OCIOs: reconnecting the dots

by charles | Comments are closed10/09/2024

“The true sign of intelligence is not knowledge, but imagination”

—Albert Einstein

You don’t have to reinvent the wheel to build a successful outsourced chief investment officer (OCIO) business, but it sure helps to connect the dots.

Despite countless paeans to AI these days, when it comes to OCIOs, there is very little new under the sun, and as most wide-eyed newcomers eventually come to admit, discretionary service providers are notoriously hard to scale.

Jon Hirtle of Hirtle Callaghan launched the first conflict-free, independent investment office managing family and institutional money in 1988. Forty years later, the OCIO industry is bifurcated, highly diverse, and intensely competitive with hundreds of OCIOs, RIAs, banks, brokers, and asset managers competing for discretionary customers. It’s a jungle out there.

But with the formidable forty-year swell in private equity, venture capital, credit, and infrastructure investing, OCIOs are matching capabilities with clients in creative new ways.

Dean Keith Simonton, Professor Emeritus of Psychology at the University of California, Davis, posits that “genius hunts widely—almost blindly—for a solution to a problem, exploring dead ends and backtracking repeatedly before arriving at the ideal answer.”

Boutique providers – that’s pretty much everyone under about one-hundred billion in AUM – such as Hirtle Callaghan, Commonfund, Makena, and McMorgan & Company, have spent years polishing their services and honing their competitive advantage. As the market grew and providers proliferated, firms adapted, combining traditional prix fixe solutions with selective a la carte services.

According to Cerulli Associates, “Amidst inflation, interest rate hikes, market volatility, and the changing implications of geopolitical conditions, asset owners are increasingly drawn to the OCIO model for the management of sleeves for alternatives and private asset classes for which they do not think they have the appropriate level of expertise.”

It’s all about access

Access to the crème de la crème of alternative managers challenges most tax-exempt institutions and family offices, but OCIOs, with the diversified endowment model as their template, have spent years sourcing and cementing relationships with top private equity and venture capital professionals. Providers now offer a variety of alternative sleeves for those who prefer specialized participation.

A few prescient firms have gotten even more creative. McMorgan & Company, for example, has an infrastructure fund not common in boutique outsourcers.

A few years ago, the company established a relationship with OMERS Infrastructure, the infrastructure investment arm of OMERS, a large Canadian pension plan that has been investing directly in infrastructure since 1999. This relationship has led McMorgan to create a fund which co-invests in certain deals alongside OMERS Infrastructure.

There’s nothing new about infrastructure funds, plenty of firms in the mix, but few boutiques take the time to build something special. The McMorgan Infrastructure Fund hews a path for prudent tax-exempt and family office investors.

Final thoughts

We’re in the executive search business, for those that haven’t already guessed, along with OCIO search and selection and the occasional consulting assignment, so job seekers send us resumes and call almost every day.

Most candidates hammer on about what they’ve got and what they want. Surprisingly few spend much time asking about what our clients want, the folks we care most about.

But now and then someone applies that “second level thinking” Howard Marks talks about. They surprise us by connecting the dots, by carefully researching a potential employer and asking, what does this company need and how can I give it to them, rather than ramble on about what they, the job seeker, wants.

Here’s an example, a story we heard some while back.

Read More »OCIOs: the price of impatience

by charles | Comments are closed09/18/2024

“The thing that never happens just happened again” – Viktor Chernomyrdin, former Prime Minister of Russia

Our latest Outsourced Chief Investment Officer spot-check notes a steady stream of RFPs, mostly under eighty million AUM, Obama Foundation excepted.

