Pay and Chief Investment Officers

by charles | Comments are closed08/23/2017

In this issue

- Compensation and the Top 100+ Chief Investment Officers

- Fiddles and finance: Navigating an inefficient market

- OCIOs and the costs of outsourcing

- 6 charts with pay, performance, OCIOs

Download letter in PDF from www.charlesskorina.com

————————————————–

Paying the Top Guns of Institutional Investing

Last month in Part One of this report we focused on relative performance. We ranked 107 CIOs by trailing 5-year returns.

See: https://www.charlesskorina.com/?p=4828

Now, we focus on how much institutions pay these excellent people.

The bare comp numbers lead us to the tricky and perennial question of whether their pay is properly aligned to their performance (or vice-versa), and we offer some analysis and opinion from the point of view of working headhunters.

We also consider the cost of an OCIO firm relative to an in-house CIO-led investment office.

Now, on to the charts!

Read More »Top endowment chief investment officers: five year performance

by charles | Comments are closed07/05/2017

This letter looks at the most recent five-year performance of over one hundred of the world’s best university endowment chief investment officers.

We rank their returns, review their performance, and reveal their strategies for the decade ahead.

Endowment chief investment officers (and other non-profit CIOs) have an infinite investment horizon, a global playing field, and can invest in anything anywhere – within the broad policy limits set by their institution. They are the top guns of the institutional investment world.

We recruit these investment heads for endowments, foundations, family offices and institutional investment firms. And, we (and many others) regard the CIOs at major American universities and foundations as the best of the best.

A CIO candidate may have a sterling character, a stunning intellect, and a winning smile. Those things do count. But will he or she make money for our clients? Recruiting a high-profile investment executive is a complex process, but it starts with objective measurements.

We compile the information presented in this report for internal use to help us as recruiters, and we think it will be useful to boards, trustees, CEOs and all our readers.

Chief investment officers “make things happen.” Security selection, manager selection, timing, and fees play an important role in investment performance – allocations don’t explain everything!

We also uncover the emergence of a new consensus around a 60/40 – alternatives/public markets – portfolio, even as we report on the embarrassing success of the old 60/40 stocks/bonds

This is our SEER report: Skorina’s Enhanced Endowment Report. The enhancements are the names and returns of individual CIOs (or OCIOs), data which are not readily available elsewhere.

If you need further information, or help with hiring decisions, please call on us anytime.

Now, on with the show:

Read More »Britt Harris and the rise of the Aggies

by charles | Comments are closed06/20/2017

Britt Harris and the rise of the Aggies

Thomas “Britt” Harris is a highly-respected investment manager around the world. But, more importantly, he is a highly-respected investment manager in Texas. More important, still, he’s an Aggie. And, now he’s been named CEO and CIO of UTIMCO effective August 1st.

Aggies are graduates of Texas Agricultural and Mechanical University. They form a proud, but slightly aggrieved subtribe among Texans. But, at UTIMCO, their stock seems to be soaring.

The nine-member UTIMCO board traditionally includes three appointees of the University of Texas System, but only two from Texas A&M System which has always rankled the folks from College Station.

See: Texas turmoil: UTIMCO reboots, https://www.charlesskorina.com/?p=4520

Last month, UT Chancellor McRaven, who had held an ex officio seat, graciously stepped down so that the Aggies could name another board member. This month, they named Janet Handley to that seat. Ms. Handley just retired as chief investment officer at the Texas A&M Foundation. She’s a very nice lady, and the performance of her fund is chronicled in our upcoming Top 100 CIOs report. More important, she graduated summa cum laude from Texas A&M in 1975.

Then the UTIMCO board voted to rename their organization, which is now officially the University of Texas/Texas A&M Investment Management Co. That’s a bit ungainly, so the Aggies conceded that they could still call themselves UTIMCO. That’s a relief to us, because that other thing won’t fit in our charts.

For the Aggies, having one of their own in the top spot is just icing on the cake. (They’re also pleased that ex-Governor Rick Perry, still another Aggie, is now U.S. Secretary of Energy.)

Oh, and by the way, the Aggies would want you to know that the Texas TRS retirement system under Mr. Harris has outperformed UTIMCO under ex-CEO/CIO Bruce Zimmerman.

