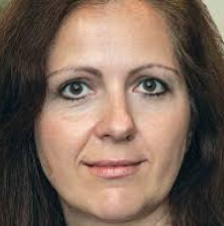

Anastasia Titarchuk just moved up to permanent chief investment officer and deputy comptroller of New York State’s $216 billion CRF fund after three years as Deputy CIO and a year as Interim CIO.

NYSCRF is the county’s third-biggest public pension fund after CalPERS and CalSTRS in California.

We have a revealing Q&A with her just below; but first here’s some context about CRF, which doesn’t usually get as much ink as the big West Coast funds.

Investment Performance

Below are the latest multiyear returns for these three mega-pensions and CRF hold its own very well on a comparative basis. (CRF has a non-standard fiscal year, but we have helpfully stated all figures as of June 30, 2019.)

For 2019, CRF tops both the Californians with 7.1 net return.

Over 10 years the New Yorkers were a close second to CalSTRS, with 9.8 percent vs. Chris Ailman’s 10.1 percent.

Investment Performance NYCRF, CalSTRS, CalPERS

As of 30 June 2019

Chief Investment Officer

|

Fund |

AUM |

1yr rtn |

3yr rtn |

5yr rtn |

10yr rtn |

– |

– |

– |

– |

– |

– |

– |

Christopher Ailman

|

CalSTRS |

$236.9 |

6.8 |

9.7 |

6.9 |

10.1 |

– |

– |

– |

– |

– |

– |

– |

Anastasia Titarchuk

|

NYCRF |

$216.2 |

7.1 |

9.7 |

6.9 |

9.8 |

– |

– |

– |

– |

– |

– |

– |

Yu (Ben) Meng

|

CalPERS |

$370.0 |

6.7 |

– |

5.8 |

9.1 |

– |

– |

– |

– |

– |

– |

Only Mr. Ailman at CalSTRS was CIO for a whole decade (now approaching two decades!). Ms. Titarchuk was interim CIO for all of 2019. And, of course, Mr. Meng at CalPERS is the newbie, in office for only the last six months of the 2019 fiscal year.

Funded Status

A very big deal for public pensions is an actuarial number called funded status, which other institutional investors don’t have to think about. The calculation depends on some tricky estimates, and opinions differ about what’s a healthy number. But higher is always better.

A recent Milliman Study of 100 major U.S. pensions found that only 11 have a funded status over 90 percent, and NYSCRF is one of them, with an enviable 94 percent as of 2018.

Good investment performance can help improve this number, but it’s only one factor. Still, a low funded ratio tends to attract attention in a not-good way and can cast a pall over the whole system.

Funded Status and Assumed Rates of Return for NYCRF, CalSTRS, and CalPERS

Plan Name |

Assumed Rate of Return (Discount Rate June 30, 2019) %

|

Funded Ratio (2018 Milliman Study) % |

– |

– |

– |

NYS Common (NYSCRF) |

6.8 |

94.7 |

– |

– |

– |

CalPERS |

7.375 |

70.1 |

– |

– |

– |

CalSTRS |

7.1 |

69.5 |

– |

– |

– |

N.D.: In an appendix way down below we show a more detailed chart for the funded status of the top eleven pensions

Assumed Rate of Return

A pension’s Assumed Rate of Return is a hot breath down the back of the CIO. She can’t reasonably expect to hit or exceed it every year; but if she can’t beat it more often than not, then she has a problem.

Compare these numbers to the historical returns shown above. None of the three funds hit their number over the most recent five years, although CRF came closest.

In this case, a smaller number is better, in the sense that the trustees have decided they can take a more conservative approach to the portfolio and still protect the pensioners.

CIO Compensation

Finally, since we’re all about performance and pay, here’s what we estimate these excellent CIOs will earn for their efforts in calendar 2019, according to public databases, media reports, and our own estimates.

These are our point-estimates for (calendar year) 2019.

