Performance and Persistence: the best CIOs stay on top

by charles | Comments are closed02/07/2017

“Persistence of returns” is a phrase we associate with hedge funds. It seems debatable whether there is any such persistence there. Hedgies say there is; others are not so sure.

In the case of endowments and chief investment officers, however, it’s a verifiable phenomenon.

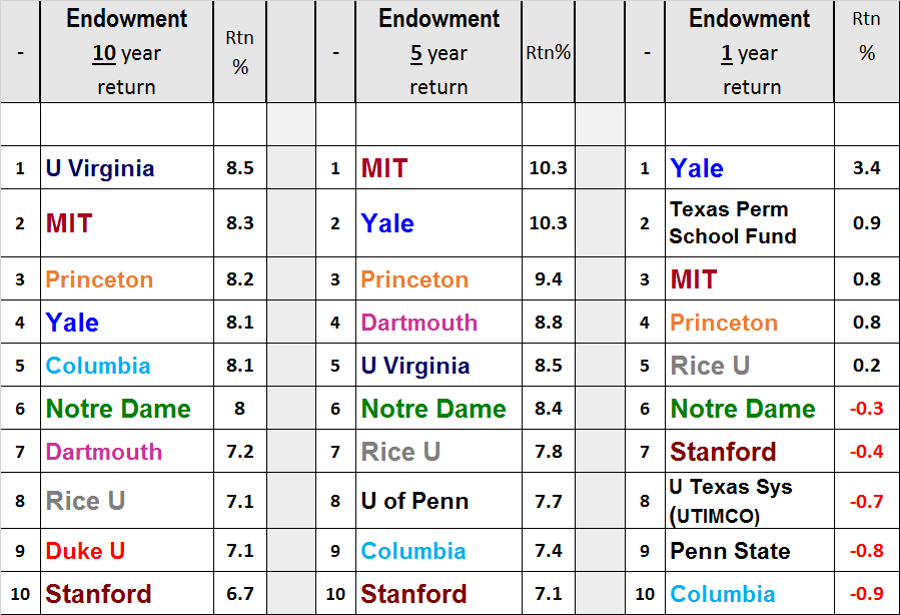

The chart below incorporates the latest numbers and lists the top-ten endowment performers (out of our Top 25 cohort) for 1, 5, and 10-year periods as of June, 2016.

What is remarkable is how the same funds tend to show up across the board, even in the more volatile 1-year numbers.

Seven funds – MIT, Princeton, Yale, Columbia, Notre Dame, Rice, and Stanford – show up in each table. Dartmouth and Virginia both make two out of three (neither of them quite made the cut for 1-year returns). Notre Dame’s consistency is uncanny: they rank 6th out of 10 on all three.

Rice’s consistent excellence may have been slightly unexpected. It’s a Southern, non-Ivy school with “only” a $5.3 billion endowment; but it has outperformed Stanford and most of the Ivys in each measurement period. Good work by Allison Thacker’s Rice Management Company.

Read More »