Family Office Investors: getting paid to wait

by charles | Comments are closed06/21/2023

Follow the money, always follow the money – William Goldman, “All the President’s Men”

Bob Dylan wrote the evocative The Times They Are a-Changin’ in 1963, and sixty years later the song might just as well be a meditation on today’s unsettled times.

While large institutional funds – pensions, sovereign wealth funds, endowments – continue to invest as if nothing has changed, our family office clients are preparing for a more nuanced and conflicted scenario, building liquidity and waiting for clarity.

Changing times

After a 2,000-basis-point decline in interest rates between 1980 and 2020, the Federal Open Market Committee on March 16, 2022 finally changed the game and began the process of lifting their price controls on money.

“Nowadays,” writes Howard Marks, “the ICE BofA U.S High Yield Constrained Index offers a yield of over 8.5%, the CS Leveraged Loan Index offers roughly 10.0%, and private loans offer considerably more.”

“In other words, expected pre-tax yields from non-investment grade debt investments now approach or exceed the historical returns from equity.”

And as Marks postulates, not only has the “sea change” in rates finally put an end to our golden era of free money, it also quite possibly signals the end of private equity’s buoyant forty-year run.

“Almost the entire history of levered investment strategies has been written during a period of declining and/or ultra-low interest rates.”

Along the watchtower

One of our family clients recently asked his private banker at Citi what he saw other large family offices doing. The banker’s answer, “going to cash!”

The latest Goldman Sachs 2023 Family Office Investment Insight Report surveyed family sentiment and found that “since 2021, global family offices, on average, increased their combined allocation across cash and fixed income from 19% to just over 22% total — 12% in cash and cash equivalents, and 10% in fixed income.”

This move to liquidity and safety is hardly surprising. As we wrote a year ago, family offices have been around for centuries and weathered every conceivable storm.

From the major-domos in ancient Rome to Rockefeller and Microsoft heirs, cash has always been king. Liquidity meant power and the means to act in good times and bad.

Maybe it’s also because family founders are usually operators who run businesses and in business, running out of cash is an original sin.

The clarity of hindsight

So, how are the nation’s largest pensions, the really big money boys and girls ($5.19 trillion in DB assets), dealing with this historic “shift?” As nearly as we can tell, they don’t have much room to maneuver.

They’re still boosting their allocations to private markets despite massive amounts of dry power, intense competition, increasing rates, decreasing returns, and make-believe marks.

The $442 billion CalPERS pension, for example, announced in January that the allocation to private equity would be increased from “8% to 13% starting with the 2022-23 fiscal year.”

Even if pensions wanted to alter course, however, they face performance pressures and institutional roadblocks. Not to mention funding commitments and low liquidity.

Changing course means educating boards, building expertise, and overcoming vested interests, an unpleasant and for now unlikely process. But with a snowballing funding crunch, something will eventually give.

To quote John Kenneth Galbraith, “There can be few fields of human endeavor in which history counts for so little as in the world of finance.”

Fixed income, how sweet it is

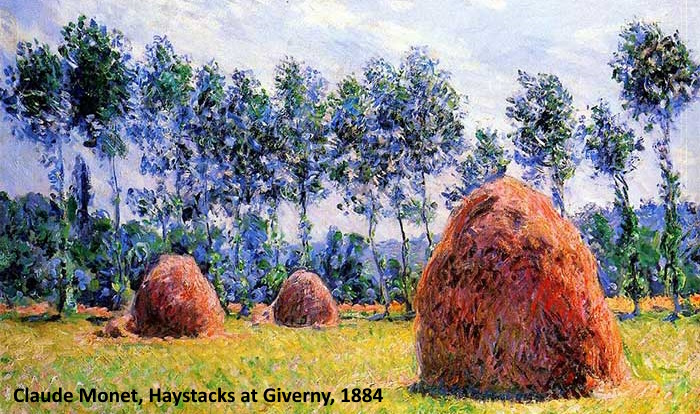

Read More »Headhunters and Haystacks

by charles | Comments are closed06/03/2023

“Don’t look for the needle in the haystack. Just buy the haystack!” — John Bogle

If it’s hard picking superior investments and asset managers, on what basis should we select the investment officers who pick those managers?

Take public markets, for example. According to Jason Zweig, Investing Columnist for The Wall Street Journal, “only 4.3% of stocks created all the net gains in the U.S. market between 1926 and 2016.”

In other words, over the last ninety years, less than two hundred stocks returned legendary money to their investors.

Zweig maintains that finding these “superstocks,” as William Bernstein of Efficient Frontier Advisor calls them, stocks that rise in value by 10,000% or more, is for most folks a losing proposition. He has argued for years that investors are better off buying a broad-market index fund.

What about private markets?

Private markets have their own challenges. A study by ULU Ventures concluded that venture capital firms “pick winners only 2.5% of the time. More than a decade of data reveals that out of more than 4,000 VC investment rounds annually, the top 100 generate between 70% and 100% of industry profits.”

