The Harvard Endowment: Time for some Creative Destruction?

by charles | Comments are closed07/13/2016

[Note: we published this piece on July 12, before Harvard announced its hire of N.P Narvekar and its disappointing returns for FY 2016]

It’s been ten years now since Jack Meyer stepped down as head of the Harvard Management Company, while David Swensen – now in his 31st year – has carried on at the Yale Investment Office.

Each endowment has pursued its own distinctive management model: HMC with its “hybrid” internal/external approach, versus YIO’s exclusive reliance on cherry-picked external managers.

We can now call the winner: It’s Yale.

And it’s time for HMC to undertake a major re-think of its business.

Six out of 13 members of the Harvard Corporation board are Harvard MBAs, and they understand what the stakes are.

President Drew Gilpin Faust has ex-officio seats on both the HMC board and the Harvard Corporation board (where the real power lies). But the chair of the HMC board is Paul J. Finnegan, who also happens to serve on the Corporation board as Treasurer and chair of the finance committee.

Mr. Finnegan is co-CEO of Chicago-based private-equity firm Madison Dearborn Partners. He has been deeply enmeshed in Harvard’s affairs for many years and is highly respected.

See: http://news.harvard.edu/gazette/story/2014/05/finnegan-new-harvard-treasurer/

Currently, Harvard harvests about 4.3 percent of endowment AUM annually. In 2015 that amounted to $1.6 billion. And that powered thirty-five percent of the school’s budget. (Off the record, the endowment’s contribution is greater.)

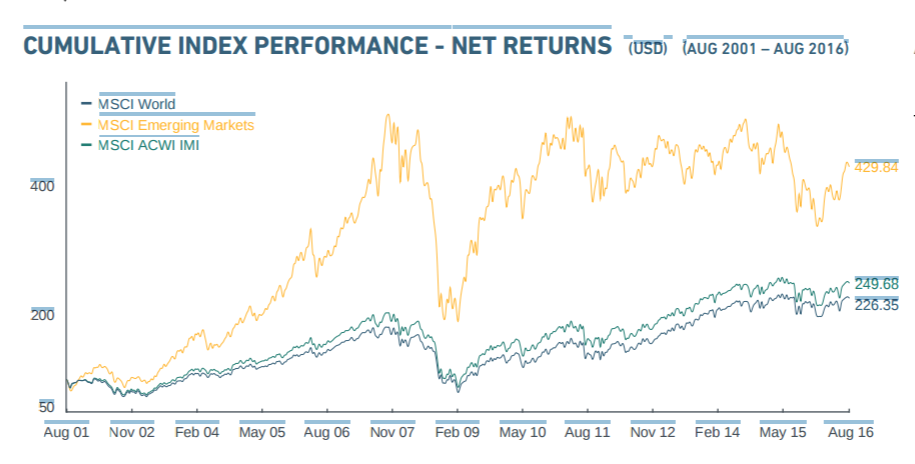

Harvard has earned an annualized 7.6 percent over ten years, versus Yale’s 10.0 percent.

It’s clear that an additional 2.4 percent annualized over ten years would have left Harvard with much more than a mere $37.6 billion endowment. And that difference would have added hundreds of millions per year to their operating budget.

Read More »Welcome to Low-Return World: Are Boards and CIOs Ready?

by charles | Comments are closed06/16/2016

For executive recruiters like us, that’s a question we’ll have to wrestle with as we present candidates to the boards of institutional asset managers.

Two of our investment-management village elders – Bill Gross and Burton Malkiel – say we’re staring down the barrel of a low-return decade. They’ve been around for a while and make good arguments. Maybe we should listen.

Mr. Gross, re-launching his career at Janus at age 72, warns in his June letter that people who have been in the financial markets for many years must recognize that their era has been “magnificent,” but it’s over.

See: https://www.janus.com/bill-gross-investment-outlook

He points to returns for the Barclay’s Aggregate Bond Index since 1976, which grew at an annualized 7.47 percent. For 40 years, conservative bond-investors reaped ample and fairly stable returns.

Then he points to stock returns over the same 40 years, which were far more volatile but paid an average premium of about 3 percent over bonds for bearing that risk.

So, a boring stock/bond blend delivered a nominal, annualized return of around 9.3 percent in those four golden decades.

But, according to Mr. Gross, this period of glorious returns was “a grey if not black swan event that cannot be repeated.”

He clinches his argument by noting that, in the kind of “laddered” constant-maturity bond portfolios most investors use, it takes a long time to raise fixed-income returns when you’re starting with low yields. This is a feature of bond-investing that isn’t intuitively obvious to most of us, but bond guys understand.

With the Barclay’s Agg now yielding just 2.17 percent it will “almost assuredly return between 1.5 and 2.9 percent over the next ten years, even if yields double (or drop to zero) by the end of that span.

Give stocks their traditional 3 percent premium and that implies a 4.5 to 5.9 percent equity return in the coming decade. Suddenly a balanced portfolio going forward produces less than 5 percent nominal.

That’s the view of a fixed-income elder. But we know forecasting bond returns is a lot easier than forecasting stock returns. How about the view of an equities elder?

Coincidentally, Burton Malkiel, wrote a column recently in which he considers three standard ways of forecasting stock returns, all of which forecast a similar low-return future.

It’s here: https://blog.wealthfront.com/us-stock-long-term-returns/

(Mr. Malkiel wrote one of the most influential investing books, ever: 1973’s A Random Walk Down Wall Street, introducing the efficient-market hypothesis to the general public. He’s a distinguished academic with a Princeton PhD who has always kept one foot in the business world. At age 82 he now serves as chief investment officer for robo-advisor startup Wealthfront.)

