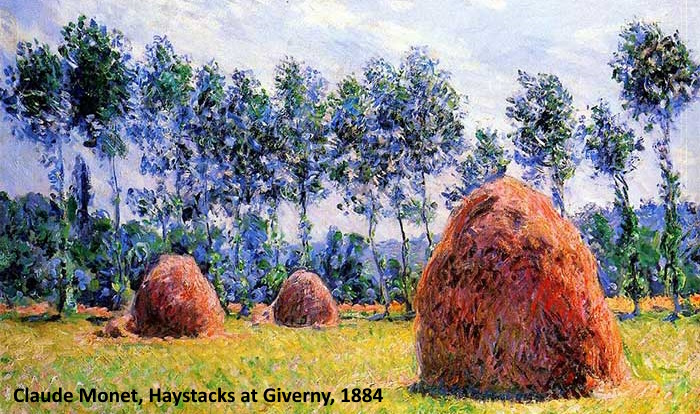

“Don’t look for the needle in the haystack. Just buy the haystack!” — John Bogle

If it’s hard picking superior investments and asset managers, on what basis should we select the investment officers who pick those managers?

Take public markets, for example. According to Jason Zweig, Investing Columnist for The Wall Street Journal, “only 4.3% of stocks created all the net gains in the U.S. market between 1926 and 2016.”

In other words, over the last ninety years, less than two hundred stocks returned legendary money to their investors.

Zweig maintains that finding these “superstocks,” as William Bernstein of Efficient Frontier Advisor calls them, stocks that rise in value by 10,000% or more, is for most folks a losing proposition. He has argued for years that investors are better off buying a broad-market index fund.

What about private markets?

Private markets have their own challenges. A study by ULU Ventures concluded that venture capital firms “pick winners only 2.5% of the time. More than a decade of data reveals that out of more than 4,000 VC investment rounds annually, the top 100 generate between 70% and 100% of industry profits.”

The odds aren’t much better across buyout firms. The Oregon Investment Council pension system has invested in private equity for years. They are experienced, savvy, and comfortable with the asset class.

But over the last ten years the staff would have been better off putting their PE allocation into the Russell 3000. For the ten-year period ending December 31, 2021, their PE investments returned 15.7% versus 17.1% for the R3000, underperforming their benchmark by 4.3%.

Serious investing is about consistency

In our interview with Jon Hirtle, executive CEO of Hirtle Callaghan, he described investing this way. “Serious investing is about consistency, and serious investors position their portfolios to succeed in a highly uncertain future.”

How uncertain? Since 1945 the S&P 500 index has grown on average 11.12% per annum but during this span there have been 14 bear markets with drops averaging 32%.

And yet, the best CIOs somehow find a way to outperform – Paula Volent and David Swensen for example. Ms. Volent, Bowdoin College chief investment officer from 2000 to 2021 and current CIO at Rockefeller University, has topped our charts for years, delivering 11.9% for the twenty-year period ending June 30, 2021, and 14.5% for the last ten years.

And David Swensen, a seminal figure in the investment industry, produced a 13.7% per annum return over his thirty-five-year tenure as CIO at Yale.

Searching for the next Volent

For us, the search process begins with two questions.

The first is data driven. After years of evaluating investment talent for families, nonprofits, and asset managers, we look for persistence along with performance in a candidate’s background.

Our pool of talent includes hundreds of endowments, foundations, public and private pensions, health systems, associations, and charities, another five hundred to a thousand family offices, and thousands of OCIOs, RIAs, and for-profit asset managers.

It’s a deep bench but consistent performance is the key. And it’s not always apparent who’s driving the process.

Every candidate tells us they find great managers and pick great stocks. They all, apparently, produced top quartile results.

But, over time top chief investment officers stay on top. It’s in our data.

The second question is based on intuition and experience. Is this candidate someone that catches our eye? Piques our curiosity? An overachiever? We look for soft skills that indicate leadership and accomplishment.

Five key attributes in winning candidates

One longtime chief investment officer described five key attributes in a winning candidate.

The first one in my book is experience, experience with market cycles, clients, boards, committees, and in managing teams.

