In this Issue

- A rough year for endowments

- Behind the latest NACUBO numbers

- Performance persistence of top CIOs

- A conversation with Mary Cahill, CIO Emory University

————————————————–

A rough year for endowments:

February moves pretty fast in the endowment world. If you don’t stop and look around, you could miss it.

On Tuesday, NACUBO and Commonfund rolled out their annual NCSE statistics: the semi-official league-tables for endowment investors.

Then, NACUBO held their conference in New York where presenters and attendees pondered the numbers.

Just behind the NACUBO conference comes Nancy Szigethy’s NMS Investment Forum in Scottsdale, an event which draws top endowment and foundation leaders for camaraderie and Arizona sunshine.

In this letter we briefly summarize the NCSE results. Further along we have an excellent, updated chart breaking down the latest returns for the Top 25 endowment for 1, 3, 5, and 10 years.

We also have some thoughts and stats concerning persistence in investment performance.

And, we have a conversation with Mary Cahill of Emory University. She manages one of those Top 25 funds and was also a presenter at the NACUBO conference.

The league standings for FY2016

The headline from the stats was no big surprise: most big endowments lost money in FY 2016. The average over-$1 billion fund had a 1-year return of -1.9 percent.

Despite their headline value, 1-year numbers are statistically noisy and far less important than 10-year numbers. The news there was more worrisome.

Last year, big endowments were cruising at an average 7.2 percent 10-year return, barely enough to maintain their value after inflation and distributions. As of FY2016 that number drops to an unsustainable 5.7 percent. Not so good.

In fact, that number looks a lot like what a couple of veteran investors are expecting for the foreseeable future. In our piece in June, “Welcome to Low-return World,” we quoted Bill Gross and Burton Malkiel, who both expect returns south of 6 percent for most public-market investors over the medium-term. The sophisticated Endowment Model is supposed to improve on that by cashing in on the illiquidity premium. But we’ll see.

See: https://www.charlesskorina.com/?s=low+return++world

The misery was not evenly distributed, however. And, while NCSE doesn’t list individual funds by performance, we take up some of that slack in our Top 25 list down below, where we name names and see who among the big endowments fared better or worse than average.

Yale, like the New England Patriots, is the team everyone loves to hate for its relentless near-perfection. It’s one of the few majors with a positive number for the year, and the only one to exceed 1 percent. They scored an excellent 3.4 percent for the year, and a lofty 8.1 percent 10-year number.

Three schools are doing slightly better than Yale on a 10-year basis: Virginia, MIT and Princeton, in that order. Arguably, Dr. Kochard’s Cavaliers top not only Dr. Swensen’s Bulldogs, but the whole league with a comfortable 10-year return of 8.5 percent.

The chatter in both New York and Scottsdale will focus on the future rather than the past. We’re already well into the 3rd quarter of FY2017, and it’s looking markedly better than the last one. The “Trump trade” in the last quarter of the year has lifted equities, and Fed action doesn’t seem to have done much damage to prices so far. But it’s still a long way to June.

According to the NCSE summary, non-U.S. stocks were a serious drag in FY2016, with the average major endowment reporting returns of -7.3 percent in that allocation. Energy-related investments were also battered.

On the other hand, private equity and venture capital did very well for endowments. Yale’s inventory of top-shelf private capital undoubtedly helped them as it has in most years. They reminded us of that in last year’s endowment report. See our article from May: “Wrangling the Unicorns: Yale celebrates its VC heroes.”

It’s here: https://www.charlesskorina.com/?p=3374

Performance and Persistence: the best chief investment officers stay on top

“Persistence of returns” is a phrase we associate with hedge funds. It seems debatable whether there is any such persistence there. Hedgies say there is; others are not so sure.

In the case of endowments and chief investment officers, however, it’s a verifiable phenomenon.

