What makes a great chief investment officer?

by charles | Comments are closed04/20/2017

What makes a great chief investment officer?

All professional investors want to make money. The question is, how and for whom?

In the for-profit world of Wall Street asset managers and retail mutual funds, the differences among managers reflect investor appetites, time horizons and risk tolerances. They must all serve their customers, or the customers will walk. But they are also profit-seekers, motivated by bonuses and the bottom line.

Most chief investment officers start their careers as traders, analysts, or consultants; working with spreads and price dislocations, capital structures and cash flows, or advising on asset allocations and manager selection. Ex-traders like Sam Gallo, CIO at the University System of Maryland, are particularly valuable now, because they know how to move large books quickly and cut transaction costs, topics of keen interest these days.

Eventually, some find their way into the family office and non-profit world of multigenerational, multiasset investing, researching opportunities and managers in public and illiquid markets.

Dedicated family office CIOs – between 800 and 1500 in the US – invest in anything and everything; in stocks, bonds, loans, cold storage, tankers, and toll roads. But tax implications become a priority; and family preferences – rational or not – drive the portfolio.

CIOs work at the pleasure of a complex and opaque authority whose circumstances, mood, location, and needs are subject to change at any time. In the family office world, one often has no idea how much liquidity is required as family purchases can be large, lumpy and unpredictable.

Both Alice Ruth and Jason Perlioni jumped to endowment CIO positions this year after long stints at family offices; Ms. Ruth moving to Dartmouth after nine years at Willett Advisors (Michael Bloomberg) and Mr. Perlioni moving to Johns Hopkins after ten years at the Pritzker Group.

Working for a family office can be an attractive and rewarding experience, but all family office CIOs understand Leo Tolstoy’s famous line from Anna Karenina, “All happy families are alike; each unhappy family is unhappy in its own way.”

Managing assets for tax-exempt Institutions differs from all the above.

Some institutions prioritize wealth creation while others prioritize transparency, political accountability, and risk minimization. Endowments, foundations, hospitals, cultural institutions, corporate and public pension funds can fall into either group.

In each case, however, the CIO job is what one makes of it; some are delegators, some are micro-managers, and some are just liaisons between a consultant and an investment committee.

Corporate and hospital chief investment officers structure their portfolios primarily to manage risk. Corporate CIOs are liability driven and have a financial mindset. They think in terms of payouts, terminal value, and matching durations. They care less about outperforming peers because absolute return is seldom their top priority or that of their boards. Bill Hammond, the CIO at AT&T and Jason Klein, CIO at Sloan-Kettering NYC, understand the mission of the institution; their job is to minimized liabilities and forestall surprises.

The “endowment model” of fund management prescribes a highly diversified portfolio of investments across public and private markets. Most endowment and foundation CIOs strive to earn the best possible risk-adjusted returns and grow the corpus over decades.

Read More »

Foundation Chief Investment Officers and the American dream

by charles | Comments are closed03/06/2017

Our letter this month focuses on the venerable foundations of New York City and one of their most accomplished investment pros: Kim Y. Lew, chief investment officer of the Carnegie Corporation.

We have an in-depth conversation with Ms. Lew on her career in foundation investing and the future of women and minorities in her field. We also look at pay and performance in the NYC foundations, with some illuminating charts for our quant readers.

Our friends at the Foundation Center tell us there are 243 American foundations with over $1 billion in assets and New York City harbors 31 of them, including some of the biggest and most storied. The money wasn’t all made there, but it tended to flow toward Manhattan because that’s where the money-managers were.

According to David Swensen, “a deep appreciation of history” is essential to an investment professional. Not just knowledge, mind you; but appreciation. History may have temporarily put that money in their care, but markets and circumstance are always threatening to take it back.

Goethe’s Faust got it right when he declaimed:

“That which thy fathers have bequeathed to thee, earn and become the possessor of it!”

Mr. Carnegie and Ms. Lew:

When Andrew Carnegie endowed the corporation with $125 million in 1911 — perhaps $3 billion in 2017 dollars — he founded the largest charitable entity of its day. Along with the creation of the Rockefeller Foundation in 1913, this marked the beginning of the modern era of foundation philanthropy.

