A Dazzling Decade with Trouble Ahead

by charles | Comments are closed12/12/2019

It’s hard to make predictions – especially about the future.

—Robert Storm Petersen, Danish cartoonist, writer, humorist

London calling

Reporter Chris Flood at the Financial Times ran an article a few weeks ago that parsed our latest endowment performance report and pounced on the fact that that none of the sixty funds we featured performed as well as Vanguard’s VFIAX, a large-cap U.S. equity fund, over the last 10 years.

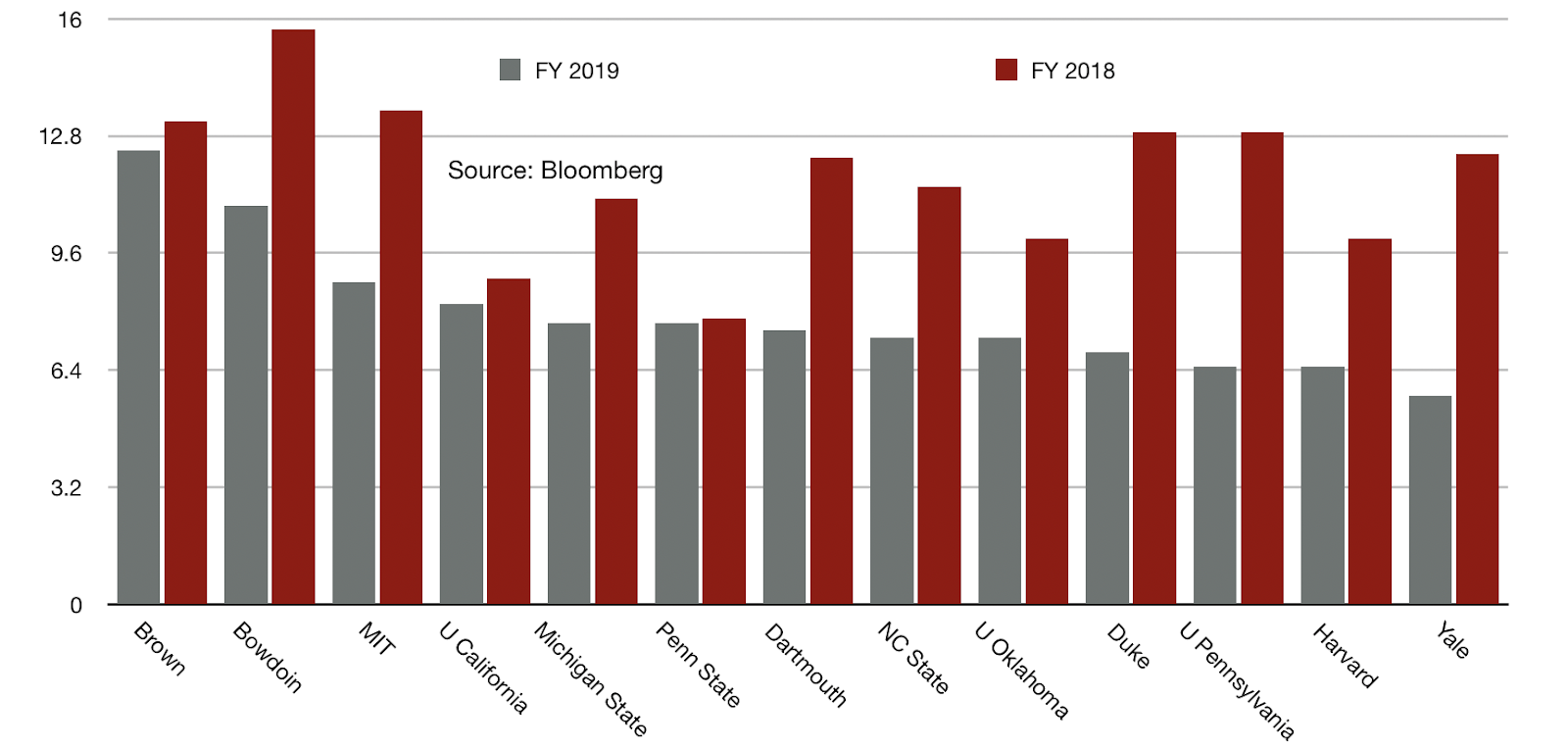

Our newsletter gave an early peek at endowment investment performance for fiscal 2019, including a ranking by 10-year returns.