Compensation Chief Investment Officers |

Fund |

Base

|

Bonus |

Total |

– |

– |

– |

– |

– |

Yu (Ben) Meng Media reports for 2019

|

CalPERS |

$707,500 |

$500,000 |

$1.2mil |

– |

– |

– |

– |

– |

Christopher Ailman Latest available 2017

|

CalSTRS |

$520,541 |

$272,685 |

$793,226 |

– |

– |

– |

– |

– |

Anastasia Titarchuk Our estimate

|

NYCRF |

$370,000 |

– |

$370,000 |

– |

– |

– |

– |

– |

Mr. Meng is a bit of a wild card. Per state records he earned an all-in $500 thousand as senior staffer in 2015, before he left for a three-year stint in China. He got a brand-new comp deal when he was recruited back to Sacramento for the CIO job in 2018, succeeding Ted Eliopoulos.

In theory, he could make as much as $1.7 million in base and bonuses, but we think his take-home in 2019 will probably be less. His bonus opportunity ranges as high as 150%.

Assuming he has a pretty good but not stellar first year, we’ll conservatively assume he gets the mean of that range applied to his base, which yields a $1.2 million total. That’s a very pleasant number, but still much less than a lot of people with his credentials make for running a lot less money.

For Mr. Meng’s excellent adventure at a $3 trillion Chinese fund, and the challenge of hitting his return target back in the USA, see this profile in Bloomberg.

The buck stops with Tom DiNapoli

Most big U.S. public pensions are governed by a board of trustees.

For instance, CalPERS, the biggest, is governed by a 13-member board whose members are variously elected, appointed or ex-officio; and always at odds with each other.

New York State’s Common Retirement Fund follows an unusual and much more streamlined model. NYS Comptroller Thomas DiNapoli is the sole trustee and runs the plan in lonely splendor, (albeit with input from several advisory committees).

(The Funston Advisory Services consultancy has published an excellent paper in which they analyze the various governance models in U.S. pension funds.)

He was re-elected in 2018 to his third three-year term with a handy 64-percent majority. And he doesn’t have to convene a board meeting to find out what he thinks.

If NYSCRF is performing pretty well – and the figures above say it is – then it’s only fair to give due credit to Mr. D.

For instance, he’s championed women in the CIO role, of which we approve. He’s also good with developing and promoting talent from within. Ms. Titarchuk spent four years as Deputy and Interim CIO, being mentored by predecessor Vicki Fuller.

<p(If you’re less good at the promotion-from-within process at your institution, our number is on the letterhead.)

Mr. DiNapoli also gets some credit for that desirably low Assumed Rate of Return number above.

In 2010, he decreased the rate from 8.0 to 7.5 percent, and in 2015 to 7.0 percent (as shown in our chart). Most recently, he cranked it down again to 6.8 percent, applying retroactively from the start of the 2020 CRF fiscal year.

This could be interpreted as an expectation that returns generally will be lower in coming years, about which he may be right. And, it takes a little pressure off the CIO. She won’t have to take excessive risks to chase higher returns.

We should also mention that Mr. DiNapoli is trustee of CFR’s sister fund, New York State Teachers, which, along with CRF, is in excellent shape. Its funded ratio, for example, is actually over 100 percent!

The persistent problem of pay for public CIOs

The differential on our chart between Ms. Titarchuk and her male counterparts looks pretty stark.

The two Californians do run larger funds with bigger staffs than Ms. Titarchuk – although she manages a hefty staff of over 80 people – but their performance is not remarkably better. And the market-price for talent shouldn’t be very different from coast to coast.

And it isn’t just a male-female problem.

The relatively low pay at most U.S. public pensions has been a problem for years. In 2016, at the Milken Institute Global Conference, Vicki Fuller (Ms. Titarchuk’s mentor and predecessor at NYSCRF) and Mr. Ailman did not hold back in their criticism of a “broken” staff compensation system, as reported in ai-CIO.