The odds aren’t much better across buyout firms. The Oregon Investment Council pension system has invested in private equity for years. They are experienced, savvy, and comfortable with the asset class.

But over the last ten years the staff would have been better off putting their PE allocation into the Russell 3000. For the ten-year period ending December 31, 2021, their PE investments returned 15.7% versus 17.1% for the R3000, underperforming their benchmark by 4.3%.

Serious investing is about consistency

In our interview with Jon Hirtle, executive CEO of Hirtle Callaghan, he described investing this way. “Serious investing is about consistency, and serious investors position their portfolios to succeed in a highly uncertain future.”

How uncertain? Since 1945 the S&P 500 index has grown on average 11.12% per annum but during this span there have been 14 bear markets with drops averaging 32%.

And yet, the best CIOs somehow find a way to outperform – Paula Volent and David Swensen for example. Ms. Volent, Bowdoin College chief investment officer from 2000 to 2021 and current CIO at Rockefeller University, has topped our charts for years, delivering 11.9% for the twenty-year period ending June 30, 2021, and 14.5% for the last ten years.

And David Swensen, a seminal figure in the investment industry, produced a 13.7% per annum return over his thirty-five-year tenure as CIO at Yale.

Searching for the next Volent

For us, the search process begins with two questions.

The first is data driven. After years of evaluating investment talent for families, nonprofits, and asset managers, we look for persistence along with performance in a candidate’s background.

Our pool of talent includes hundreds of endowments, foundations, public and private pensions, health systems, associations, and charities, another five hundred to a thousand family offices, and thousands of OCIOs, RIAs, and for-profit asset managers.

It’s a deep bench but consistent performance is the key. And it’s not always apparent who’s driving the process.

Every candidate tells us they find great managers and pick great stocks. They all, apparently, produced top quartile results.

But, over time top chief investment officers stay on top. It’s in our data.

The second question is based on intuition and experience. Is this candidate someone that catches our eye? Piques our curiosity? An overachiever? We look for soft skills that indicate leadership and accomplishment.

Five key attributes in winning candidates

Read More »Succession and the Business of Money

by charles | Comments are closed05/02/2023

If I thought all I could achieve over the next ten years was 13 percent annual growth I’d junk my company and start over. – Anonymous Founder

Sooner or later most successful businesses lose the founder’s intensity and vision, and attention eventually shifts to the mundane business of making money.

Founders grows old, the heirs lose interest, marriage, divorce, and death intervene and before they know it all that’s left are trusts, dividends, and decline.

It doesn’t have to be that way. Some families stay on top for centuries. A Bank of Italy study a few years back found that many wealthy Florentine families have stayed wealthy for 600 years.

And a recent IMF paper concludes that “for given portfolio allocation, individuals who are wealthier are more likely to get higher risk-adjusted returns” and “high returns both bring individuals to the top of the wealth scale and prevent them from leaving it.”

Education, culture, and entrepreneurial talent all play a part and an internal investment office for UHNW families may help promote generational alignment and cohesion.

As professor Mandy Tham at the Singapore Management University writes, a constructive family office can serve as a forum where the generations can negotiate and agree on investment goals and legacy.

But building a family investment office to last is not easy. Too many family heads confront what Noam Wasserman, professor, author, and dean of Yeshiva University’s Sy Syms School of Business calls the founder’s dilemma.

Founders who want to manage empires will not believe they are successes if they lose control, even if they end up rich. Conversely, founders who understand that their goal is to amass wealth will not view themselves as failures when they step down from the top job.

Family office confidential

What some founders and CIOs really think about building and running an investment office.

A family office investment operation will never earn as much as the family business, so why have one?

The business of money management is all about risk mitigation and wealth preservation and first-gen founders aren’t usually built that way.

A notably successful individual had this to say after we showed him our latest 10-year Endowment Performance Rankings a few weeks ago.

Keep in mind that these are terrific returns for diversified, multi-asset, global portfolios and these CIOs are the best in the business.

Bowdoin and former CIO Paula Volent topped the charts with a 13.3 percent return, MIT and Seth Alexander finished a hair’s breadth behind at 13.02, Brown and Jane Dietze ranked third with 12.3, and Princeton and Andy Golden fourth at 12.2.

After studying our rankings and returns, he paused for a moment and then said “Charles, if I thought all I could achieve over the next ten years was 13 percent annual growth I’d junk my company and start over.”

[The average return by the way, for our pool of one-hundred endowments over one billion dollars AUM, was 9.2 percent with a mean of 9 percent.]

I don’t want a chief investment officer looking over my shoulder.

Jon Hirtle, co-founder of Hirtle Callaghan, has been managing family and institutional money for almost forty years.

We asked him why successful founders don’t always see eye to eye with endowment style chief investment officers and here’s his reply.

