Family office survival: nothing’s guaranteed

by charles | Comments are closed11/26/2022

If you’re a great entrepreneur, you’re likely a pretty bad investor

Family office survival is no sure bet, according to Josh Baron and Rob Lachenauer, co-founders of BanyanGlobal Advisors. In fact, family-owned companies have a better chance of managing succession than the family investment office. But wealth preservation has never been easy. For those founders facing the perils of passing on the legacy, Messrs. Baron and Lachenauer have a few suggestions that just might help.

Their September 2022 article in Harvard Business Review, Is Your Family Office Built for the Future, highlights internal office tensions, the lack of emotional connections among generations, and unintentional dependencies.

The authors argue that family office founders face five key decisions which determine success or failure. They are:

- Design: How will you own your assets together?

- Decide: How will you structure governance?

- Value: How will you define success for your family office?

- Inform: What will and what won’t you communicate with your family?

- Transfer: How will you handle the transition to the next generation?

Family office clout

It’s tough to get a handle on how many family offices there are in the US, the assets they control, or their objectives because most prefer to stay unnoticed. But no matter how you count them, they are a significant force for investment and philanthropy.

An oft-cited Campden Wealth study estimates roughly 3,100 large single-family offices in North America, 42 percent of the global 7,300.

Forbes reported in 2020 that the top fifty wealthiest US families alone were collectively worth about $1.2 trillion.

Casting a broader net, Credit Suisse counts about 140,000 ultra-high-net-worth individuals in the US with wealth over $50 million.

While endowments and foundations get most of the attention, the family office universe is larger, growing faster, and doing a great deal of good while doing well.

So, what’s on their minds?

Family dynamics, more than money

Read More »Family Office direct investing: the thrill is gone

by charles | Comments are closed11/07/2022

No matter who you are, most of the smartest people work for someone else. — Bill Joy

Large family offices over $5 billion AUM with five or more years of experience running in-house direct investing programs now have the data to assess their efforts. From what we hear, for many families, it’s just not worth the effort.

Attribution studies conducted recently by a number of family office investment staffs conclude that they would have been better off buying an index.

Our clients and contacts cite three reasons for their disappointment, public market performance, high costs, and competition.

A few caveats. We usually provide data to back up our thesis, but in this case, due to the sensitivity of our sources (i.e., the career limiting nature of any disclosures), our comments will have to be anecdotal.

Also, the SFOs we spoke with on background regarding direct investing made their money from tech, energy, and manufacturing, not finance.

It’s tough to beat public markets

US equities set a particularly high hurdle for performance this past decade and over longer periods remain a hard mark to beat.

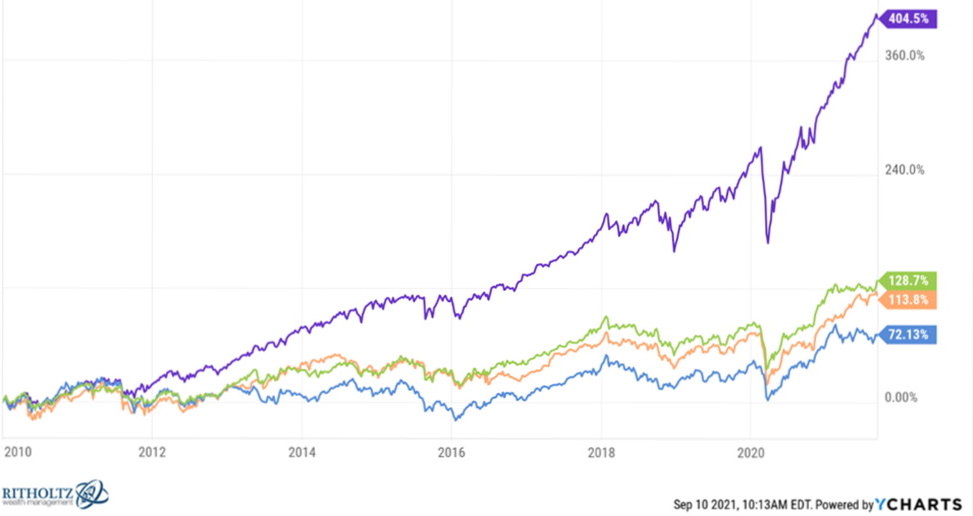

Here’s a snapshot of the S&P over the last twelve years along with some international peers.

(S&P 500 12-yr performance 2022)

Lamentably the stock market took a nasty fall this year after capping an extraordinary run in 2021, but for long term investors it’s hard not to embrace public equities.

Since 1945 the S&P increased on average about 11% annually, posting an inflation-adjusted return of 7.14% per year. More than enough to provide comfortable payouts for generations of happy heirs.

High costs

Read More »