Ms. Fuller pointed out an intimate relationship between comp and the ability to hit those AAR numbers:

“If it doesn’t get fixed, no, you won’t meet the target rates of return. You won’t have the talent,” said Vicki Fuller, CIO of the $185 billion New York State Common Retirement Fund.

On a $1 billion private equity mandate, for example, New York’s fund might spend $30 million to $50 million in fees per year. The employee responsible for that mandate? “$150,000,” Fuller pointed out. “It doesn’t make sense.”

The net investment of increasing staff wages to effectively manage assets in-house would be paid off many times over, according to panelist Chris Ailman. He knows from experience.

“In the public markets, it costs us about one-tenth the cost to run money in-house as it does to hire an external manager,” Ailman said. “If we could run money in private markets and do direct deals, it would probably be 25 times cheaper.”

That’s pretty bold talk from the usually discreet Vicki Fuller, and we suspect that her boss, Mr. DiNapoli, may have concurred, even if he thinks it would be quixotic for an elected official to take that position publicly.

CRF: Divesting with divestment

On another critical issue for all institutional investors, Ms. Titarchuk, also took a public stand just a few months ago.

The New York State Senate (which flipped from Republican to Democrat last fall) was marking up an aggressive climate bill. The bill passed in June, but it’s noteworthy that a proposed divestment mandate on the state pensions was left out.

For years, a mandate on NYSCRF to divest from fossil fuels has been urged by Governor Cuomo and taken up by the legislature, but without success.

The soft-spoken Ms. Titarchuk (albeit as a surrogate for Mr. DiNapoli) entered the lion’s den in Albany and told the Senate what it probably didn’t want to hear: that a divesting mandate would be ineffectual, possibly harmful to net investment returns, and probably unconstitutional under NYS law.

All the while paying prudent and effusive obeisance to the nobility of their ends, of course.

Her testimony may or may not have moved the solons, who may or may not have listened to or understood very much of it.

We suspect the failure of an imposed mandate had at least as much to do with pushback from powerful state unions fond of their pension checks as with Ms. Titarchuk’s careful reasoning.

An Interview with Anastasia Titarchuk

Ms. Titarchuk’s family moved from Moscow to Maryland when she was fourteen years old and, after graduating from Yale in 1999 with a BS in applied math, joined JP Morgan as an interest rate trader, eventually moving to equity derivatives sales.

After eight years at JPMorgan and additional years at Barclays/Lehman and Bank of America, she joined NYS Common in 2011.

We were delighted to talk with her recently about her history, the challenges of managing a large pension fund, and women in finance.

Skorina: you have an unusual background, Anastasia. Born and raised in Moscow, moving to the states as a teenager, always focused on math and science. You’re a role model for STEM kids.

So, how did you wind up in investment management?

Titarchuk: Our whole family has a math and science background, so it would almost be odd if I had diverged from it. And, the short answer to your question, how did I get into finance, is my older sister.

Anna has a BS in math from Moscow Engineering University and a masters in banking and finance from Columbia. She started working on Wall Street and did well. My twin and I would talk to her about finance and we thought we would give it a try.

Skorina: Wait, what? Did you say “twin?”

Titarchuk: Well, yes. I have an identical twin, Nadia; and we both have math and finance backgrounds.

Skorina: Ok, I just looked up Nadia’s background. She has a BS in computer science from Harvard and you have a BS in math from Yale. You have to tell me how that all came to be.

Titarchuk: Well, let’s back up a little. My family moved from Moscow to the States, to Maryland and my parents found work in teaching. Both my parents have PhDs in math and science.

My father was a professor of math and now is in astrophysics. And my mother taught chemistry at Howard University.

My sister and I assumed we would go to the University of Maryland because they have an excellent financial assistance program. As immigrants, money was tight, and my parents had to work hard to raise three daughters.

