Public pensions, endowments, and foundations will announce blow-out performance when returns are released this fall.

Thanks to bold moves and celestial markets the fiscal year ending June 30, 2021 will be a block-buster for the ages.

A little over a year ago, around March 2020 when markets fell off a cliff, veteran chief investment officers scrambled to rebalance and put their extra cash to work, a gutsy call but not without precedent.

Modern portfolio theory – and the 2009 crash – taught CIOs that when markets crater, investors big and small should rebalance (i.e., buy everything in sight).

Experience, history, and luck were on their side. As of April 30, 2021, the S&P 500 has had a one-year total return of 45.98% and the Barclays Agg ETF returned a minus 0.27%, so a plain vanilla 70/30 portfolio scored about 32.1%.

As a result, equity-heavy, risk-on pensions will have their best returns in years. We could see thirty percent and more.

Endowment and foundation CIOs should do almost as well thanks to eye-popping, co-invested venture and private equity returns and good old-fashion leverage. E&Fs may hold less equity and more alts, but many private market pay-offs were extraordinary.

On the other hand, for those CIOs and investment committees who missed the 2009 memo and panicked — slashing equity exposure then belatedly rebalancing at much higher prices — things aren’t looking so good!

Sub-par returns don’t sit well with trustees and donors. There will be consequence.

CIO Turnover: Pink Slips and Greener Pastures

Poor performance is not the only reason for a rash of CIO departures over the coming year. Early retirement is in the air.

Many investment heads have grown accustomed to the no-commute, work-from-anywhere lifestyle during covid and they don’t look forward to rejoining what they left behind.

They saved their money, invested wisely, and now have a healthy retirement cushion. Many have told us privately that they plan to retire early.

Registered Investment Advisors hear the same thing. Over the past year we’ve spoken with over two-hundred RIAs and they say that among clients in their fifties, early retirement is the number one question on their minds. “I don’t want the commute, stress, and hassles any more. Do I have enough to retire now?

For those of us in the search business, it’s going to be a very busy year.

When the Music Stopped

My wife and I have a ranch in Uruguay, South America, about fifty miles across the Rio de la Plata from Buenos Aires. Uruguay is a lovey, safe, and investment-friendly country with a healthy democracy. But it wasn’t always so.

Thanks to wool and beef exports, the Uruguayan economy grew at a healthy rate through the first half of the 20th century until demand flatlined in the 1950s. What to do next?

The government solution was simple, create public sector jobs and provide income subsidies for all unemployed, slap on price controls and high tariffs to protect local industries, and let the unions and government bureaucracy steer the ship. What could possibly go wrong?

Surprise, surprise!. The economy collapsed, a military junta seized control (1973-1985), and it took about thirty years – with privatizations, public sector cut-backs, and a return to free markets and democratic rule – for Uruguay’s three and a half million citizens to climb out of their hole.

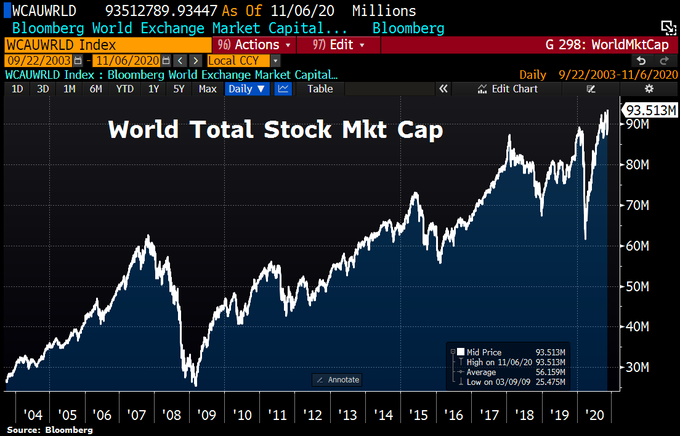

Fast forward to present-day America and what do we see? Bubbles and deficits. Tariffs and tax hikes. A free-money fed. Wage and price inflation. “New-deal” subsidies and social upheaval. Talk about economic headwinds.

One more red-flag example. It used to be not long ago that private equity and venture capital firms raised a new fund every few years. Now CIOs tell me it’s every few months. Spray and pray.

It’s a Robinhood world. What could possibly go wrong?

————————————————–

The Skorina Letter

Each issue explores how the world’s most accomplished asset managers think and invest. Original content includes profiles and interviews with industry veterans and research on compensation and investment performance.

Our insights and commentary come from our clients – board members, CEOs, chief investment officers – and the global investment community within which we work as executive search professionals.

Institutional investors operate at the crossroads of capital, talent, and ideas, shepherding over seventy trillion dollars in global assets. It’s a constantly evolving spectacle and The Skorina Letter gives readers a ringside seat.

Prior issues can be found in “archives” on our website.