“The true sign of intelligence is not knowledge, but imagination”

—Albert Einstein

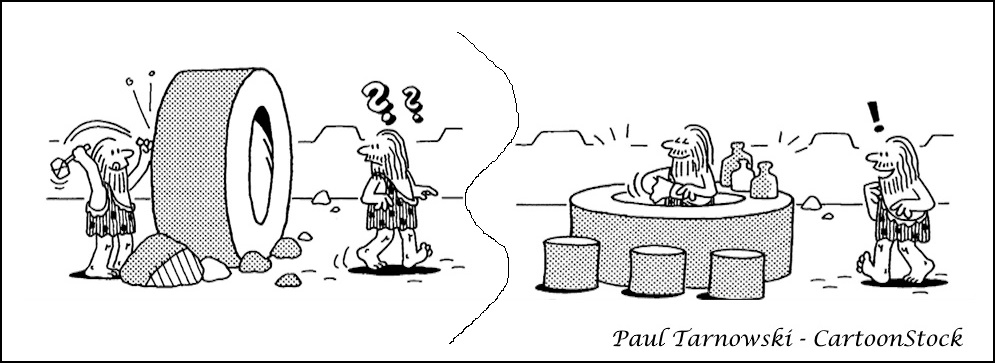

You don’t have to reinvent the wheel to build a successful outsourced chief investment officer (OCIO) business, but it sure helps to connect the dots.

Despite countless paeans to AI these days, when it comes to OCIOs, there is very little new under the sun, and as most wide-eyed newcomers eventually come to admit, discretionary service providers are notoriously hard to scale.

Jon Hirtle of Hirtle Callaghan launched the first conflict-free, independent investment office managing family and institutional money in 1988. Forty years later, the OCIO industry is bifurcated, highly diverse, and intensely competitive with hundreds of OCIOs, RIAs, banks, brokers, and asset managers competing for discretionary customers. It’s a jungle out there.

But with the formidable forty-year swell in private equity, venture capital, credit, and infrastructure investing, OCIOs are matching capabilities with clients in creative new ways.

Dean Keith Simonton, Professor Emeritus of Psychology at the University of California, Davis, posits that “genius hunts widely—almost blindly—for a solution to a problem, exploring dead ends and backtracking repeatedly before arriving at the ideal answer.”

Boutique providers – that’s pretty much everyone under about one-hundred billion in AUM – such as Hirtle Callaghan, Commonfund, Makena, and McMorgan & Company, have spent years polishing their services and honing their competitive advantage. As the market grew and providers proliferated, firms adapted, combining traditional prix fixe solutions with selective a la carte services.

According to Cerulli Associates, “Amidst inflation, interest rate hikes, market volatility, and the changing implications of geopolitical conditions, asset owners are increasingly drawn to the OCIO model for the management of sleeves for alternatives and private asset classes for which they do not think they have the appropriate level of expertise.”

It’s all about access

Access to the crème de la crème of alternative managers challenges most tax-exempt institutions and family offices, but OCIOs, with the diversified endowment model as their template, have spent years sourcing and cementing relationships with top private equity and venture capital professionals. Providers now offer a variety of alternative sleeves for those who prefer specialized participation.

A few prescient firms have gotten even more creative. McMorgan & Company, for example, has an infrastructure fund not common in boutique outsourcers.

A few years ago, the company established a relationship with OMERS Infrastructure, the infrastructure investment arm of OMERS, a large Canadian pension plan that has been investing directly in infrastructure since 1999. This relationship has led McMorgan to create a fund which co-invests in certain deals alongside OMERS Infrastructure.

There’s nothing new about infrastructure funds, plenty of firms in the mix, but few boutiques take the time to build something special. The McMorgan Infrastructure Fund hews a path for prudent tax-exempt and family office investors.

Final thoughts

We’re in the executive search business, for those that haven’t already guessed, along with OCIO search and selection and the occasional consulting assignment, so job seekers send us resumes and call almost every day.

Most candidates hammer on about what they’ve got and what they want. Surprisingly few spend much time asking about what our clients want, the folks we care most about.

But now and then someone applies that “second level thinking” Howard Marks talks about. They surprise us by connecting the dots, by carefully researching a potential employer and asking, what does this company need and how can I give it to them, rather than ramble on about what they, the job seeker, wants.

Here’s an example, a story we heard some while back.

When Mr. Scott Nuttall, who is now KKR’s co-chief executive officer, first met with the eponymous proprietors at the private equity giant twenty-eight years ago, he didn’t just walk in with a resume and spiel about how wonderful he was, he came prepared with a plan and compelling proposition.

Having worked on the capital markets desk at Citicorp early in his career, he knew how the business worked, how to staff a desk, and how to run it, and offered to build a similar full-service operation for KKR.

There’s nothing new or inscrutable about capital markets. The Dutch established a bustling trade in VOC shares (Dutch East India Company) on the Amsterdam Stock Exchange in the early seventeenth century to help finance the Company’s mercantile expeditions. Today there are hundreds of players.

But KKR at the time did not have the capability, and an internal origination and distribution desk would save millions in fees paid to the street and generate revenue for the firm.

KKR didn’t have it, Mr. Nuttall said he’d build it, and the rest is history.

———————————————–

Time to update our OCIO directory

It’s time once again to update our Outsourced Chief Investment Officer directory. So please send us any changes in contact information — name, phone, email, and AUM as of June 30, 2024.

Prospective clients can’t reach you if they don’t know how to find you.

—Charles Skorina

———————————————–

Disclosures and disclaimers

For Informational Purposes Only. Any and all information in this newsletter (The Skorina Letter) or on this site (charlesskorina.com) is provided for promotional and or informational purposes only and is not to be relied upon as a professional opinion whatsoever. This includes all digital content, including but not exhaustive of, email, blog, podcasts, events, and all social media (inclusive of: Facebook and Instagram), webinars and other content whether or not they are available for purchase, as resources or education and information only. All content mentioned does not constitute professional advice and is not guaranteed to be accurate, complete, reliable, current or error-free. By reading this newsletter and or using this site, you accept and agree that following any information or recommendations provided therein and all channels of digital content is at your own risk.

Charles Skorina & Company (CAS) currently maintains or has maintained in the past business relationships (general business consulting, executive search consulting, OCIO search and selection, and M&A advisory) with McMorgan & Company, Hirtle Callaghan, Brown Brothers Harriman, Alan Biller and Associates, Michigan State University, University of Nebraska, University System of Maryland Foundation, Casey Family Programs, UnitedHealth Group, JPMorgan, private equity firms, family offices, and international educational institutions) under which (CAS) is or was compensated (cash, barter, exchange of favors) for providing consulting services in connection with investment services, executive search, marketing, and research.