The Carnegie Corporation, headed by the eminent Vartan Gregorian, marked its centenary in 2011, the year Kim Lew became co-CIO, and it is still among the twenty-five largest foundations in the U.S.

Despite continuing to give away at least $150 million every year (5% of net investment assets), the Corporation’s endowment is larger today — in constant dollars — than it was in 1911. This is due in part to the forbearance of America’s taxpayers via the Internal Revenue Code, but also in large part to the skill of Ms. Lew, her colleagues, and their predecessors in maintaining impressive investment returns over the generations.

A New York story:

Kim Lew was born in Harlem, daughter of a Chinese immigrant father and an African-American mother. She was admitted to one of New York’s most selective public high schools, the famous Bronx High School of Science, and then became the first in her hard-working family to reach college.

She earned degrees at the University of Pennsylvania and Harvard Business School, came home to launch a financial career in New York, and joined the investment office of the Carnegie Corporation in 2007.

That’s a tall mountain to climb for anyone, but especially challenging for a minority female.

By our own ballpark estimates, only about 25 percent of major educational endowments and about 30 percent of big foundation funds are managed by women, and only a handful are African-Americans.

So, hers is in some ways an unusual story, but New York is a place where unlikely people have always accomplished remarkable things.

Here’s a snapshot of New York City’s top foundation CIOs, where they work, and how much money they manage.

Read More »Performance and Persistence: the best CIOs stay on top

by charles | Comments are closed02/07/2017

“Persistence of returns” is a phrase we associate with hedge funds. It seems debatable whether there is any such persistence there. Hedgies say there is; others are not so sure.

In the case of endowments and chief investment officers, however, it’s a verifiable phenomenon.

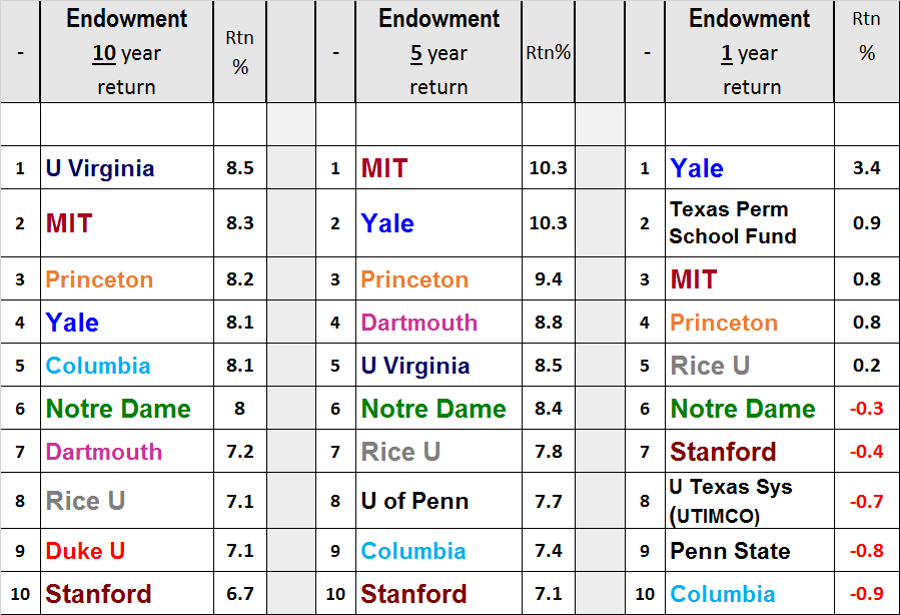

The chart below incorporates the latest numbers and lists the top-ten endowment performers (out of our Top 25 cohort) for 1, 5, and 10-year periods as of June, 2016.

What is remarkable is how the same funds tend to show up across the board, even in the more volatile 1-year numbers.

Seven funds – MIT, Princeton, Yale, Columbia, Notre Dame, Rice, and Stanford – show up in each table. Dartmouth and Virginia both make two out of three (neither of them quite made the cut for 1-year returns). Notre Dame’s consistency is uncanny: they rank 6th out of 10 on all three.

Rice’s consistent excellence may have been slightly unexpected. It’s a Southern, non-Ivy school with “only” a $5.3 billion endowment; but it has outperformed Stanford and most of the Ivys in each measurement period. Good work by Allison Thacker’s Rice Management Company.

