Chief Investment Officers for Dummies

by charles | Comments are closed10/22/2023

Thinking is the hardest work there is, which is the probable reason why so few engage in it. – Henry Ford, SF Chronicle 1928

What do chief investment officers actually do for a living? Most board members, executives, reporters, the public, apparently have no idea. So, here’s our learned take after decades recruiting them.

The number one job of a chief investment officer is to protect the money their patron spent a lifetime accumulating. Job two is to construct and implement a portfolio that will compound at seven to ten percent a year for the rest of eternity. Job three is to keep jobs one and two from going off the rails.

A True Story

Here’s an example of what can go wrong, a true story. I sat in on a college board meeting a few years ago at the invitation of the CIO who would soon retire. This CIO had managed not long before to wangle a modest initial allocation to Sequoia Capital, one of Silicon Valley’s seminal venture capital firms.

The CIO had produced excellent performance over his tenure, and he looked at the Sequoia investment as a parting gift to the school, and proudly mentioned it at the board meeting.

This, unfortunately, did not sit well with the new board chairperson, a trial lawyer, who knew and cared nothing about institutional investing, venture capital, or diversified portfolios, but a lot about how to lean on witnesses and win an argument.

“Why would you waste your time on a piddling investment like that? I think we [the board] should agree that no investment will be made in the future for under three million dollars.”

The CIO looked at me, my cue to speak up, and I told the members about persistence in VC performance and Peter Thiel’s five-hundred-thousand dollar bet on Facebook, which reportedly returned about a billion to Mr. Thiel.

“That’s like saying if someone had invested in Apple in the beginning they’d be rich today,” replied the chairperson. And that was that. The board acquiesced, the resolution passed, and the CIO’s best intentions took an unexpected turn.

There is an interesting postscript, however. A year or so later the board majority decided to outsource the portfolio and do an end run around the chairperson whom, they decided, was too much at odds with the rest of the members to pursue a coherent investment policy.

The Tao of Investing

True investment professionals develop a discipline that rivals any Olympic athlete: the ability to temper their emotions, place well researched bets, and hold fast come rain or shine.

Portfolio construction and sitting tight may not be as exciting as buying a sports team, building office towers, or striking oil, but over the long haul, diversification and compounding win most races.

Jon Hirtle, executive chairman of Hirtle Callaghan, describes investing this way. “Serious investing is about consistency, and serious investors position their portfolios to succeed in a highly uncertain future.”

Warren Buffett views investing as a journey, always engaging, never certain. “Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.”

And Larry Fink, CEO of BlackRock, points to “a consistent voice, a clear purpose, a coherent strategy, and a long-term view,” as hallmarks of superior leadership, qualities that shine in top-ranked chief investment officers.

Watching Paint Dry

Read More »Rates? Recession? What me worry?

by charles | Comments are closed10/21/2023

We’re gathering comments and ideas from readers for a conference in NYC and we would love to hear from you. Observations, news, hiring? We’re all ears. See our email at the bottom of this newsletter.

As we mentioned last week, we’ve noticed more chief investment officers on the move than usual this fall.

Could surging yields have something to do with it? We’re in the search business after all, so, we pulled our billing history from the beginning of time and mapped our flows against historic rates. To our surprise the more rates spiked the busier we got.

Mortgage Rates: start – end of decade

1970s: start 7.33% – end 12.9%

1980s: start 12.9% – end 9.78%

1990s: start 9.83% – end 8.06%

2000s: start 8.15% – end 5.14%

2010s: start 5.09% – end 3.74%

2020s: start 3.72% – end 7.63% Oct 2023

*Data from Rocket Mortgage and Freddie Mac

True, for us the last decade has been a good one, but our business has evolved. We’re doing more family office recruiting and OCIO search work, even some M&A.

We recall something Peter Lynch wrote in his first book after retiring from Fidelity, One Up on Wall Street. He said that when he checked his trade records at Magellan against what he and others were saying in interviews and on panels, his money and his mouth weren’t talking the same book.

