Leadership is the capacity to translate vision into reality —Warren Bennis

Chief investment officers are C-suite executives. They manage a business that generates revenue and supports an enterprise. Be it OCIO, endowment, or family office, investment leadership matters.

We recruit these executives and facilitate OCIO selections so we pay attention to who they are, what they do, and how well they do it. Here are a few observations.

Larry Fink, CEO of BlackRock, describes leadership as “a consistent voice, a clear purpose, a coherent strategy, and a long-term view.” McKinsey defines leadership as “enabling others to accomplish something they couldn’t do on their own.” Jon Hirtle, executive chairman Hirtle Callaghan and former Marine Corps officer, considers leadership “the noble cause – serving the client.”

The authors of “What Makes a Great Leader,” list three qualities as key – architects, bridgers, and catalysts. “As architects, they build the culture and capabilities for co-creation. As bridgers, they curate and enable networks of talent inside and outside their organizations to co-create. And as catalysts, they lead beyond their organizational boundaries to energize and activate co-creation across entire ecosystems.”

Myra Drucker’s prolific CIO academy

Some years ago we spoke with Myra Drucker, the former chief investment officer of the Xerox corporate pension group, and wrote about her impressive internal CIO training program.

Notable alumni include Joseph Boateng, CIO of Casey Family Programs Foundation, MaDoe Htun, CIO of the William Penn Foundation, former endowment CIO’s Mary Cahill and Matthew Wright of Emory and Vanderbilt respectively (and founders of OCIO firms Acansas and Disciplina).

Mr. Boateng recalled that “Myra told all of us in the investment office that she would consider her job a success if she accomplished just two objectives: first, meet her performance targets for the pension fund; and second, develop all of us so well that each of us could go on to become a CIO. She is a role model I still look up to.”

When we asked Ms. Drucker for the secret to her CIO sauce, she answered this way: “First, obviously, you hire the best people you can find. Every hiring decision should be a big deal that gets your full attention.

“Then, push them. Make them stretch and take on new assignments. I rotated my people among asset classes. Nobody just sits at a fixed-income desk without ever having to deal with equities or alternatives. For every asset class and major initiative, I made sure there were two team-members assigned: a lead and a back-up.

“But it goes beyond just portfolio management. Everybody is exposed to the operational and administrative tasks. Everybody has to understand fund accounting.

“I know that some fund managers think they should be the sole interface with the board or trustees, and reserve that job to themselves. I think that’s a mistake. I made sure my people were in meetings with the board members and made presentations to them. “Managing” a board is a key, make-or-break skill for a fund manager, but if you’re not taught how to do it, how can you ever operate on that level?”

Time and money

Leadership training takes time and money, a hard sell these days. When I joined Chemical Bank some decades ago, training programs were de rigueur among the Wall Street money center banks. We trainees spent a year studying accounting and corporate finance, working on credit and risk reports, rotating through term lending, trading, investments, workouts, and sales.

Today, others on the Street have picked up the mantle. Columbia has launched a Chief Investment Officer Program starting December 2024, Harvard offers a profusion of leadership programs, and hedge fund founder and NY Mets owner Steve Cohen established a comprehensive training program, the Point72 Academy, within his $35 billion investment firm.

Final thoughts

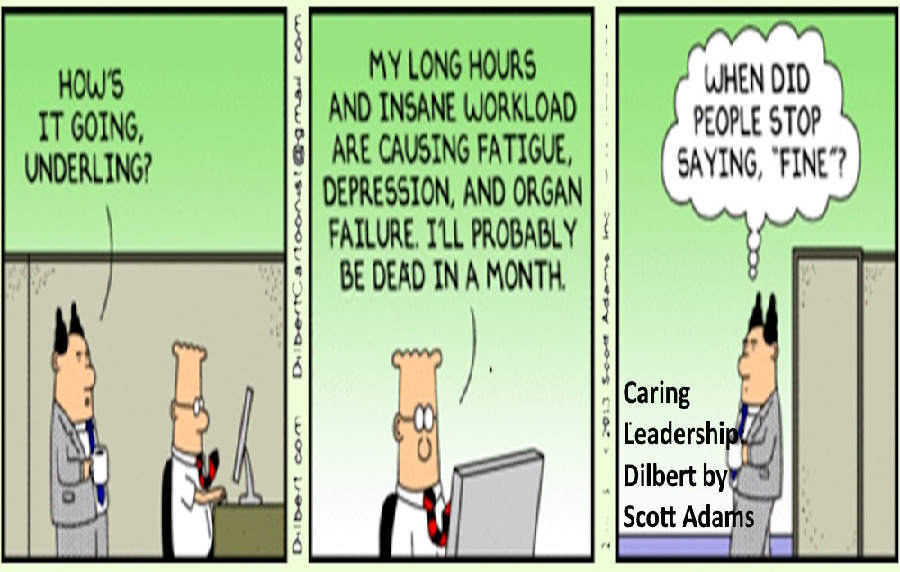

Investment leaders motivate, mentor, and manage capital and staff. But chief investment officers have an additional challenge, dealing with the follies of human psychology.

Phil Zecher, Ph.D. nuclear physics and chief investment officer Michigan State University, cautions in our upcoming interview that “humans are very good at creating plausible stories to explain purely random events.”

Today, notes Felix Salmon in AXIOS, “the [S&P 500] index’s thirty-year return is 1,135 percent.” Yet, over the last fifty years the US has experienced seven major financial shocks:

- Stock market crash 1973–74

- Late 80s S&L crisis

- Black Monday October 1987

- Long-Term Capital Management bust 1998

- Dot-com collapse 2000–2002

- The “Great Recession” 2008-2009

- COVID-19 related market crash March 2020

Whether irrational exuberance or insightful pessimism, Berkshire Hathaway’s burgeoning $325 billion cash hoard suggests that market perspectives vary.

No matter the prognosis, John Santaguida, CEO of OCIO firm McMorgan & Company, views successful investment leaders as highly “adaptive” – curious, rigorous, and resilient.

Unfortunately, most stakeholders – investors, pensioners, students, faculty, foundation beneficiaries, charity recipients, board members – care more about today’s headlines and next year’s budget than what might happen ten, twenty, fifty years down the road.

The challenge for investment leaders is to manage the very human thirst for excitement and gratification against the need to invest wisely and preserve capital for when the music stops next.

—Charles Skorina

skorina@charlesskorina.com

(520) 428-4180