CIO job at Rockefeller University.

Five years ago we interviewed Ms. Falls in Manhattan and marked her as someone to watch when a top-tier endowment position opened up. (See “Coffee with Amy” below.)

Now, it has just been announced that she’ll be moving on to Northwestern University. She’ll lead their $12.2 billion endowment, succeeding William McLean as CIO.

Clearly she impressed Northwestern’s search committee by leading the Rockefeller endowment to consistently excellent performance.

But not everyone may have noticed just how excellent it was.

By our reckoning she is in the top 10 among all US endowments over those ten years – ranking ninth out of ten to be exact.

Paula Volent at Bowdoin ranks first for 2011-2020, with 11.6 percent.

All the other endowment big guns (MIT, Yale, Dartmouth, Princeton, Williams, Notre Dame, Brown, Carnegie Mellon) and their renowned CIOs are strung out between 11.4 and 9.5 percent for ten years. Ms. Falls squeezed past Debbie Kuenstner at Wellesley with 9.6 percent.

But she was even more impressive in the second half of her decade at Rockefeller.

As she increasingly put her own stamp on their allocations, she surged even closer to the top of the pack.

Over the last five years, 2016-2020, her return tied with Paula Volent at Bowdoin for third-ranking among all US (and Canadian!) endowments with 8.5 percent. They were surpassed only by Brown and MIT, with 9.8 and 9.0 percent, respectively.

As she has moved up to head bigger funds her comp has grown proportionately.

She made about $800K at Andover. At Rockefeller her pay rose to about $1.5 million by 2020. And now, at Northwestern, we estimate that her comp will be well north of $2 million.

Amy’s Excellent Network

Read More »Jon Hirtle and the OCIO Juggernaut

by charles | Comments are closed12/01/2020

OCIO Growth Tops 15.8 Percent in 2020

Our latest Outsourced Chief Investment Officer report features a list of 104 OCIO firms, each with updated contact information and AUM numbers. It’s the most comprehensive and accurate available.

We also have a deep-dive interview with Jon Hirtle, a pivotal leader in the industry he helped create.

We invite both institutions and high-net-worth families to check out our list – below and on our website – and call a few of the firms if you’re in the market for money-management help.

It may not be as exciting as Tinder, but it could still be the start of a beautiful new relationship!

Observations on a Plague Year

2020 was a strange and tumultuous year.

But, after trudging through a cruel pandemic, rancorous politics, and vertiginous markets, there still seems to be some hope left in the world.

In the OCIO industry, for example, managers have amassed an additional $431 billion AUM over the last twelve months, topping out at a record $2.812 Trillion as of 30 June 2020.

That’s a year-over-year growth of 15.8 percent!

And yet, as we’ve noted in past reports, the same big six – Aon, Blackrock, Goldman Sachs, Mercer, Russell, and Willis Towers Watson – still manage almost half (45%) the OCIO money.

A few firms sold themselves to larger players in 2020. Athena Capital Advisors joined Franklin Templeton, Focus Financial Partners acquired CornerStone Partners, and private equity investors CC Capital and Motive Partners teamed up to buy Wilshire Associates.

We’ve been charting the growth of the OCIO industry for over a decade in our annual OCIO reports and the heirs of Hirtle, big and small, seem (mostly) to have flourished.

Jon Hirtle of Hirtle Callaghan hatched the concept of an “independent investment office” managing family and institutional money over thirty years ago.

The idea was conceptually simple, but not necessarily easy to execute – or to market: take the proven success of sophisticated multi-billion-dollar investment offices and deliver those same benefits to smaller institutions and high-net-worth families at fees they could afford.

Four decades later we see not only independent firms like Hirtle Callaghan and Alan Biller and Associates, but also giants like JPMorgan, Blackrock, Vanguard, and AON; and boutiques like Edgehill and Disciplina. It’s a big, wonderfully diverse industry and, as we’ve seen, still growing briskly.

Jon Hirtle and the OCIO Juggernaut

Mr. Hirtle was born in a small town outside of Pittsburgh. He had a very American boyhood; working with horses, learning to fish, camping with the Boy Scouts, and playing football.