I am not the same CIO I was ten years ago nor the trader and portfolio manager I was twenty years ago. Every experience has made me a better investor, risk manager, and team leader.

Second, a deep respect for strategic asset allocation and risk management.

Understanding how the asset classes fit together is a huge edge, as well as managing liquidity, tracking error, and operational risks.

Third, a profound and intense level of intellectual curiosity.

Look for someone who loves to learn and discover the next great idea or manager. But not just a great analyst, look for someone who motivates their teammates to feel the same way about this quest for knowledge and great investments.

Fourth, a candidate should love working with, educating, and communicating with the board, staff, and outside groups.

There is a big political, or as I said before, ambassadorship, component to being CIO. If a candidate or CIO does not like this part of the job, it will show, and that person will not last long.

And fifth, a strong ability to collaborate.

Top CIOs draw out the best in people. We want the best version of our advisors and team to show up every day. So, it’s important to support them behind the scenes by removing obstacles that sometimes they are not even aware of, and open paths for their growth.

Final thoughts from Mr. Zweig

“Identifying superstocks is hard. Identifying managers who can identify superstocks is harder. And identifying managers who can identify superstocks and hold them through death-defying drawdowns is even harder. I’m not saying it’s impossible. But, wow, is it hard. It’s surely one of the greatest challenges in investment management.”

————————————————–

Comments

Lauren Blum, chief investment officer at Capital Counsel has this to say about concentration and selection.

“The long-term statistics that you quote, Charles, may not tell the whole story. There might be 200 stocks at any one time that account for most of the gains in U.S. markets, but not over the entire 90-year period. Some may have gains of over 10,000%, but there are plenty of opportunities to achieve outstanding returns, say 2,000% to 4,000% over ten or twenty years.

Granted, it’s likely few investors held on to their Apple stock from 1992 to 1997 [when the price fell 79.6% and underperformed the S&P 500 by 771%], but if you had bought the stock when the iPhone was introduced in 2007 and continued to hold it, you would have achieved a cumulative total return of about 4,100% over the 16-year holding period.

To identify these opportunities, investment managers must have a disciplined strategy that they refine over time. Warren Buffett and David Swensen had different strategies, but they executed them well and allowed time to compound the returns.”

————————————————–

Appendix

|

Oregon Investment Council – Private Equity Returns 1, 3, 5, 10-year as of Dec 31, 2021 |

||||

|

– |

– |

– |

– |

– |

|

Private Equity Returns |

1 year |

3 year |

5 year |

10 year |

|

– |

– |

– |

– |

– |

|

OPERF* Private Equity |

41.6% |

21.0% |

19.7% |

15.7% |

|

– |

– |

– |

– |

– |

|

Russell 3000 +300bps (QTR Lag) |

35.7% |

19.4% |

20.3% |

20.1% |

|

Excess Return |

5.8% |

1.6% |

-0.6% |

-4.3% |

|

Correlation |

0.32 |

0.60 |

0.56 |

0.67 |

|

– |

– |

– |

– |

– |

|

MSCI ACWI +300bps (QTR Lag) |

31.2% |

15.9% |

16.6% |

15.2% |

|

Excess Return |

10.4% |

5.1% |

3.1% |

0.5% |

|

Correlation |

0.50 |

0.51 |

0.46 |

0.29 |

*OPERF – Oregon Public Employee Retirement Fund

Oregon Investment Council minutes March 9, 2022 (pg.12/13)

Total pension AUM $134 billion. Private equity allocation 20% of the portfolio.

The private equity portfolio targets a 65-85% allocation to leveraged buyouts, with the remaining allocation to venture capital (0-5%), growth equity (0-5%) and special situations (5-15%).

————————-

Asset class returns over the last 145 years

A 2019 research paper, The Rate of Return on Everything, 1870–2015, tackled the challenging task of calculating and comparing long term returns on various asset classes including equities, housing, bonds and bills. Their conclusion?

Risky assets in aggregate – stocks and property – aren’t as risky as one might think and the diversification gains are significant. On the other hand, supposedly safe assets, such as bonds and bills, may not always be the best option for widows and orphans.