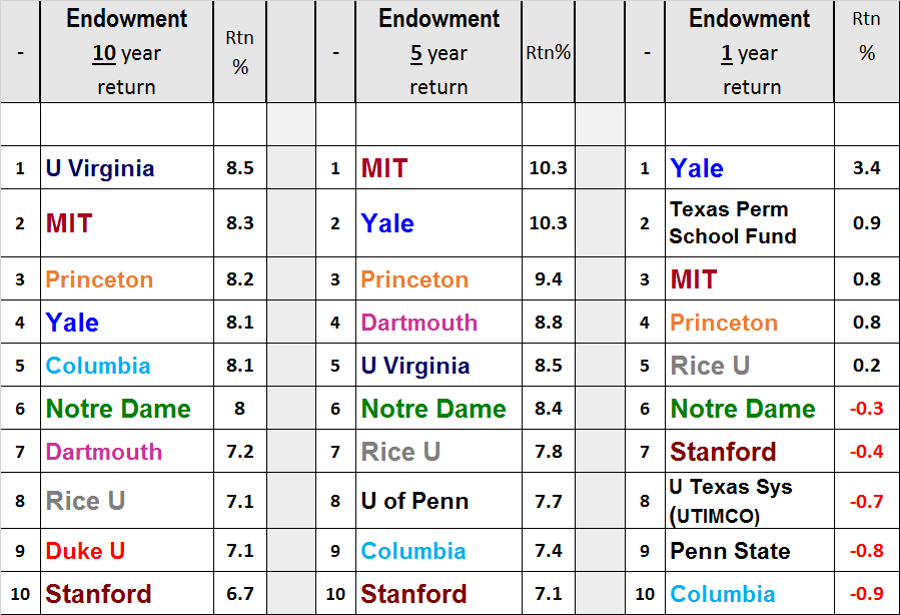

See our chart below — ten years of performance persistence — incorporating the latest numbers and listing the top-ten endowment performers (out of our Top 25 cohort) for 1, 5, and 10-year periods as of June, 2016.

What is remarkable is how the same funds tend to show up across the board, even in the more volatile 1-year numbers.

Seven funds – MIT, Princeton, Yale, Columbia, Notre Dame, Rice, and Stanford – show up in each table. Dartmouth and Virginia both make two out of three (neither of them quite made the cut for 1-year returns). Notre Dame’s consistency is uncanny: they rank 6th out of 10 on all three.

Rice’s consistent excellence may have been slightly unexpected. It’s a Southern, non-Ivy school with “only” a $5.3 billion endowment; but it has outperformed Stanford and most of the Ivys in each measurement period. Good work by Allison Thacker’s Rice Management Company.

Ten years of performance persistence

(Rank by 10 years, 5 years, and 1 year returns)

– |

Endowment 10 year return |

Rtn % |

– |

Endowment 5 year return |

Rtn % |

– |

Endowment 1 year return |

Rtn % |

||

1 |

U Virginia |

8.5 |

1 |

MIT |

10.3 |

1 |

Yale |

3.4 |

||

2 |

MIT |

8.3 |

2 |

Yale |

10.3 |

2 |

Texas Perm |

0.9 |

||

3 |

Princeton |

8.2 |

3 |

Princeton |

9.4 |

3 |

MIT |

0.8 |

||

4 |

Yale |

8.1 |

4 |

Dartmouth |

8.8 |

4 |

Princeton |

0.8 |

||

5 |

Columbia |

8.1 |

5 |

U Virginia |

8.5 |

5 |

Rice U |

0.2 |

||

6 |

Notre Dame |

8 |

6 |

Notre Dame |

8.4 |

6 |

Notre Dame |

-0.3 |

||

7 |

Dartmouth |

7.2 |

7 |

Rice U |

7.8 |

7 |

Stanford |

-0.4 |

||

8 |

Rice U |

7.1 |

8 |

U of Penn |

7.7 |

8 |

U Texas Sys (UTIMCO) |

-0.7 |

||

9 |

Duke U |

7.1 |

9 |

Columbia |

7.4 |

9 |

Penn State |

-0.8 |

||

10 |

Stanford |

6.7 |

10 |

Stanford |

7.1 |

10 |

Columbia |

-0.9 |

Return of the Top 25

This is an updated version of a table we presented in our last letter.

The population is the biggest 25 endowments by AUM. It’s basically the same as the top 25 in the NCSE rankings except that we’ve added the Texas Permanent School Fund. It’s certainly an educational endowment, even though it funds K-to-12 schools. We think they deserve the recognition based on size as well as their performance under CIO Holland Timmins.

There were no glaring errors in our previous list, but we tweaked several things in this version. Notably, we’ve obtained performance numbers as of June 30 for a couple of funds for which we previously had August 31 numbers. In this one, it’s all apples to apples. And, we’ve double-checked all data with the respective investment offices. (Thank you to those CIOs and staffers who took the time to help us out!) And, we’ve inserted the just-published NCSE average returns for the over-$1 billion cohort so we can clearly see how the 25 stack up against that useful benchmark