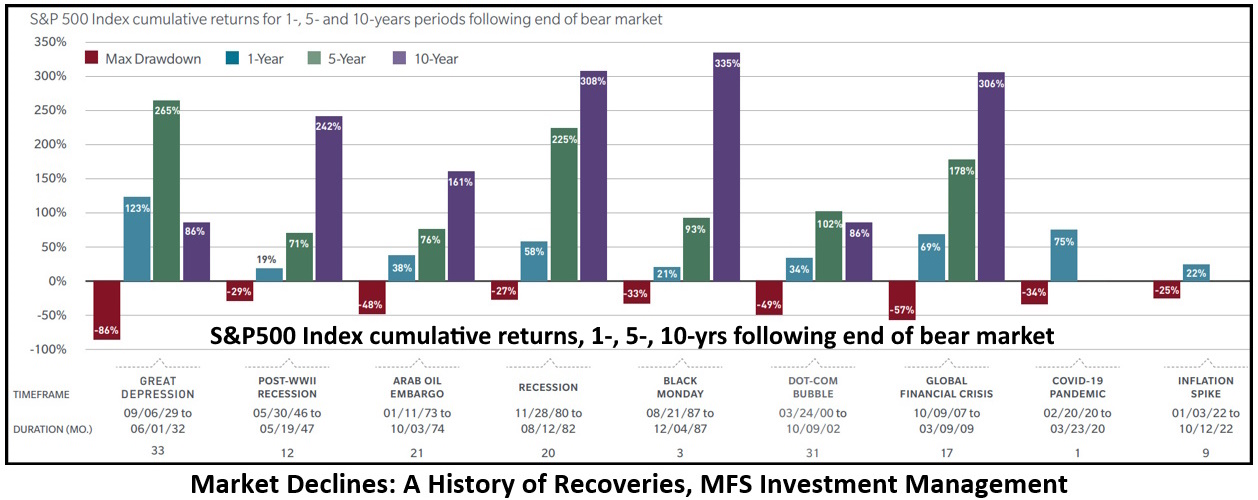

Some client institutions are looking to change providers, unhappy with recent returns. But if better performance is what they’re after, a word of caution: their current OCIO’s best years might be just beginning.

Even Berkshire Hathaway, with one of the best runs ever, “has had 10 negative return years, four years where it has fallen greater than -20% and six years where it underperformed the S&P500 by more than -20%.”

Apples and oranges

How should one compare OCIO returns? Commonfund considers comparisons “a complex apples-to-oranges exercise because there are so many variables to consider. Performance outcomes are as unique as the institutions themselves.”

We keep track of over one hundred OCIOs. Each has its own culture, client mix, investment style, and biases. Some firms focus on indexing and liquid markets, others on alternatives, still others on ESG. Some customize portfolios for clients, others don’t.

When we speak of past performance we are referring to history. But forecasting what’s to come is mostly an expression of hope. And hope is not a strategy, or reason to change providers.

According to Business Insider, “the S&P 500 average return over the past decade has come in at around 10.2%, just under the long-term historic average of 10.7%.”

Does this mean all OCIOs or clients should have indexed and gone home? Are they sure these public market returns are baked in for the next ten to twenty years? As Brad Conger at Hirtle Callaghan wrote a while back, “not even the most insightful among us can see around corners.”

“Historically, markets have posted strong long-term gains following declines,” but that’s over ten years and more. For most investors, or board members, patience is not their strong suit. Unfortunately, there’s usually a price to pay for impatience.

People come first

We begin an OCIO search and selection assignment by looking at the talent. Who are they, what is the turnover, how long has the firm been in business, and what’s their plan for staying on top? Then investment philosophy, process, and incentives. Then performance.

In the end it’s the ability to adapt, revitalize, and deliver over time that’s key. Brown Brothers Harriman, Goldman Sachs, J.P. Morgan, and Morgan Stanley have been around for more than a century and they keep signing up clients.

But how about the eighty or so OCIO firms in our last directory under fifty billion AUM? Hirtle Callaghan, Commonfund, and a few others have engineered smooth successions. Yet most still have first-gen founders in place or soon to retire. What comes next?

There’s a related issue. What happens when outside money enters the picture? Will the passion and focus remain? Or will the firm lose the founder’s intensity and become one more commodity in a collection of disposables?

Final thoughts

As we’ve said many times before, given the talent and resources in this country, the chances of building top-ranked, enduring investment teams capable of vaulting over the competition are slim to none without superior technology, blockbuster products, or a relentless M&A machine.

If the goal is to deliver exceptional performance, service and solutions and be there for the client over decades, forget about reinventing the wheel. Talk to your competitors. Some might make fine partners.

———————————————–

Time to update our OCIO directory

It’s time once again to update Skorina’s Outsourced Chief Investment Officer (OCIO) directory. So please send us any changes in contact information (name, phone, email) and AUM as of June 30, 2024.

Prospective clients can’t reach you if they don’t know how to find you.

—Charles Skorina

Read More »Anything new under the sun?

by charles | Comments are closed07/27/2024

“There’s only one way to describe most investors: trend followers.” —Howard Marks

We recently sent out an email query asking asset managers and chief investment officers, “anything new under the sun,” and received some serious replies. One thoughtful, highly respected, mega-fund chief investment officer wrote:

“There are quite a few interesting trends: AI, energy transition, innovations in healthcare are a few positive ones. Commercial RE, small cap, China and Emerging Markets are a few negative ones.