He starts, like Mr. Gross, with the historical risk premium of stocks over bonds. With T-bills now yielding 0.25 percent and assuming a 6.5 percent equity premium, that implies long-term future stock returns of 6.75 percent. That’s far below recent historical returns of around 10 percent, but higher than Mr. Gross’s number above.

Then, he considers current stock valuations. He thinks current low dividend yields between 2 and 2.5 percent portend future 10-year returns of less than 6 percent.

Finally, he looks at price-earnings ratios, specifically, Professor Shiller’s famous cyclically-adjusted (CAPE) statistic. Result: “Today the CAPE is in the low 20s, suggesting a future 10-year return of less than 5%.”

All three methods point to lower stock returns, and his median estimate – “less than 6 percent” – is congruent with Mr. Gross’s number. Our elders seem to agree.

Both also opine that we didn’t just stumble into Low-Return World; central bankers pushed us here, and they’re still pushing.

No wizards need apply:

I talk to amazingly smart asset-managers every day. But few have faced the kind of decadal low-return world Messrs. Gross and Malkiel are heralding.

They all went to good schools, but none of them graduated from Hogwarts Academy. They can’t wave a wand and produce 10-percent returns in a 5-percent world.

For chief investment officers and investment leaders, managing expectations in this environment becomes a career-defining skill as they deal with boards, politicians, and shareholders accustomed to Golden Age returns.

Low-Return World is not going to be a comfortable place for asset-owners and their CIOs to live in. On the other hand, it opens up big opportunities at for-profit asset-managers on the other side of the market.

If you’re BlackRock, or any of the bigger, diversified firms on our SLAM37 list, your marketers and managers should be offering solutions to institutional investors: innovative vehicles that improve on public-market returns, at a price and a risk-level they can live with (and keeping expenses down is more important than ever in Low-Return World).

See our SLAM37, where we see what the for-profit asset managers are up to: https://www.charlesskorina.com/slam-wars-flow-awakens/

“Real” assets (like real estate, commodities, and infrastructure) may offer an escape hatch from Low-Return World, but how many funds can get there from here? A recent Prequin survey says lots of public pensions are looking hard at infrastructure.

See: their chart for “Growing appetite for infrastructure assets”:

http://fingfx.thomsonreuters.com/gfx/rngs/2/192/458/USA-INFRASTRUCTURE-PENSIONS.jpg

Just last month, for instance, CalPERS bought a 10-percent stake in an Indiana toll road.

That’s great, but there are few such deals in the U.S., and they’re pricey. The good infra-deals are ex-U.S., which leads to another problem for public funds: they can’t afford to hire qualified managers.

Paul Mouchakkaa, the CalPERS real-assets guy, says they’ve had to cap foreign investments because it would require them to hire “a significant number of people.” And, if CalPERS can’t afford to hire such skills, it’s likely that most other funds can’t, either.

If asset-owners expect their managers to find opportunities outside the public markets, they’ll have to pay for that specific experience and expertise one way or another, either internally or externally.

That was true in Bill Gross’s lost Golden Age, and it’s going to be even truer in Low-Return World.

Read More »Listed Asset-Manager Flows and Profits, FY2015

by charles | Comments are closed05/25/2016

Asset-Manager Flows and Profits

As recruiters we work both sides of the investment-management street: serving for-profit money managers and not-for-profits like foundations and endowments.

Fee-based publicly listed asset managers, especially the big ones, are newsworthy because they invest a lot of money for a lot of customers, including non-profits investors. There’s plenty in the media about these firms, but it’s often piecemeal commentary on quarterly results. It’s newsworthy because it drives markets. But our perspective is different.

Ultimately we want to make judgments about the success or failure of leadership: who is outperforming or underperforming their peers? Who is earning his or her pay? Who isn’t?

Read More »Wrangling the Unicorns: Yale celebrates their VC heroes

by charles | Comments are closed05/01/2016

Wrangling the Unicorns: Yale celebrates their VC heroes

Yale, in their 2015 annual report issued this month has broken out their private equity allocation into two distinct segments: Leveraged Buyouts and Venture Capital. See:

http://investments.yale.edu/images/documents/Yale_Endowment_15.pdf

This is the first time in many years they’ve offered that level of detail. And they’ve given the whole report a VC-and-entrepreneurial theme, supplementing the numbers with profiles of some Yale-linked VC heroes and heroines.

Read More »Interview with Russell Read, new CIO at APFC in Juneau

by charles | Comments are closed04/05/2016

A conversation with Russell Read, new CIO at APFC in Juneau

Russell Read has just been appointed chief investment officer of the $52 billion Alaska Permanent Fund Corporation (APFC), and he’s headed for a state in crisis.

The collapse of global oil prices has put a big squeeze on all of the world’s oil producers; and in Alaska, where oil funds 90 percent of the state budget, Governor Bill Walker has nothing but bad news for his constituents. He may even have to reinstate the income tax after 25 years of living on the oil boom.

And he’s proposed to cut the cherished annual cash dividend the APFC pays to each resident: from $2,072 last year to just $1,000 in 2016.

Mr. Read arrives in Juneau on May 1, and he’ll have to hit the tundra running.

His appointment is part of a general recent shake-up at APFC.

Angela Rodell was appointed CEO six months ago, succeeding Mike Burns, who retired last summer. Ms. Rodell is a familiar face in the state capital and at APFC, having served as revenue commissioner under former Governor Sean Parnell and as an ex officio member of the APFC board.

Our friend Tim Walsh will also be a frequent visitor. He just inked a two-year contract as a part-time advisor to the fund. Tim is the former CIO of New Jerseys $72 billion pension fund and will add considerable heft to APFC’s strategic deliberations.

Last week I congratulated Russell on his appointment and we had a chance to catch up with a wide-ranging conversation about where he’s been and what lies ahead.

Read More »