Largest 25 Endowments: Returns FY 2016

Ranked by 1-year FY16 performance. Includes 3, 5, 10 year returns

– |

Endowment |

CEO/CIO |

1yr Rtn % |

3yr Rtn % |

5yr Rtn % |

10yr Rtn % |

AUM FY16 $bn |

1 |

Yale |

Swensen, David F. |

3.4 |

11.5 |

10.3 |

8.1 |

25.4B |

2 |

Texas Permanent School Fund |

Timmins, Holland |

0.9 |

6.0 |

6.2 |

5.7 |

30.2B |

3 |

MIT |

Alexander, Seth |

0.8 |

10.8 |

10.3 |

8.3 |

13.2B |

4 |

Princeton |

Golden, Andrew |

0.8 |

10.7 |

9.4 |

8.2 |

22.2B |

5 |

Rice U |

Thacker, Allison K. |

0.2 |

7.3 |

7.8 |

7.1 |

5.3B |

6 |

U of Notre Dame |

Malpass, Scott C. |

-0.3 |

9.1 |

8.4 |

8.0 |

8.4B |

7 |

Stanford |

Wallace, Robert |

-0.4 |

7.6 |

7.1 |

6.7 |

22.4B |

8 |

U of Texas Sys (UTIMCO) |

x Zimmerman, Bruce |

-0.7 |

6.2 |

5.3 |

5.4 |

24.2B |

9 |

Penn State U |

Pomeroy, John C. |

-0.8 |

6.4 |

6.8 |

6.3 |

3.6B |

10 |

Columbia |

Holland, Peter |

-0.9 |

7.8 |

7.4 |

8.1 |

9.0B |

11 |

U of Michigan |

Lundberg, Erik L. |

-1.4 |

6.6 |

6.0 |

6.7 |

9.7B |

12 |

U of Pennsylvania |

Ammon, Peter H. |

-1.4 |

7.6 |

7.7 |

6.5 |

10.7B |

13 |

U of Virginia |

Kochard, Larry |

-1.5 |

8.1 |

8.5 |

8.5 |

5.9B |

14 |

Dartmouth |

x Peedin, Pamela L. |

-1.9 |

8.7 |

8.8 |

7.2 |

4.5B |

15 |

U of Chicago |

Schmid, Mark |

-1.9 |

5.0 |

5.7 |

6.3 |

7.0B |

– |

NCSE > $1bn Mean |

– |

-1.9 |

6.0 |

6.1 |

5.1 |

– |

16 |

Harvard |

Narvekar, Narv |

-2.0 |

6.2 |

5.9 |

5.7 |

34.5B |

17 |

U of So. Calif |

Mazzocco, Lisa |

-2.1 |

6.6 |

6.3 |

5.5 |

4.6B |

18 |

Duke University |

Triplett, Neal F. |

-2.6 |

6.9 |

7.0 |

7.1 |

6.8B |

19 |

Northwestern |

McLean, William H. |

-2.7 |

6.5 |

6.5 |

6.6 |

9.6B |

20 |

Washington U |

x Walker, Kimberly |

-3.3 |

5.4 |

5.6 |

5.4 |

6.5B |

21 |

Cornell U |

Miranda, Ken |

-3.3 |

5.0 |

5.3 |

5.2 |

5.8B |

22 |

U Calif. Regents |

Bachher, Jagdeep S. |

-3.4 |

7.1 |

6.5 |

5.9 |

8.3B |

23 |

Ohio State U |

Lane, John C. |

-3.4 |

4.7 |

5.0 |

NA* |

3.6B |

24 |

Emory U |

Cahill, Mary |

-3.9 |

5.8 |

6.1 |

5.3 |

6.4B |

25 |

Vanderbilt |

Hall, Anders W. |

-4.3 |

4.0 |

4.5 |

4.8 |

3.8B |

NB: All AUMs updated to match the latest NACUBO report.

NB: Numbers confirmed by investment offices and/or school reports.

NB: All endowment returns are for FY Jun 30th to conform to NACUBO

NB: Ohio State University investment office started in 2009

————————————————–

A Conversation with Mary Cahill:

Mary L. Cahill has been vice president of investments and chief investment officer at Emory University in Atlanta since 2001 when she joined the school as their first CIO.

She’s now the second longest-serving female CIO among the major endowments. (See our recent piece about female CIOs, with a current list.)

It’s here: https://www.charlesskorina.com/?p=4357

Emory’s AUM stood at just $4.3 billion when she came aboard (and much of that was Coca-Cola stock donated by the Woodruff family). Now, she leads a team of 25 professionals investing a highly-diversified $6.4 billion endowment. Her Emory Investment Management team also runs operating and pension funds, pushing their total assets up to $7 billion.

Skorina: What got you interested in this business, Mary?

Cahill: It started in high school. My girlfriend’s aunt worked as an executive assistant at Merrill Lynch on Wall Street and when we would visit, she would take us on a tour, showing us the trading floor and brokerage operations. Things most people never get to see.

I thought those were some of the coolest things I had ever seen, and it really stuck with me.