His conclusion: he was no better than anyone else at parsing headlines, but his trade discipline kept him focused on what he was good at, buying bargains and holding on. Sounds like some other CIOs we know.

Read More »Headhunters Ball

by charles | Comments are closed10/20/2023

Employees don’t leave companies, they leave bosses — Anonymous

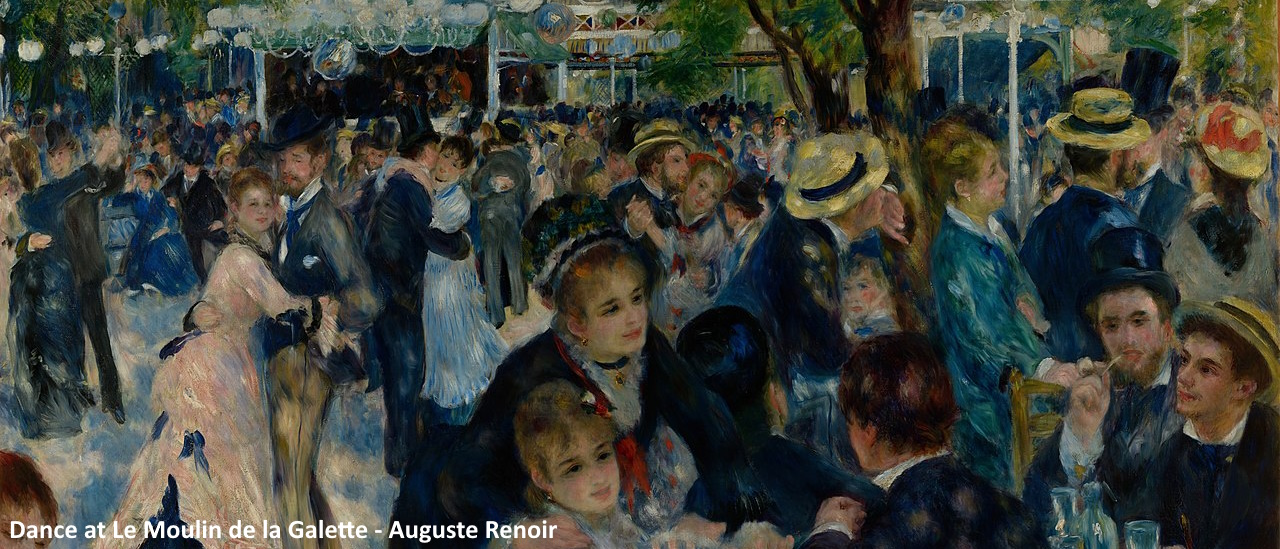

Fall recruiting is in full swing and chief investment officers are the belles of the balls. Johara Farhadieh, Kathleen Jacobs, and Nicole Mussico are moving on, Rosalind Hewsenian and Collette Chilton will soon take their bows, and Mark Baumgartner (a nod to the Misters) just picked a new partner. So many dance cards yet to fill.

As recruiters, we should be delighted, but for employers there’s a downside: turnover affects investment performance.

It takes time for CIOs to build rapport with boards and colleagues, articulate an investment philosophy, and roll out a diversified portfolio.

Only about a third of the CIOs in our FY2022 endowment investment report logged a decade or more tenure, but those are mostly the ones on top.

To repeat a well-worn trope, it takes years to fully implement a multi-asset, multi-generational investment strategy and altering course mid-stream – a new investment chair or a change in CIOs – can sap performance for a decade.

Superior returns start with well-run boards and smooth succession planning. Yale, Brown, Notre Dame did it right. Best practices suggest others should follow.

Read More »Foundation Investment Performance: doing good, investing well

by charles | Comments are closed10/01/2023

The problem of our age is the proper administration of wealth. — Andrew Carnegie, The Gospel of Wealth, June 1889

Who manages foundation money and how well are they doing?

John Seitz, CEO of FoundationMark, gnawed on that bone for years while working as a hedge fund analyst, portfolio manager, and Outsourced Chief Investment Officer (OCIO). Finally, in 2015, frustrated at the lack of available data, he established FM to produce and provide performance indices, peer group data, and research tools for nonprofits, asset managers, and Wall Street sellsiders.

