Endowment Returns Update: There’s More to the Story

— Lux Et Veritas

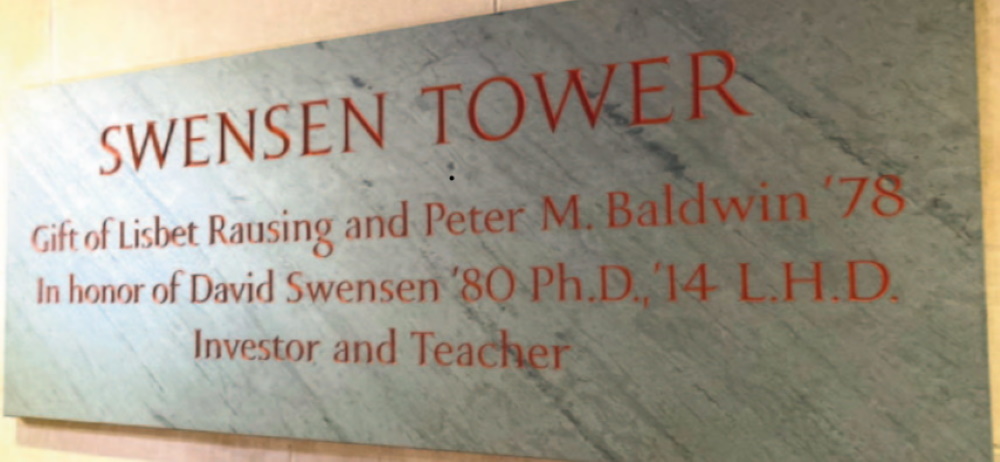

David F. Swensen, Ph.D., Yale ’80 and chief investment officer Yale endowment, died May 5th, 2021.

Mr. Swensen was a 32-year-old kid in 1985 with no endowment experience and a couple of years on Wall Street when William Brainard ’62 Ph.D. and Yale provost hired him as the university’s first endowment investment manager.

When Swensen accepted the position at Yale, most endowments held US stocks and bonds. That’s it!

His iconoclastic views on markets and investment opportunities led to a fundamental shift in how and where institutional investors sought to make money.

The conceptual groundwork had been laid for Mr. Swensen’s investment heresy in 1967 by another Yale alum, McGeorge Bundy A.B. ‘40, then-president of the Ford Foundation.

In the Foundation’s ‘67 annual report, President Bundy noted that “…the true test of performance in the handling of money is the record of achievement, not the opinion of the respectable.”

Mr. Bundy commissioned influential studies attacking the old assumption that the “prudent man” rule of personal trust law applied to management of endowment and foundation funds.

Along with the dissemination of modern portfolio theory, these initiatives cleared the path for Swensen’s sophisticated and non-traditional portfolio management style at Yale and, in the years that followed, other Ivy schools.

Today, thanks to Mr. Swensen’s “Pioneering Portfolio Management“, endowment investment chiefs are the ultimate long-term, strategic investors.

They have an infinite investment horizon, a global playing field, and can invest in anything anywhere – within the broad policy limits set by their institution.

He will be missed and hard to replace.

Swensen’s investment portfolio and returns are baked in for at least five more years. But good management starts with good succession planning.

As I mentioned to Bloomberg News, culture and institutional memory play an important role in top quartile investing. And in the case of Yale, we should add “tradition.”

Our first headhunting calls would be to two of the top CIOs on our list; 47 years old MIT CIO Seth Alexander ‘95, and Stanford University’s CIO Rob Wallace ‘02, 55 years old.

Both have years remaining in their careers, stellar track records, and strong ties to the school and the Yale investment office (YIO).

If not Messrs. Alexander or Wallace, well there’s plenty of Yale alumni and YIO talent to pick from.

See the YaleNews’ touching “In Memoriam”, next article.

—————

Updates and Erratum

We have updated our charts to include ten more schools and highlight more women CIOs among the top performers.

Also, the University of Virginia earned ten and five-year returns of 10.1% and 6.6% (not 8.10% and 5.80% as we first reported) for June 30, 2020.

See: Endowment Returns 2020, Strange Days for updated charts and rankings.

— Charles Skorina