Growing a discretionary asset management or investment advisor business is tough.

We have yet to see an independent Outsourced Chief Investment Officer firm reach $100 Billion AUM through organic growth.

Most of them will never even reach $20 Billion.

Of the thirteen firms managing $50 billion or more on our annual OCIO list, only one – Alan Biller and Associates – launched as a pure-play OCIO and consulting start-up. And they’re just over the $50 Billion line.

OCIO Over $100bn AUM |

AUM (as of 6-30-20) |

Mercer |

$305.9 |

Russell Investments |

$234.7 |

BlackRock |

$228.0 |

SEI |

$181.0 |

Goldman Sachs |

$168.0 |

AON Hewitt |

$162.7 |

Willis Towers Watson |

$148.0 |

State Street Global Advisors |

$145.6 |

|

$1,573.9 |

OCIO $50bn to $100bn AUM |

AUM (as of 6-30-20) |

Northern Trust |

$88.7 |

Wilshire Associates |

$73.4 |

JP Morgan Asset Mgmt |

$63.3 |

Vanguard |

$57.0 |

Alan Biller and Associates |

$51.1 |

|

$333.5 |

Most except Biller began as financial mega-firms long before OCIOs were even invented. Several have roots stretching far back into the nineteenth century. JPM goes all the way back to the 1800s!

Independent OCIOs and RIAs have not been able to grow their way into this select company, and probably never will.

Why is this?

Total OCIO assets have been growing briskly, at more than 15 percent annually (In the 12 months July 2019 to June 2020).

But it’s scattered among dozens of relatively small firms.

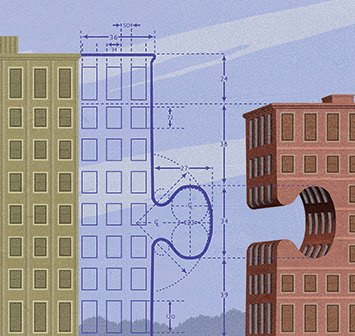

The solution seems obvious: Do it the old-fashioned way. Grow by acquisition and aggregation. Buy, sell, and merge firms. That’s how the mega-financials have done it.

It’s a well-understood historical process. Railways, utilities, steelmakers, banks, brewers, hotels, airlines all grew like this.

The boffins at Harvard Business School call it the Industry Consolidation Lifecycle. (See: https://hbr.org/2002/12/the-consolidation-curve) It’s easy to see after the fact, but much harder when we’re all floundering through it in real time.

And yet, for most OCIOs under $50 Billion, there seems to be a deep aversion to mergin’.

When we ask them why, they say: we will lose our independence. Or, our client service will suffer. Or, our culture is unique.

There is a place in the world for boutiques. But it’s not at the top.

Larry Fink and his BlackRock partners bought and merged their way to nearly nine trillion in assets over the last 32 years and their customers don’t seem to mind.

But among OCIOs we almost never hear: “we’re looking to link up with our competitors so that we can grow bigger and faster and serve clients better together.”

Only a few managers – Hirtle Callaghan, for example – seem hungry and open to discussions with like-minded partners. But these companies started as pure-play OCIOs and they know how tough it is to capture and hold customers.

OCIOs seem loath to partner with their competitors. But RIAs (who serve mostly, but not exclusively, HNW individuals and families) have no such scruples. There, the M&A machines are running full tilt.

ECHELON Partners, a wealth-management investment bank and consulting firm, tracked 205 RIA M&A transactions in 2020, while Fidelity reported 18 deals in December alone.

Lately, RIAs have been hungrily eyeing their institutional cousins.

In December, Focus Financial Partners (FOCS), an RIA aggregator backed by Stone Point Capital and KKR, with about 70 roll-ups under its belt, bought CornerStone Partners, a $5.6bn full-discretion OCIO provider servicing mostly endowments and foundations.

With private-equity money pouring into the financial aggregator space, more deals are likely.

We understand the dilemma OCIO founders face.

Investment firms are notoriously hard to scale. Brilliant, original strategies lose their potency when they are widely copycatted. Or, a strategy works in one season, in one kind of market, but not in another.

To make matters worse, management expertise is often thin.

OCIOs and RIAs are mostly small businesses, run by bright, competitive, individuals with little to no general management experience.

Many founders were wirehouse reps, analysts, chief investment officers. Or they were portfolio managers, where management skills are notoriously not a high priority. But as companies grow, they need leadership, mentoring, and execution to successfully scale.

It’s difficult to acknowledge one’s limitations and recruit people with the skills to complement the founders’ customer-relationship smarts. And, it’s expensive to bring in and integrate new partners, staff, systems, and technology.

For OCIO and RIA founders, growing a firm usually means giving up front-end pay for greater returns – hopefully – down the road. A pay cut can be hard to swallow.

Michael Kitces, Head of Planning Strategy at Buckingham Wealth Partners cites two pay-versus-growth studies which outline the revenue milestones partners must achieve in order for take-home pay per founder to beat that of a top-performing solo advisor.

OCIO services are a compelling proposition for many institutions and high-net-worth families. And the demand for full-service, discretionary asset-management shows no sign of slowing.

But building distribution, adding financial muscle, enhancing investment capabilities, and developing bench strength can take years.

There’s no need to reinvent the wheel. Buy. Sell. Merge. It worked for Morgan, Rockefeller, and Carnegie. Someone will build the next great investment-management powerhouse the reliable, old-fashioned way.

Why not you?

————————————————–

Appendix

RIAs and RIA aggregators

Of the 12,993 RIAs in the US registered with the SEC or a state securities administrator as of 2019, InvestmentNews lists 304 with “discretionary” assets over one Billion dollars and just 35 with assets over five Billion.

(NASAA reports 17,500 state registered investment advisers.)

In the course of our search work and M&A consulting, we’ve encountered twenty-one active RIA aggregators and we’re sure there are many more considering the number of private equity firms investing in the space.

Partial List of RIA Aggregators

AMG Wealth Partners

Atria

Beacon Pointe Advisors

Bluespring Wealth Partners

Buckingham Wealth Partners

CapTrust

Carson Group

Cerity Partners

CI Financial

Dynasty Financial Partners

Emigrant Partners

Fiduciary Network

Focus Financial Partners

HighTower

LPL

Mariner Wealth Advisors

Mercer Advisors

Sanctuary

Snowden

United Capital

Wealth Enhancement Group

Wealth Partners Capital Group