But, we thought, maybe we should check out other universities. You never know. We didn’t think we would get in, or that we could afford it. But what’s the harm in trying?

Since, as twins, we had rarely been apart, we thought we should try separate colleges and we had heard that Harvard and Yale were both excellent. So, we flipped a coin and I chose Yale and she chose Harvard.

And what do you know? We were both accepted!

Skorina: So, three immigrant sisters succeed on Wall Street. Alexander Hamilton would be impressed! Once he got his head around the woman thing.

Titarchuk: Well, there is a lot of math and analysis involved in portfolio theory and security selection. And, the pay is good!

Skorina: Indeed it is! But how did you cross the street from the sell side to the buy side?

Titarchuk: After my career at the Wall Street banks, I thought I’d take some time off and think about what I really wanted to do next.

One of my old bosses at Barclays heard of a hedge fund director opening at New York State Common and suggested I give them a call. I did, and the rest, as they say, is history.

Vicki Fuller joined as CIO about a month after me and she was a terrific boss and mentor. A few years ago, when the deputy CIO position opened up, she encouraged me to compete for the position.

Skorina: I’ve been asking public pension and sovereign fund CIOs whether it’s realistic to think they can beat the broad market indexes over twenty years and more. Why not just index a 60/40 equity fixed income and go home?

Titarchuk: It’s a fair question Charles that we ask ourselves. And we do have a lot of money passively invested. But my short answer is: we still matter.

Remember, pension funds have increasing cash outflows as the workforce matures and the ratio of active to retired pension recipients typically decreases.

As plans mature, liquidity becomes more important. We have to be very careful to keep that increasing liquidity demand in mind. We have to reduce equities and add fixed income, while still hitting return targets. It’s a tricky balancing act.

If our returns fall short, taxpayers have to make up the difference. Our job is to earn as much as we can, so the taxpayers pay less. And when a fund is over $200 billion, every basis point is serious money. In this respect, scale can work for you.

Ultimately, asset allocation is everything with big funds. We have some excellent managers in our public and private equities and over time they do add some value. We also think PE can still out-perform, for example.

However, I’ll admit that all prices in all classes are currently high and hitting our return target this year will be a challenge.

Skorina: Is the scale of the NYSCRF fund at all intimidating? What are the challenges of investing that much money?

Titarchuk: Sometimes, yes. Maybe the most frustrating challenge is that you need to invest with size. People come to us with all kinds of interesting opportunities, and we often have to pass just because they are too small.

In our world, even a very good return on just a few million dollars can’t move our dial enough to matter.

Skorina: CalPERS seems to be going big on venture capital and private equity. What do you think of that strategy?

Titarchuk: We have a different approach. Again, size is a challenge. We do VC very selectively in certain geographies where we think we have an edge, but generally we avoid it.

In private equity, we are more active, but for now we are happy with our 10 percent allocation to the space.

We are not in a position to build out our direct program and we also face statutory limitation on our commitments to all alternatives.

Skorina: How and where do you find good outside managers?

Titarchuk: There is no one way. You find them where you find them. You just have to keep your antennas out. It can be via networking, spinoffs from current relationships, emerging manager programs, consultant recommendation and other ways.

Skorina: Looking out over the next 10 years, do you think even a 6.8% average return is doable?

Titarchuk: Yes, but it won’t be easy.

Skorina: You were born and raised in Moscow and Ben Meng was born and raised in northern China. People from very different cultures are managing huge chunks of money for American retirees

Titarchuk: I think it just shows the opportunities this country still presents to newcomers, and why it still attracts global talent.

Skorina: You have an equities derivatives sales background. You sat on the other side of the table and sold investment vehicles to institutional investors. Different from most CIOs. So, do you look at the process differently?

Titarchuk: I think more than anything it’s my mathematics background that impacts the way I look at investments. I tend to be more statistics-focused than others.

And the derivatives sales background certainly helps too in understanding the working of both the buy and the sell side. It is also useful in analyzing any structured product offerings being pitched to us.