Although Mr. Zimmerman is technically a Texan, he went to Harvard, which should speak for itself.

Read More »Cambridge Associates: Leading the charge into OCIO battlespace

by charles | Comments are closed06/01/2017

Two Harvardians invent an industry

In 1973, two former Harvard roommates and budding entrepreneurs – Jim Bailey and Hunter Lewis – took on an assignment to review the investments held in their school’s endowment.

Things were very different back then. A treasurer of the Harvard Corporation with the wonderfully Bostonian name of Paul Codman Cabot had managed the endowment from 1948 to 1965 as an account at his own firm, State Street Research & Management; charging the school $20,000 per annum for his services.

Mr. Cabot, one of the inventors of the modern mutual fund, had daringly shifted the Harvard portfolio from ultra-safe bonds into a more balanced stock-and-bond mix, catching the equities boom of the 50s and early 60s. And in 1973, with the fund having risen to a then-colossal $1 billion, Treasurer George Putnam and President Derek Bok created the Harvard Management Company.

When Messrs. Bailey and Lewis began their consulting relationship with the Harvard endowment in 1973 and formally established Cambridge Associates, Mr. Bailey was still on campus, finishing his joint MBA/JD program, while Mr. Lewis was working at The Boston Company, an old-line merchant banking firm. Forty-four years later, CA continues to count Harvard as a client.

A decade later, a young woman named Sandra Urie wangled a one-on-one job interview with Jim Bailey. She was a product of Stanford and Yale (and development office head at Phillips Andover Academy, a CA client). The scheduled 30-minute interview lasted 3 hours, and Mr. Bailey hired her.

As a divorced single mother, she was not the typical junior consultant of that era. Yet, fifteen years later she was named CEO of Cambridge Associates, and subsequently chairman, stepping back to become Chairman emeritus in 2016 after thirty-two years with the firm.

Consulting and asset management: the rapidly blurring boundaries

Traditionally, institutional investment consulting – which Cambridge virtually invented – and asset management were distinct businesses run by different kinds of people, and the twain seldom met.

The barrier was as much cultural as institutional. Consultants were seen (and saw themselves) as operating in a more disinterested, academic, and research-related environment. Asset managers were closer to the Street: faster-paced, more competitive. They were increasingly publicly-traded, and therefore relentlessly profit-driven.

An individual consultant who wanted a more hands-on job could always become an institutional CIO (and many CA alumni did just that). Or, they could move over to a Wall Street asset manager. CA consultants tend to have good contacts in both worlds.