As recruiters, we are avid consumers of investment metrics and publish a yearly endowment performance report to support our candidate and OCIO selections. So, we asked Mr. Seitz if he would share his data on one hundred large US private foundations. You will find his latest available foundation investment returns below.

We think his research and rankings are useful companions to our endowment studies, of interest to asset owners and all purveyors of investment products and services.

Foundations everywhere

College endowments bask in media attention, yet foundations embrace a much larger market, both in numbers and assets – about 3,300 foundations versus 573 endowments over $50 million, totaling $1.4 trillion versus $807 billion.

While the corporate world jettisons their pension liabilities, and head count flattens at endowments, health systems, and public pensions, the foundation community and family office segment (a major source of charitable largesse) is flourishing.

US Private Foundations

• 151: over $1 bn

• 185: $500 mil – $1 bn

• 343: $250 mil – $500 mil

• 1,076: $100 mil – $250 mil

• 1,613: $50 mil – $100 mil

• 116,000: under $50 mil

Source: FoundationMark

US Endowments

• 131: over $1 bn

• 75: $500 mil – $1 bn

• 257: $100 mil – $500 mil

• 210: $1 mil – $100 mil

Source: NACUBO

So far, so good

When Andrew Carnegie endowed his newly formed Carnegie Corporation with $125 million in 1911 – roughly $3 billion in current dollars – he founded the largest charitable entity of its day. Along with the creation of the Rockefeller Foundation in 1913, this marked the beginning of the modern era of foundation philanthropy.

Today, U.S. tax-exempt charitable organizations are a major force in American life, administering 3.8 trillion dollars in assets, of which approximately a third reside in private foundations.

Jon Hirtle, executive chairman of OCIO provider Hirtle Callaghan puts it this way:

Read More »OCIOs: Your New Best Friends

by charles | Comments are closed08/29/2023

However beautiful the strategy, you should occasionally look at the results – No attribution

As luck would have it, we’re currently managing an OCIO (outsourced chief investment officer) search for a notable east coast organization and thought we’d share some of what we’ve learned over the years. A few tips for our board and family readers. Why this “noblesse oblige?” If you believe the pundits, investment advisors are about to enter a new golden age of wealth management.

According to UBS and a flurry of broadsheets, “over the next 20 years, the world will experience the greatest transfer of wealth in history with $84 trillion expected to pass down to younger generations in the US alone.”

At the celestial end of the wealth spectrum, we find a little over half the world’s wealthiest living in the United States. UBS counts 123,870 ultra-high-net-worth individuals with investable assets of $50 million or more on our shores, and the bank expects that number to top 180,00 in five years.

Add in another 3,300 foundations with assets over $50 million and no wonder both Cerulli Associates and Capgemini forecast voracious demand for OCIO services for years to come.

But with over one hundred firms on our latest OCIO provider list, how’s a family or institution to choose among discretionary investment managers?

Managing money ain’t cheap

As we wrote a few weeks ago in our OCIO summer update, it’s expensive to support an institutional grade full-service asset management platform. Costs are climbing for infrastructure, cyber-security, audits, and compliance.

Boston Consulting Group, in their Global Asset Management 2023 review, estimates that – due to rising costs – the industry’s compound annual growth rate in profits “will be approximately half the average of recent years (5% versus 10%).”

In a related wealth report, BCG highlights the impact rising costs are having on smaller investment managers, those with less than $150 billion AUM (i.e., family offices and OCIO’s, among others.)

Most nonprofits and families (basically anyone under $500 million in investable assets) just don’t have the time or resources to build competitive and secure internal investment capabilities. Hence the spiraling demand for professional full-service OCIO providers.

So, where to begin?

Your new best friends

Our advice? Start your search by answering the following question. How will you measure success? Absolute return? Capital appreciation? A new admin building with your name on it?

Before you pick through our handy OCIO directory and cogitate on the entries, please write down what you would like your new investment partner to accomplish. Best to set expectations before they are set for you.

Read More »