“The slow pace of private capital coming back to investors is another important trend that everyone is contemplating. Everyone is hoping that lower interest rates will restart more M&A and IPO activity.

“However, personally I think the bigger trend is how investors are thinking about asset allocation. I remember the strong emphasis across the industry on diversification. If you could find uncorrelated return streams, the trend was to add them almost blindly. Diversification and low vol was the main point.

“Today (and for some time), diversification has not been your friend. The future is moving to disruption, and you need companies and funds that have size, data, the ability to invest in AI, and cheap financing.

“Disruption is so large in the U.S. that we may not need geographic diversification like we used to.”

Another CIO replied:

“I find the dominance of U.S. public equities, and a teeny-weeny handful of them at that, to be quite troubling.

“One of our IC members is pushing us to divest of non-U.S. equities and it’s difficult to find any recent data to argue against that, yet the idea of having 40% of our endowment in a stock portfolio that’s really just five giant tech stocks is scary to me.

“We’ve reduced our hedge fund exposure, our real asset portfolio was always pretty small, and those big tech companies are amazing economic engines, so I am not sure I would say we are in a bubble.

“But some of the most successful endowments have one-sixth, one-fifth, or even one-quarter of their portfolios with a single VC firm. Maybe we should be worried.”

Pay and Chief Investment Officers

Speaking of chief investment officers, in case you missed it, here are a few highlights from an interesting paper on chief investment officer compensation by Matteo Binfarè, University of Missouri and Robert S. Harris, University of Virginia:

“Endowments pay CIOs more, rely more on bonuses, attract more experienced professionals, and have lower turnover than pensions.

“On average, endowment CIOs earn a whopping $800,000 in total annual compensation, three times more than their peers at pension funds. Incentive compensation makes up a significant portion of their pay, with more than 40% being tied to incentives — almost four times more than pension plan CIOs.

“Endowments that pay their CIOs top quartile compensation significantly outperform endowments with bottom quartile compensation by almost 100 basis points annually.”

All great stuff, but this begs the question, what are chief investment officers actually getting paid for? Size, complexity, performance?

The compensation conundrum

According to Business Insider, “the S&P 500 average return over the past decade has come in at around 10.2%, just under the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago.”

Read More »Affluent Family Affairs

by charles | Comments are closed07/22/2024

Money, if it does not bring you happiness, will at least help you be miserable in comfort. —Helen Gurley Brown

While family dynamics probably haven’t changed much since Count Leo Nikolaevich Tolstoy wrote his famous line about unhappy families, the modern family office has come a long way from 1878 when Anna Karenina was published, adding structure, discipline, academic rigor, and, most importantly, convenience to the management of UHNW affairs.

Ultras place a premium on convenience and they are more than willing to pay for it. Whether it’s a dedicated family office or a cadre of wealth and client service providers, when you’ve made it big, you need a lot of help, as Deloitte explains in a recent report. There are operating companies and investment portfolios, estates and staff, trusts, foundations, donor-advised funds, art collections, cars, boats, and planes, accountants, lawyers, and specialized service providers.

Here to help

We’ve been sifting through this rarefied mix of New York wealth and family service elites, on assignment for a notable Wall Street firm. Our mandate? Recruit a professional client service maven who will make the partners’ lives easier and their balance sheets stronger.

Firms like Goldman Sachs, KKR, and McKinsey have dedicated concierge groups to service their partners. Goldman, in fact, just renamed their partners coverage group the “partners family office.”

One candidate with considerable experience working for billionaires described the work this way:

“My writ was straightforward, Charles: create wealth, reduce taxes, and mitigate risk. But the job was a little more complicated than that.

“Over the years, I’ve worked with experts on investments and allocations, restructured lines of credit, and arranged and refinanced mortgages. I dealt with accountants, attorneys, and realtors, bought and sold property, art, and collectibles, researched state and global tax domiciles, and negotiated loans on assets. Whatever the client wanted, you name it.

“But in this job you also have to read people and be the consummate diplomat. As families grow larger and wives and husbands come and go, competition increases for access and influence. Don’t ever forget who you work for.”

Where are the ultras?

It’s tough to get a handle on the number of ultra-high-net-worth families in the US, the assets they control, or their objectives because most prefer the shadows to the limelight.