Read More »Harvard throws in the towel, UTIMCO reboots

by charles | Comments are closed01/28/2017

Harvard throws in the towel, UTIMCO reboots

In our piece on Harvard last July titled “The Harvard Endowment: Time for some Creative Destruction?” we wrote the following…

It’s been ten years now since Jack Meyer stepped down as head of the Harvard Management Company, while David Swensen – now in his 31st year – has carried on at the Yale Investment Office.

Each endowment has pursued its own distinctive management model: HMC with its “hybrid” internal/external approach, versus YIO’s exclusive reliance on cherry-picked external managers.

We can now call the winner: It’s Yale.

See: “The Harvard Endowment: Time for some Creative Destruction”

It’s here: https://www.charlesskorina.com/?p=3631

Well, the creative destruction has arrived in the person of Narv Narvekar.

On January 25th, reporters Dawn Lim and Juliet Chung broke the big news in the Wall Street Journal that Harvard will adopt a new model of endowment management.

Maybe we should call it the “Columbia model” rather than the Yale Model, but it amounts to the same thing.

In brief, Harvard Management Company will cut its staff by 50 percent, outsource internally-managed assets, and hire a CIO which, technically, HMC has never had. The new CIO will be Richard Slocum, an old colleague of Mr. Narvekar’s from JPMorgan.

With a separate CEO and CIO, and a much smaller staff, HMC will look a lot like Columbia under Mr. Narvekar.

We all knew changes were coming, but we didn’t foresee such rapid and dramatic restructuring. Obviously this happened with the full support of Chairman Paul Finnegan and the HMC board and was probably in the works since Mr. Narvekar was offered the job.

See: http://www.wsj.com/articles/harvard-to-outsource-management-of-its-35-7-billion-endowment-1485363650

Texas Turmoil

UTIMCO picks a new path through a political minefield

Endowment returns took a beating last year and the turnover in chief investment officers tells the tale.

Among the big names to make an exit in 2016 was Bruce Zimmerman, longtime CEO of The University of Texas Investment Management Company (UTIMCO).

We wrote about endowment turnover in our last newsletter.

See: https://www.charlesskorina.com/?p=4488

Texas is the home of big money, big egos, and bare-knuckled politics and the last few years have been uneasy ones for the UT system and, collaterally, for UTIMCO.

Here’s what happened:

Read More »

Turmoil and Turnover in the age of Trump

by charles | Comments are closed12/29/2016

Turmoil and Turnover in the age of Trump

The year-end look-back is a lazy journalistic artifact we can all do without.

So, here’s our year-end look-back.

We exculpate ourselves by arguing that it’s really a look-forward.

First: We have a few remarks about shocking recent events that will shape the investment landscape as we slide into 2017.

Second: We offer a roundup of 2016’s turnovers in the ranks of chief investment officers. There are a number of fresh leaders who will be steering some important institutions into the new year.

Our village elders on the rise of Trump:

Two oddly similar events dominated the news this year: the UK Brexit referendum in June, and the U.S. presidential election in November.

They both produced the wrong outcome from the point of view of most opinion leaders and market-makers, and both will have continuing influence on financial markets.

All respectable commentators, from the Church of England to the BBC to David Beckham, urged a vote for Stay. Even President Obama crossed the pond to buttress the Stay forces. Learned economists warned that the entire global financial system could melt down if the UK unwisely separated from the EU. Pollsters lined up to assure the nervous that a Stay vote was in the bag.

But, Leave prevailed. Global markets dropped, then snapped back. Despite the dire auguries, Britain carried on, and today you can hardly see the scar.

Across the Atlantic and five months forward, we were dealt another shockingly wrong outcome. Respectable opinion and pollsters were again flummoxed, and here we are with President-elect Donald John Trump.

We were as gobsmacked as anyone and we turned, as we always do, to the investment community’s village elders to learn what it all portends.

Ray Dalio of Bridgewater was quick out of the box with some cautious notes one week after the Trump victory.

He seemed to think that, based on “very early indications of what a Trump presidency might be like” there would be more good news than bad news for markets in 2017:

Relatively stronger US growth and relative tightening of US policy versus the rest of world is dollar-bullish. All this, plus fiscal stimulus that will translate to additional economic growth, corporate tax changes, and less regulation will on the margin be good for profitability and stocks, though for domestically oriented stocks more than multinationals, etc.