The VFIAX returned 14.7 percent net of fees for the decade while the top 10-year endowment investor on our list was Paula Volent at Bowdoin College, who racked up an excellent 12.0 percent.

Mr. Flood’s observation makes a good story-hook but, comparing diversified endowment or foundation portfolios to the VFIAX – or to any similar pure-play equity index makes little sense in the real world.

Retrospectively (looking backwards from 2019), placing all your chips on a cheap equity-only index fund looks like genius, but prospectively (forwards from 2009) it would have been insane for any prudent institutional investor.

Endowments and foundations are long-term global investors with horizons extending out fifty, a hundred years and more, and the trustees and CIOs build portfolios to last for generations.

The job of CIO at an endowment or any financial institution is not to beat the VFIAX, but to meet the objectives set by the board who view capital preservation and steady cash flows as paramount.

The sages speak: Omaha vs. New Haven

In our letter we quoted an anonymous board member who was ready to throw up his hands and index his institution’s endowment, thereby avoiding a lot of fees.

We know this board chair and he’s an able and experienced financial exec.

But some bigger and more eminent investors have also taken positions both for and against a passive strategy.

Read More »Performance & Persistence: 1-10 year Endowment Returns

by charles | Comments are closed11/26/2019

Our FY2019 institutional investment update presents the latest one and ten-year returns for sixty endowments.

We consider ten-year returns to be a rigorous and revealing measure of the strength of an institution’s oversight and investment abilities.

Despite rumblings to the contrary, our latest research shows that many nonprofit chief investment officers – and their boards – deliver meaningful value to their institutions.

The road to riches

Most high-performance investment offices on our list have stable boards and long serving CIOs.

It takes years to fully implement a multi-asset, multi-generational investment strategy and altering course mid-stream – a new investment chair? a change in CIOs? – can sap performance for a decade.

We recruit these executives for a living and avidly follow all institutional investment heads managing assets over $1 billion (and many with less), tracking their performance and scrutinizing their abilities.

They may have a down year or two but, as we spotlighted in an earlier report, top chief investment officers stay on top.

And now, on to the table for our fresh-from-the-oven, pre-Thanksgiving performance chart!

Read More »OCIO Growth in 2019: The Party’s Over

by charles | Comments are closed10/29/2019

No one knows exactly when the Southern Cottontail Rabbit diverged from its other 19 (or so) North American Cottontail cousins, becoming its own distinct species of bunny.

In evolution these things just happen.

Similarly, among financial institutions, modern banks seem to have evolved from traditional moneylenders somewhere in northern Italy in the late 14th century. But that fateful development could only be recognized in retrospect.

Our friend John Hirtle, of Hirtle, Callaghan & Co, claims that he (with fellow Goldman Sachs vet Donald Callaghan) birthed the OCIO species in 1988. He’s a very nice (and imposing) man, so we take him at his word.

In any case, there were soon several smallish firms pursuing the OCIO business model in the early 1990s.

The core idea was to offer a diversified and full-discretion money management function to family offices and others who could no longer effectively or affordably do the job in-house (even with the help of traditional trust banking services).

The job was becoming too sophisticated and complex, both conceptually and operationally.

Observing their success, a number of larger firms joined the scrum in the OCIO space and, in a couple of decades we had the OCIO landscape of today, managing not just billions, but trillions of dollars. And reaping proportionate fees therefrom.

We’ve been charting the growth of the OCIO industry for the past decade in our annual OCIO report and the heirs of Hirtle, big and small, seem (mostly) to have flourished.

In our shiny new 2019 report we observe that total OCIO assets grew from $1.98 Trillion to $2.38 Trillion. That’s a year-over-year growth rate of 19 percent.

That’s pretty impressive! But, the AUM increase is not as vigorous as the annual growth over the previous four years (2014 through 2018). And some of the increase represents a “reclassification of assets” at two OCIO providers.