After I earned a BA in accounting at Kean College in New Jersey, I was hired by Merck, originally seeking an accounting job. But my mentor at the time, told me that accounting would not be enough of a challenge for me, and suggested I take positions first in credit, then in the pension management group, instead. I’ve never looked back.

After six years at Merck and a few years at BellSouth and SmithKline, I became the deputy director of the Virginia Retirement System.

Skorina: That’s a big fund. How did that work out?

Cahill: Let’s just say my year at a public pension system was a valuable learning experience which confirmed my enthusiasm for the private sector. When Xerox called, I jumped at the opportunity.

Skorina: Your decade at Xerox was clearly your step up into the investment-management big leagues. You became Deputy CIO. How did it happen?

Cahill: Bob Evans, the chief investment officer of the Xerox pension, knew me slightly from my work in the corporate pension world. He had a position open and was trying to reach me. Somehow he got my mother’s number in New Jersey, and he called her saying he wanted to offer me a job. My mother said, well that’s nice but I don’t give my daughter’s number out to anyone, so she’ll call you if she’s interested. Well, he got a very fast call-back! And I wound up spending the next ten years at Xerox.

(Bob Evans headed Xerox’s pension fund from 1977 to 1992, growing their assets to $5.5 billion. He retired in 1994.)

Skorina: So what do you really like about the money-management business? And, I suppose, by inference, what do you think would attract young women thinking about making a career there?

Cahill: I love the complexity and dynamic nature of the job. It’s a global business, with new developments literally 24/7. I get to meet and work with really smart people and I read and learn constantly.

But it’s more than just markets. It’s really running a business. I manage people, controls, and cash-management. I’m making judgement calls on managers all the time. We are constantly talking to managers and looking for new ideas and alignment of interests. It’s a very challenging job.

Skorina: How do you stay on top of all that? What’s your process like?

Cahill: Well, to begin with, I work out 6 days a week; I listen to some analyst on the squawk box almost every day; I have a staff meeting once a week; and a portfolio review meeting every other week. And during the week I set aside material to read on the weekend

When I go on manager trips I usually take about fifteen meetings in a week. And, of course, my team does a lot of prep-work. They will have had maybe four meetings before I even get involved.

Skorina: You’ve mentioned the importance of mentors in your career, and you had a great one in Myra Drucker, who took over the Xerox CIO job from Bob Evans in 1992.

Cahill: Mentors are important to both men and women. It takes time for gender roles to evolve, especially in finance. In popular culture, certainly, we see Wall Street execs as men in dark suits and suspenders. But things are changing.

Skorina: And Myra was one of the change-agents?

Cahill: Myra was a great teacher, and very good with the details. Her process for interviewing external managers, for instance, was impeccable. She was a friend to many young professionals, both men and women.

[Myra Drucker headed the pension funds at both International Paper and Xerox, and she trained a number of people who went on to important careers. They include Joseph Boateng, the CIO at Casey Family Programs (Foundation); Matthew Wright, who went on to run the Vanderbilt endowment for five years; Madoe Htun, CIO at the William Penn Foundation; and Connie Caperella; who headed the pension fund at Pitney Bowes; among others. See “Myra Drucker’s Amazing CIO Academy” in our archive.]

It’s here: https://www.charlesskorina.com/?p=307

Skorina: And now you’re the old pro doing the mentoring. Full circle. How does that feel?

Cahill: It feels good. At some point you’re suddenly the adult in the room who’s supposed to have all the answers. You don’t really, but you try to rise to the occasion.

In 2008, for instance, when the market cratered it was my job to stay calm, and then to keep my staff and university colleagues calm, even though there were a lot of sleepless nights. But we pulled together, took advantage of market opportunities and had some very good returns in following years.

I love working with this team, seeing individuals grow and knowing that the work they’re doing is satisfying to them. And helping young women find their feet in the financial world is especially important. It’s a way to remember and pay back the people who went out of their way to teach and encourage me.

Skorina: thank you Mary. It’s a pleasure speaking with you.

Cahill: you’re welcome Charles.

————————————————–

The Skorina Letter:

Each issue explores how the world’s most accomplished asset managers think and invest. Original content includes profiles and interviews with industry veterans and research on compensation and investment performance.

Our insights and commentary come from our clients – board members, CEOs, chief investment officers – and the global investment community within which we work as executive search professionals.

Institutional investors operate at the crossroads of capital, talent, and ideas, shepherding over seventy trillion dollars in global assets. It’s a constantly evolving spectacle and The Skorina Letter gives readers a ringside seat.

Prior issues can be found in “archives” on our website, www.charlesskorina.com