See: https://www.linkedin.com/pulse/reflections-trump-presidency-one-week-after-election-ray-dalio

A month later, he was back with a longer, more considered analysis. He sees momentous change ahead and, on balance, more upside than downside for investors:

The shift from the past administration to this administration will probably be even more significant than the 1979-82 shift from the socialists to the capitalists in the UK, US, and Germany when Margaret Thatcher, Ronald Reagan, and Helmut Kohl came to power…. This particular shift by the Trump administration could have a much bigger impact on the US economy than one would calculate on the basis of changes in tax and spending policies alone because it could ignite animal spirits and attract productive capital.

See: https://www.linkedin.com/pulse/reflections-trump-presidency-one-month-after-election-ray-dalio

This is an interesting point. But, Is there any evidence of such reviving animal spirits? Maybe.

Luke Kawa writing for Bloomberg on 15 December said:

… indexes that track confidence have jumped, with respondents citing the potential for deregulation and tax cuts once President-elect Donald Trump takes office…

He concludes:

Should animal spirits kick into force… this would buoy economic expansion, notwithstanding any fiscal stimulus from the incoming administration.

A week later the Conference Board announced that U.S. consumer confidence had hit a new 15-year high.

Per Reuters:

Americans saw more strength ahead in business conditions, stock prices and the job market following the election of Donald Trump as president in November.

See: http://www.reuters.com/article/us-usa-economy-confidence-idUSKBN14G18M

Another elder we always look to is Howard Marks of Oaktree Capital. On November 14 he filed a memo which noted, inter alia:

…there was a near-universal belief that a Trump victory – as unlikely as it was – would be bad for the markets.

But, as he notes, the U.S. stock market then had its best week since 2014. The Dow Jones Industrials rose almost 5% for the election week, taking them to a new all-time high.

Mr. Marks explains this with his general theory of market behavior:

While people search the market’s behavior for logic, there really doesn’t have to be any.

He sees both positives and negatives under the new management:

Trump’s statements regarding business and the economy contain some real positives and are the best part of his platform . . . if he and his administration are up to the task of putting them into practice.

On the other hand, he doesn’t like Mr. Trump’s stance on international trade and the possibility that he will raise import duties on goods from China and Mexico.

Mr. Marks is a credit investor, and he has this to say about the outlook for bonds:

Equity investors like inflation because it pumps up profits. Bond investors dislike it because it raises interest rates, reducing the value of the bonds they hold. But the two can’t go in opposite directions forever. At some distant point, higher interest rates can cause bonds to offer stiffer competition against highly appreciated stocks.

Bill Gross of Janus Capital issued his own November letter in which he expressed general unhappiness with the Trump election, although he notes that things would probably not have been much more to his liking under a Clinton presidency. He voted for neither Trump nor Clinton.

He concludes:

Global populism is the wave of the future, but it has taken a wrong turn in America. Investors must drive with caution, understanding that higher deficits resulting from lower taxes raise interest rates and inflation, which in turn have the potential to produce lower earnings and P/E ratios. There is no new Trump bull market in the offing. Be satisfied with 3-5% globally diversified returns. The Wall Street, finance-led hegemon is fading. The Populist sunrise has barely broken the horizon.

See: http://advisoranalyst.com/glablog/2016/11/17/bill-gross-investment-outlook-november-2016.html

It seems to us that Mr. Gross has been grumpier in general over the last year. Of course, that doesn’t necessarily mean he’s wrong.

Finally, we checked in with one of the country’s most prominent economists, Nobel-prize winner and New York Times columnist Paul Krugman.

On election night as the astonishing results came in (and overnight stock futures tumbled), a crestfallen Mr. Krugman wrote.

It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover?” Krugman said in his post. “If the question is when markets will recover, a first-pass answer is never.

He then doubled down, suggesting that a recession was imminent.

We are very probably looking at a global recession, with no end in sight… a terrible thing has just happened.

But by Wednesday, the futures market reversed course and indexes opened basically unchanged from Tuesday’s close. Then the Dow began an epic upward trek to near 20,000.

Mr. Krugman hasn’t gotten any happier but, as we go to press, U.S. equities are up more than 9 percent since he issued his forecast.

Read More »