Anything new under the sun?

by charles | Comments are closed07/27/2024

“There’s only one way to describe most investors: trend followers.” —Howard Marks

We recently sent out an email query asking asset managers and chief investment officers, “anything new under the sun,” and received some serious replies. One thoughtful, highly respected, mega-fund chief investment officer wrote:

“There are quite a few interesting trends: AI, energy transition, innovations in healthcare are a few positive ones. Commercial RE, small cap, China and Emerging Markets are a few negative ones.

“The slow pace of private capital coming back to investors is another important trend that everyone is contemplating. Everyone is hoping that lower interest rates will restart more M&A and IPO activity.

“However, personally I think the bigger trend is how investors are thinking about asset allocation. I remember the strong emphasis across the industry on diversification. If you could find uncorrelated return streams, the trend was to add them almost blindly. Diversification and low vol was the main point.

“Today (and for some time), diversification has not been your friend. The future is moving to disruption, and you need companies and funds that have size, data, the ability to invest in AI, and cheap financing.

“Disruption is so large in the U.S. that we may not need geographic diversification like we used to.”

Another CIO replied:

“I find the dominance of U.S. public equities, and a teeny-weeny handful of them at that, to be quite troubling.

“One of our IC members is pushing us to divest of non-U.S. equities and it’s difficult to find any recent data to argue against that, yet the idea of having 40% of our endowment in a stock portfolio that’s really just five giant tech stocks is scary to me.

“We’ve reduced our hedge fund exposure, our real asset portfolio was always pretty small, and those big tech companies are amazing economic engines, so I am not sure I would say we are in a bubble.

“But some of the most successful endowments have one-sixth, one-fifth, or even one-quarter of their portfolios with a single VC firm. Maybe we should be worried.”

Pay and Chief Investment Officers

Speaking of chief investment officers, in case you missed it, here are a few highlights from an interesting paper on chief investment officer compensation by Matteo Binfarè, University of Missouri and Robert S. Harris, University of Virginia:

“Endowments pay CIOs more, rely more on bonuses, attract more experienced professionals, and have lower turnover than pensions.

“On average, endowment CIOs earn a whopping $800,000 in total annual compensation, three times more than their peers at pension funds. Incentive compensation makes up a significant portion of their pay, with more than 40% being tied to incentives — almost four times more than pension plan CIOs.

“Endowments that pay their CIOs top quartile compensation significantly outperform endowments with bottom quartile compensation by almost 100 basis points annually.”

All great stuff, but this begs the question, what are chief investment officers actually getting paid for? Size, complexity, performance?

The compensation conundrum

According to Business Insider, “the S&P 500 average return over the past decade has come in at around 10.2%, just under the long-term historic average of 10.7% since the benchmark index was introduced 65 years ago.”

Read More »Affluent Family Affairs

by charles | Comments are closed07/22/2024

Money, if it does not bring you happiness, will at least help you be miserable in comfort. —Helen Gurley Brown

While family dynamics probably haven’t changed much since Count Leo Nikolaevich Tolstoy wrote his famous line about unhappy families, the modern family office has come a long way from 1878 when Anna Karenina was published, adding structure, discipline, academic rigor, and, most importantly, convenience to the management of UHNW affairs.

Ultras place a premium on convenience and they are more than willing to pay for it. Whether it’s a dedicated family office or a cadre of wealth and client service providers, when you’ve made it big, you need a lot of help, as Deloitte explains in a recent report. There are operating companies and investment portfolios, estates and staff, trusts, foundations, donor-advised funds, art collections, cars, boats, and planes, accountants, lawyers, and specialized service providers.

Here to help

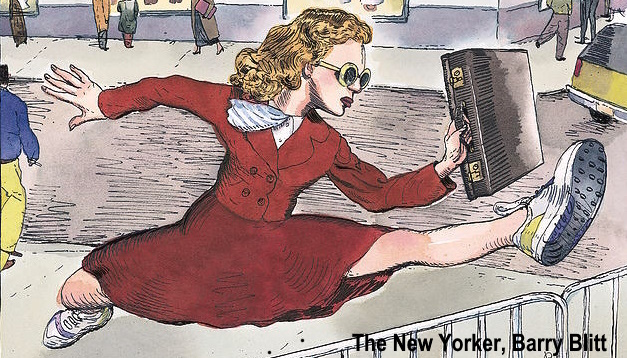

We’ve been sifting through this rarefied mix of New York wealth and family service elites, on assignment for a notable Wall Street firm. Our mandate? Recruit a professional client service maven who will make the partners’ lives easier and their balance sheets stronger.

Firms like Goldman Sachs, KKR, and McKinsey have dedicated concierge groups to service their partners. Goldman, in fact, just renamed their partners coverage group the “partners family office.”

One candidate with considerable experience working for billionaires described the work this way:

“My writ was straightforward, Charles: create wealth, reduce taxes, and mitigate risk. But the job was a little more complicated than that.

“Over the years, I’ve worked with experts on investments and allocations, restructured lines of credit, and arranged and refinanced mortgages. I dealt with accountants, attorneys, and realtors, bought and sold property, art, and collectibles, researched state and global tax domiciles, and negotiated loans on assets. Whatever the client wanted, you name it.

“But in this job you also have to read people and be the consummate diplomat. As families grow larger and wives and husbands come and go, competition increases for access and influence. Don’t ever forget who you work for.”

Where are the ultras?

It’s tough to get a handle on the number of ultra-high-net-worth families in the US, the assets they control, or their objectives because most prefer the shadows to the limelight.

In one widely quoted survey, Campden Wealth reckoned there were 3,100 large single-family offices in North America. The Family Office Exchange (FOX), on the other hand, cast a wider net, estimating closer to 10,000 SFOs given the relentless growth in global wealth.

As for billionaires, the Hurun Global Rich List 2024 counts one-hundred-nineteen billionaires in New York while Henley Global’s World’s Wealthiest Cities Report 2024 uncovered a mere sixty.

Chart: US cities with millionaires, centi-millionaires, billionaires

As an aside, of the roughly $83 trillion in wealth transfer over the next twenty years, according to the UBS Global Wealth Report 2024, “a notable amount of this wealth will move horizontally between spouses first, before moving to the next generation. In practice, this means a considerable transfer of wealth to women, considering their comparatively higher life expectancy.”

What’s a client service professional?

Read More »