So, three decades into the OCIO era, we’re minded to ask whether the OCIO growth rate may be slowing, maybe even plateauing. Are the OCIO rabbits multiplying faster than the green, green grass of customer money they live on?

Let’s consider the evidence, both statistical and anecdotal.

The hard numbers

Read More »From Russia, with math! Anastasia Titarchuk takes over New York State’s CRF fund

by charles | Comments are closed09/17/2019

Anastasia Titarchuk just moved up to permanent chief investment officer and deputy comptroller of New York State’s $216 billion CRF fund after three years as Deputy CIO and a year as Interim CIO.

NYSCRF is the county’s third-biggest public pension fund after CalPERS and CalSTRS in California.

We have a revealing Q&A with her just below; but first here’s some context about CRF, which doesn’t usually get as much ink as the big West Coast funds.

Investment Performance

Here are the latest multiyear returns for these three mega-pensions and CRF hold its own very well on a comparative basis. (CRF has a non-standard fiscal year, but we have helpfully stated all figures as of June 30, 2019.)

For 2019, CRF tops both the Californians with 7.1 net return.

Over 10 years the New Yorkers were a close second to CalSTRS, with 9.8 percent vs. Chris Ailman’s 10.1 percent.

Investment Performance NYCRF, CalSTRS, CalPERS

[Click “read more” below for charts and complete report]

Only Mr. Ailman at CalSTRS was CIO for a whole decade (now approaching two decades!). Ms. Titarchuk was interim CIO for all of 2019. And, of course, Mr. Meng at CalPERS is the newbie, in office for only the last six months of the 2019 fiscal year.

Funded Status

A very big deal for public pensions is an actuarial number called funded status, which other institutional investors don’t have to think about. The calculation depends on some tricky estimates, and opinions differ about what’s a healthy number. But higher is always better.

A recent Milliman Study of 100 major U.S. pensions found that only 11 have a funded status over 90 percent, and NYSCRF is one of them, with an enviable 94 percent as of 2018.

Good investment performance can help improve this number, but it’s only one factor. Still, a low funded ratio tends to attract attention in a not-good way and can cast a pall over the whole system.

Read More »Trustees: Are You Holding Your Investment Office Accountable?

by charles | Comments are closed07/07/2019

We have worked over three decades recruiting chief investment officers and advising boards on investment performance and our research on investment leaders goes back years. No one has been a stronger supporter of building internal investment management teams than us.

But lately we’ve been wondering if non-profit boards and trustees are holding their investment offices accountable for performance.

Here is what’s bothering us: Many tax-exempt institutional investors have underperformed public markets for ten years and more and, according to board members we have spoken with, failed to meet the needs of their stakeholders.

In some cases, as we have highlighted in past newsletters, it’s the board’s fault. Dissension or timidity tied the hands of highly skilled staff. In others, the chief investment officer just didn’t have what it takes.

So, here’s the way some of our trustee clients see it: If the current investment team at an endowment, foundation, pension fund, or family office can’t out-perform the market over a reasonable period, say five to ten years, then the trustees or principals should replace them with those who can…or get out of the investment business.

In our latest study of large endowment performance, not one investment office out of the hundred we ranked beat the S&P over five years and only a third managed to out-perform a traditional sixty-forty stocks and bonds portfolio.

We tend to focus on foundations, endowments, and family offices but, in the larger universe of pension investors the story is mostly the same.

The annual report of the $150-billion Texas TRS fund (seventh-largest tax-exempt fund in the country) just became available, and Scott Burns at the Dallas Morning News gave it a hard look this week.

Over ten years (ending August 2018) they earned an annualized 7.1 percent with a portfolio that’s more than 40-percent invested in alternatives.

By comparison, the one-stop Vanguard Balanced Index Fund, invested entirely in marketable U.S. stocks and bonds, earned 9.95 percent. The Vanguard fund also beat them over one, three, and five years.

He concludes:

The comprehensive annual report provides thoughtful reasons for this, laying out its sophisticated case for global equity, stable value, real return and risk parity investments.

But simplicity and low cost would have been worth $46.2 billion more [over the same ten-year period].

Read More »