Skorina: How can you help encourage more women to consider financial careers?

Titarchuk: Networking with other women in the industry, starting as young as you can. You must also create a good work/life balance.

Skorina: What advice would you give the next gen of women investment managers?

Titarchuk: Nobody’s good at everything. Focus on your strengths; be comfortable with your own unique style; and compete on things you are good at. Don’t let yourself be intimidated.

Skorina: How did Vicki Fuller help mentor you in your career?

Titarchuk: Vicki put me in a position to compete and provided me useful advice on speaking up and managing different personalities.

Skorina: It’s been a pleasure meeting you, Anastasia. Thank you for your time, and good luck in your new job.

Titarchuk: Thank you, Charles; I enjoyed it!

Footnote 1: Dr. Lev G. Titarchuk, the father Ms. Titarchuk mentions in passing, is a distinguished astrophysicist. He was, for instance, a co-discoverer of the universe’s smallest black hole.

Footnote 2: Her older sister Anna Titarchuk-Berman is Senior Strategist at Israel Englander’s $38 billion hedge fund Millennium Management LLC.

Appendix

US retirement funds with funded status over 90 percent.

CalPERS & CalSTRS included for comparison.

Ranked by funded status. Measurement date for most funds, June 30, 2017

– |

Plan Name |

discount rate % |

Total Pension Liability $mil |

Funded Ratio % |

Active Members |

Ret. members |

– |

– |

– |

– |

– |

– |

– |

1 |

Wash St Police & Fire

|

7.50 |

14,608 |

119.9 |

17,739 |

13,287 |

– |

– |

– |

– |

– |

– |

– |

2 |

Tennessee Ret. Sys

|

7.50 |

22,614 |

101.2 |

62,320 |

89,992 |

– |

– |

– |

– |

– |

– |

– |

3 |

NYS Teachers

|

7.25 |

114,708 |

100.7 |

256,171 |

172,408 |

– |

– |

– |

– |

– |

– |

– |

4 |

S. Dakota Ret. Sys

|

6.50 |

11,635 |

100.1 |

40,452 |

45,799 |

– |

– |

– |

– |

– |

– |

– |

5 |

Wisconsin Ret. Sys

|

7.20 |

93,404 |

99.1 |

257,285 |

364,838 |

– |

– |

– |

– |

– |

– |

– |

6 |

NYS Common (NYCRF)

|

7.00 |

177,401 |

94.7 |

496,441 |

538,201 |

– |

– |

– |

– |

– |

– |

– |

7 |

Oklahoma Public Employees

|

7.00 |

9,455 |

94.3 |

38,873 |

40,530 |

– |

– |

– |

– |

– |

– |

– |

8 |

N. Carolina Public Employees

|

7.20 |

26,231 |

94.2 |

126,647 |

129,612 |

– |

– |

– |

– |

– |

– |

– |

9 |

Utah Ret. Sys

|

6.95 |

35,299 |

90.3 |

97,522 |

120,629 |

– |

– |

– |

– |

– |

– |

– |

10 |

NYS Police & Fire

|

7.00 |

31,670 |

93.5 |

32,332 |

37,805 |

– |

– |

– |

– |

– |

– |

— |

11 |

LA Fire & Police

|

7.25 |

20,814 |

91.3 |

13,327 |

13,310 |

– |

– |

– |

– |

– |

– |

– |

– |

7.375 |

70.1 |

1,257,384 |

668,059 |

||

– |

– |

– |

– |

– |

– |

– |

– |

CalSTRS

|

7.10 |

302,769 |

69.5 |

445,935 |

487,475 |

– |

– |

– |

– |

– |

– |

– |

N.L.: Measurement date for most funds – June 30, 2017

Wisconsin Ret. Sys – December 31, 2016

Utah Ret. Sys – December 31, 2017

NYCRF and NYS Police & Fire – March 31, 2017