Read More »Foundation Chief Investment Officers and the American dream

by charles | Comments are closed04/28/2017

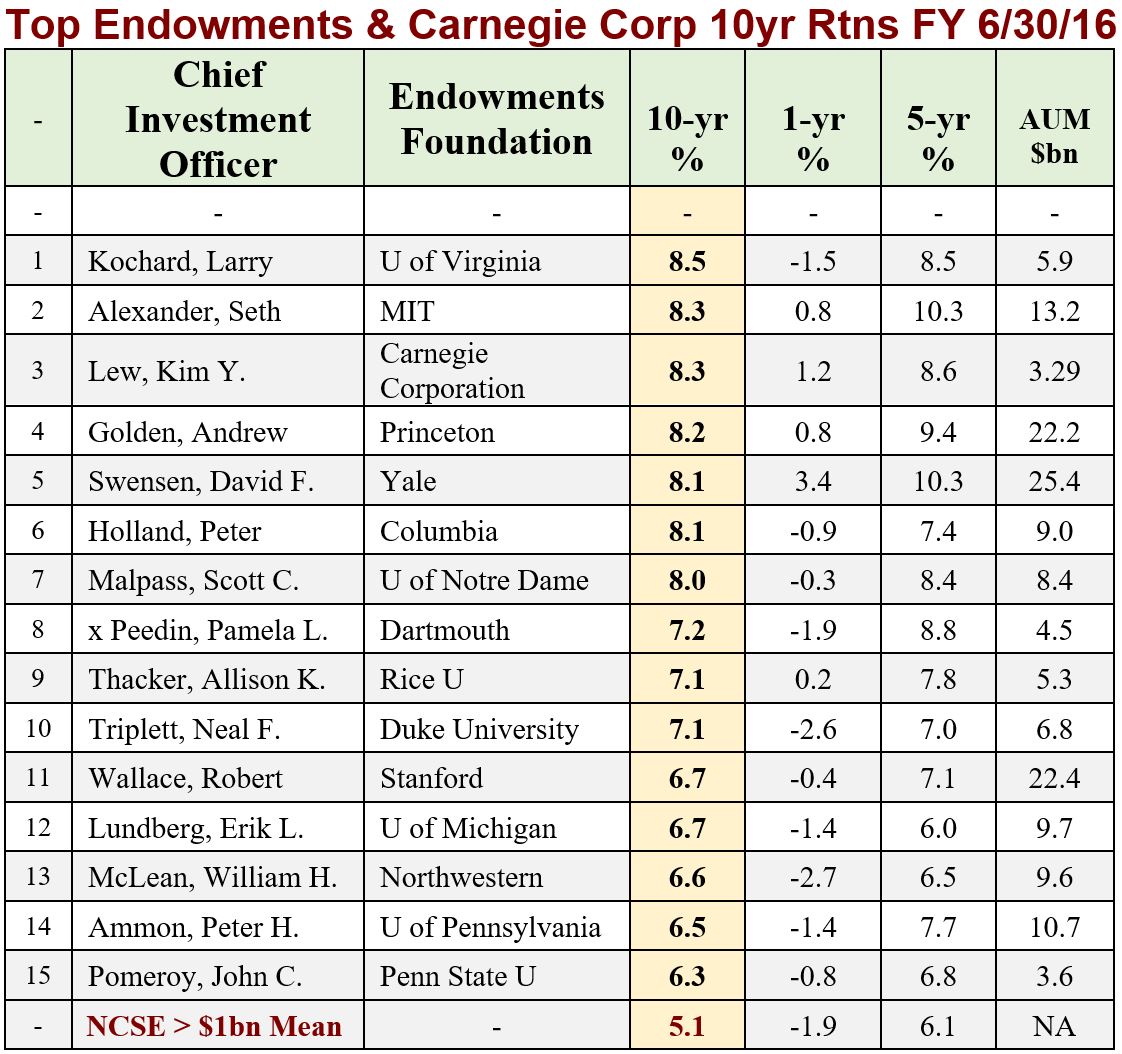

Our March letter focuses on the venerable foundations of New York City and one of their most accomplished investment pros: Kim Y. Lew, chief investment officer of the Carnegie Corporation.

We have an in-depth conversation with Ms. Lew on her career in foundation investing and the future of women and minorities in her field. We also look at pay and performance in the NYC foundations, with some illuminating charts for our quant readers.

Our friends at the Foundation Center tell us there are 243 American foundations with over $1 billion in assets and New York City harbors 31 of them, including some of the biggest and most storied. The money wasn’t all made there, but it tended to flow toward Manhattan because that’s where the money-managers were.

According to David Swensen, “a deep appreciation of history” is essential to an investment professional. Not just knowledge, mind you; but appreciation. History may have temporarily put that money in their care, but markets and circumstance are always threatening to take it back.

Goethe’s Faust got it right when he declaimed:

“That which thy fathers have bequeathed to thee, earn and become the possessor of it!”

Mr. Carnegie and Ms. Lew:

When Andrew Carnegie endowed the corporation with $125 million in 1911 – perhaps $3 billion in 2017 dollars – he founded the largest charitable entity of its day. Along with the creation of the Rockefeller Foundation in 1913, this marked the beginning of the modern era of foundation philanthropy.

The Carnegie Corporation, headed by the eminent Vartan Gregorian, marked its centenary in 2011, the year Kim Lew became co-CIO, and it is still among the twenty-five largest foundations in the U.S.

Despite continuing to give away at least $150 million every year (5% of net investment assets), the Corporation’s endowment is larger today – in constant dollars – than it was in 1911. This is due in part to the forbearance of America’s taxpayers via the Internal Revenue Code, but also in large part to the skill of Ms. Lew, her colleagues, and their predecessors in maintaining impressive investment returns over the generations.

Read More »