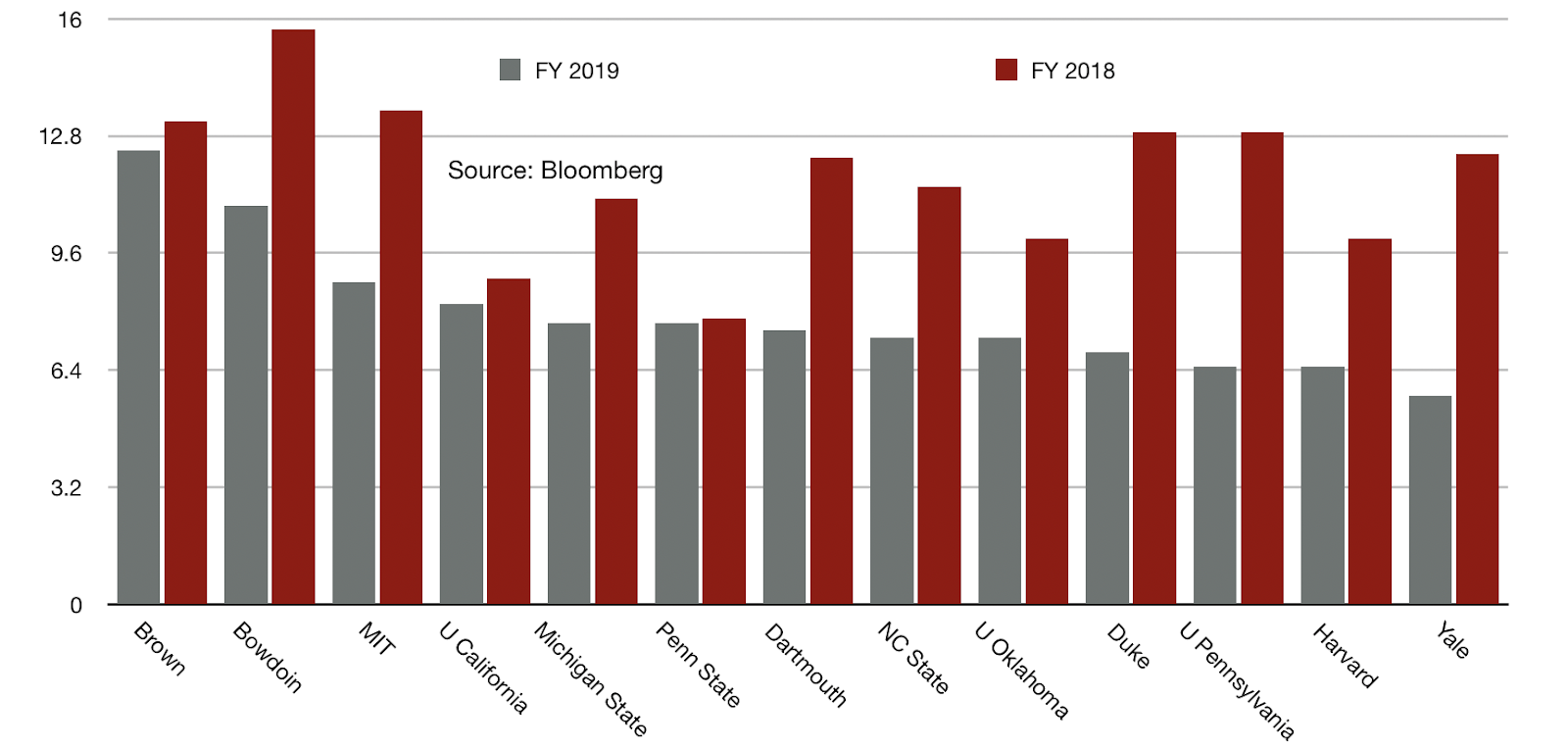

Performance & Persistence: 1-10 year Endowment Returns

by charles | Comments are closed11/26/2019

Our FY2019 institutional investment update presents the latest one and ten-year returns for sixty endowments.

We consider ten-year returns to be a rigorous and revealing measure of the strength of an institution’s oversight and investment abilities.

Despite rumblings to the contrary, our latest research shows that many nonprofit chief investment officers – and their boards – deliver meaningful value to their institutions.

The road to riches

Most high-performance investment offices on our list have stable boards and long serving CIOs.

It takes years to fully implement a multi-asset, multi-generational investment strategy and altering course mid-stream – a new investment chair? a change in CIOs? – can sap performance for a decade.

We recruit these executives for a living and avidly follow all institutional investment heads managing assets over $1 billion (and many with less), tracking their performance and scrutinizing their abilities.

They may have a down year or two but, as we spotlighted in an earlier report, top chief investment officers stay on top.

And now, on to the table for our fresh-from-the-oven, pre-Thanksgiving performance chart!

Read More »