In one widely quoted survey, Campden Wealth reckoned there were 3,100 large single-family offices in North America. The Family Office Exchange (FOX), on the other hand, cast a wider net, estimating closer to 10,000 SFOs given the relentless growth in global wealth.

As for billionaires, the Hurun Global Rich List 2024 counts one-hundred-nineteen billionaires in New York while Henley Global’s World’s Wealthiest Cities Report 2024 uncovered a mere sixty.

Chart: US cities with millionaires, centi-millionaires, billionaires

As an aside, of the roughly $83 trillion in wealth transfer over the next twenty years, according to the UBS Global Wealth Report 2024, “a notable amount of this wealth will move horizontally between spouses first, before moving to the next generation. In practice, this means a considerable transfer of wealth to women, considering their comparatively higher life expectancy.”

What’s a client service professional?

Read More »Following Next-Gen Money

by charles | Comments are closed06/17/2024

When I was young I thought that money was the most important thing in life; now that I am old I know that it is. — Oscar Wilde

An exceptional, highly successful family office client and I were discussing the differences in generations a while back and he characterized the divergences this way.

“Charles, my brothers and I slept two to a room in a tract home and sat at the family table each night for dinner. We grew up with a common set of values and beliefs. We have worked together all our adult lives, and I can’t remember the last time we had an argument. But our kids grew up rich, in separate households, with different friends and a diverse mix of views. We got an allowance, our kids have trust accounts.”

Next-gen heir-do-wells

We’ve all heard by now that the next several decades will see the “greatest transfer of wealth in history with $84 trillion expected to pass down to younger generations.” But what are the implications for asset and wealth managers? How are these next-gen heir-do-wells any different than prior generations?

Estimated Wealth to be Inherited

The UHNWs

At the heart of the wealth management mother lode runs the ultra-high-net-worth seam, households with net assets over $30 million. These denizens of El Dorado may represent just a sliver of the population – one half to one percent – but they control almost a third of the investable assets.

Altrata/Wealth-X estimates that about ninety percent of the current North American UHNW contingent are entrepreneurs and hands-on operators, mostly self-made men and women who are accustomed to being in control.

These wildly successful entrepreneurs have a hard time understanding what institutional CIOs do or why anyone would waste their time investing that way. Most would side with Andrew Carnegie, who once advised the students of Curry Commercial College in Pittsburgh, Pennsylvania to “put all your eggs in one basket, and then watch that basket.”

Different ages, different apps

Capgemini’s latest wealth report 2024, highlights the challenges of servicing this wealth tsunami, describing these next-geners as principled, passionate, and looking for more than just cents on the dollar. They are also comfortable with technology.

These digital immigrants, natives, and nomads want their assets globally accessible, kept safe, and managed well, but unlike prior generations they don’t always need or want human contact.

The London-based KnightFrank Group notes that “we’re talking about a cohort that is seeking a wealth manager who is on their wavelength, if indeed they want to deal with a human at all.”

As an aside, an executive at a major west-coast software company told me recently that technology is moving so fast that age groups (and the firm’s employees) just a few years apart use completely different apps to connect and interact. From text to TikTok in the blink of an eye.

Mission-based, promise driven

Americans by nature are a generous people giving almost half a trillion dollars to charity in 2022. UHNWs topped the list, contributing almost five percent to total individual donations of $319 billion. But that’s not all.

The UHNW cohort cares deeply about their causes and they drive foundation formation which, in turn, gave an additional $105.21bn in 2022. There are well over 100,000 private foundations in the U.S with AUM totaling about $1.4 trillion, 3,300 of these have AUM over $50 million.

The next generation of philanthropists will want help from their advisors as they align their investments with their philanthropy.

Suzanne Brenner, partner and former chief investment officer at Brown Brothers Harriman, puts it this way “research shows millennials are twice as likely to invest in companies that make a positive impact. It’s important that we understand not only what they want to do, but that we all understand what defines success.”

Jon Hirtle, executive chairman of Hirtle Callaghan, describes the commitment to mission-based wealth management as promise driven.

“We promise our families that we will continue to live in a certain way, we promise to support the causes we care for and often we promise to help provide for our children and grandchildren.”

Here’s a breakdown of those promises in the two charts below. Data from the Lilly Family School of Philanthropy, Indiana University.

US Charitable Giving in 2022 by Donors/Recipients

Final thoughts

Read More »