At fifteen he and a classmate hiked several hundred miles on the Appalachian Trail – by themselves. The following summer he landed a job in Wyoming after typing (remember typing?) 100 letters to all the ranches advertising in the back of Outdoor Life magazine.

That first summer in Wyoming he dug ditches, built fence, rode broncs (the fun part according to Jon) and fell in love with the west.

As a Penn State undergrad he studied pre-veterinary medicine, walked onto the football team, appeared in musicals, joined a fraternity and, most importantly, met Debby, his wife of over 40 years and counting.

After graduation, Jon joined the Marines where he earned honors in officer training, led troops overseas, trained recruits at Parris Island and finally, returned to Penn State to recruit more candidates for officer training and earn an MBA.

After the Marine Corps he headed for Wall Street and Goldman Sachs.

And that’s where the story of OCIO begins.

Read More »Casey Family Programs and Joseph Boateng CIO: Investing for Children in Need

by charles | Comments are closed11/09/2020

Our November newsletter looks at one of the country’s biggest and most effective operating foundations – the $2.5 billion AUM Casey Family Programs (CFP) in Seattle – and Joseph Boateng, the man who manages the money.

An “operating” foundation uses most of its resources to run its own, internally-managed charitable programs. Among the 86,000 foundations in the U.S. totaling $715 billion in assets, almost all are grant-makers. Only 5 percent run their own charities as CFP does. This has implications, as we shall see, for their investment program.

In 1907, 19-year-old Jim Casey and his 18-year-old pal Claude Ryan between them had one bicycle and $100 borrowed from a friend. They set up the American Messenger Company, operating out of a hotel basement in Seattle. The automobile was still a novelty and aviation barely existed. His brother George and a few friends worked as messengers.

The tiny bike-messenger company grew into mighty UPS, with an enterprise value of over $100 billion and which now moves its packages on its own aerial fleet (UPS Airlines), flying hundreds of giant jet freighters all over the globe. Not to mention 96,000 trucks, vans, tractors and even motorcycles. Alas, no bikes.

When Mr. Casey died in 1983 he’d turned his borrowed $100 into a personal fortune of $100 million. Most of that went into the CFP operating foundation and the related grant maker Annie E. Casey Foundation. The former is still sited in Seattle, while the latter – also focused on child welfare – is in Baltimore.

For any of our readers who lives have been touched by foster care, you know Casey.

President and CEO William C. Bell, Ph.D., a former New York City commissioner for Child Services, joined CFP in 2004 and became CEO in 2006. A year later the Casey Board recruited Joseph Boateng to work with Dr. Bell as the foundation’s first and only CIO, bringing the investment portfolio inhouse. It had been previously managed externally by Russell Investments.

CFP’s charities, despite their altruistic aims, have budgets, expenses, and many commitments to meet, like any big business. But revenue comes through a single pipe: investment returns on Jim Casey’s original endowment.

For CFP, any unexpected shortfall in investment revenue means either a cut in programs for kids, or an invasion of the corpus. Both are unacceptable.

For fourteen years, Mr. Boateng has managed to produce that steady income while walking an investment tightrope.

Kim Lew, the new CIO of Columbia University, previously managed investments at the Carnegie Corporation, another major private foundation. As she told us in our recent interview:

A private foundation is not a university endowment. We don’t have rich alumni we can go to for help if we take an unexpected haircut. We have constraints which demand close attention to liquidity. That means we can’t lay out sixty to seventy percent of the portfolio in private equity, venture capital, timber, and other assets which might take years to sell.

Joseph Boateng, an American Success Story

Mr. Boateng was born in the west African republic of Ghana, son of a prominent local leader.

There were early signs of his business acumen. During his student leader days at the University of Ghana, Joseph launched a number of innovative programs for small business owners including education sessions and seminars on accounting, business development, and cash management.

AIESEC International even gave him an award for the most Innovative Program of the Year Award at their Annual International Congress in Innsbruck Austria in 1987.

Read More »