Read More »Wealth and Succession, Family Matters

by charles | Comments are closed04/05/2023

I’ve been poor and I’ve been rich. Rich is better! — Beatrice Kaufman, author and raconteur, 1895-1945

Here’s some good news for those UHNW families who have worked hard to make it and hope to keep it. Turns out that contrary to conventional wisdom, wealthy families are likely to stay wealthy over multiple generations.

“We can predict strongly, based on family background, who is likely to have the compulsion to strive and the talent to prosper” writes professor Gregory Clark, University of California, Davis.

James Grubman, Ph.D. family wealth consultant agrees. If we focus on the families rather than the family firms, we find “significant longevity and success across generations.”

He rejects the apocryphal adage that it’s shirtsleeves to shirtsleeves in three generations and the related oft-quoted statistic that 70 percent of family businesses don’t survive the second generation.

After combing through the literature, Dr. Grubman traced each hoary myth back to the same narrowly focused study published in the mid-1980s. His conclusion? These pessimistic views of family business survival simply aren’t true.

The Quick and the Bold

According to the Center for Family Business at University of St. Gallen, a privately-held firm is considered family-owned if a family controls more than 50 percent of the voting rights, while a publicly-held company is defined as family-owned if a family holds at least a 32 percent share of the voting rights.

Although it’s hard to get an accurate fix on the number of family businesses in the US – between 7.2 and 32.4 million in one recent study – there is broad consensus that family controlled enterprises are key drivers of U.S. GDP and employment, accounting for anywhere from 14 to 54 percent of private sector GDP and 14 to 59 percent of the private sector workforce. Walmart alone, with 2.3 million employees, adds 2.4 percent to GDP.

But it’s not just their numbers that gives them clout, explain professors Asker, Farre-Mensa, and Ljungqvist, “private firms invest substantially more than public ones on average, holding firm size, industry, and investment opportunities constant” and their “investment decisions are around four times more responsive to changes in investment opportunities than are those of public firms.”

Some family businesses are exceptionally good at navigating life’s twists and turns.

Take the Zildjian company for example, the oldest family-owned and operating business in the USA. Supplying the world’s percussionists from Norwell Massachusetts since 1929, Avedis Zildjian the elder began forging cymbals – those shiny shimmering saucers – around 1620 in Constantinople. Four hundred years later they are still at it. Same family, same specialty.

By the way, they are not the oldest family business by a long shot. The record was held by Japanese temple-builder Kongo Gumi, in business from 578 to 2005. Bad luck and a fading heritage finally did them in. But what a run.

Does a Family Office matter?

Read More »When Investment Advisors Merge

by charles | Comments are closed02/22/2023

All growth is not created equal — McKinsey & Company

It’s never been easier to start a wealth management advisory business and never been harder to grow it. Very few investment advisors achieve national size and status without a product or technology edge.

Of the approximately three thousand RIAs and OCIOs in the US, only about eighty have managed to accumulate over five billion in AUM.

According to the Investment Adviser Industry’s snapshot 2022, “most investment advisers (88.1%) are small businesses with 50 or fewer employees and one or two offices.”

These small advisors, from $100 million to $5 billion AUM, grew at a compound rate of about 6% over the four-year period from 2017 to 2021. The largest advisors on the other hand, those over $100 billion AUM, grew more than twice as fast, 14.9% over the same four years.”

Concentration creates another roadblock. As we noted in our last Outsourced Chief Investment Officer (OCIO) report, just eight providers out of the one hundred seven we listed – Aon, Blackrock, Goldman Sachs, Mercer, Russell, SEI, State Street, and Willis Towers Watson – manage well over half the OCIO assets, $2.073 trillion of the $3.74 trillion AUM.

So how do you build “the next great investment institution” as Jon Hirtle, executive chairman of Hirtle Callaghan describes the challenge? Why are there so few breakthrough OCIOs?

Barring a rare exception, there are only three ways most wealth and institutional money managers grow — buy, sell, or merge.

Those that finally opt for better-resourced allies are in good company. Echelon Partners 2022 RIA M&A Deal Report tracked 340 announced transactions in 2022 alone, the tenth straight year of record acquisitions.

The problem is, most mergers and acquisitions crash and burn. Roger L. Martin, former dean of the Rotman School of Management at University of Toronto, noted in a Harvard Business School article that 70% to 90% of all acquisitions are “abysmal failures.”

Why? “Companies that focus on what they are going to get from an acquisition are less likely to succeed than those that focus on what they have to give it.”

Professor Martin offers four suggestions to improve M&A outcomes.

- Be a smarter provider of growth capital.

- Provide better managerial oversight.

- Transfer valuable skills to the acquisition.

- Share valuable capabilities with the acquisition.

But if the dream is to build an enduring investment powerhouse, you had better pick the right partners.

Mr. Hirtle cautioned in a recent Financial Advisor interview that “a lot of acquirers are ‘financial consolidators’ who will be ready to sell again in three to five years after making an acquisition. Clients and staff do not want to deal with that kind of disruption a second time, so it is important to join with a stable firm who values you as a long term partner.”

What do you guys really want?

Read More »