OCIOs: reconnecting the dots

by charles | Comments are closed10/09/2024

“The true sign of intelligence is not knowledge, but imagination”

—Albert Einstein

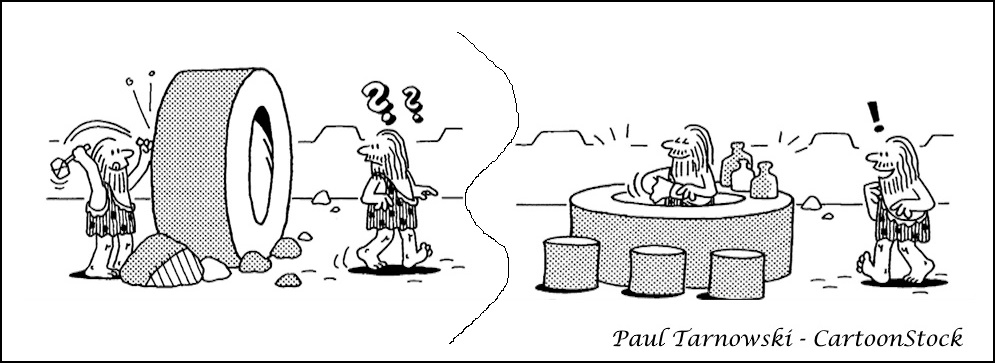

You don’t have to reinvent the wheel to build a successful outsourced chief investment officer (OCIO) business, but it sure helps to connect the dots.

Despite countless paeans to AI these days, when it comes to OCIOs, there is very little new under the sun, and as most wide-eyed newcomers eventually come to admit, discretionary service providers are notoriously hard to scale.

Jon Hirtle of Hirtle Callaghan launched the first conflict-free, independent investment office managing family and institutional money in 1988. Forty years later, the OCIO industry is bifurcated, highly diverse, and intensely competitive with hundreds of OCIOs, RIAs, banks, brokers, and asset managers competing for discretionary customers. It’s a jungle out there.

But with the formidable forty-year swell in private equity, venture capital, credit, and infrastructure investing, OCIOs are matching capabilities with clients in creative new ways.

Dean Keith Simonton, Professor Emeritus of Psychology at the University of California, Davis, posits that “genius hunts widely—almost blindly—for a solution to a problem, exploring dead ends and backtracking repeatedly before arriving at the ideal answer.”

Boutique providers – that’s pretty much everyone under about one-hundred billion in AUM – such as Hirtle Callaghan, Commonfund, Makena, and McMorgan & Company, have spent years polishing their services and honing their competitive advantage. As the market grew and providers proliferated, firms adapted, combining traditional prix fixe solutions with selective a la carte services.

According to Cerulli Associates, “Amidst inflation, interest rate hikes, market volatility, and the changing implications of geopolitical conditions, asset owners are increasingly drawn to the OCIO model for the management of sleeves for alternatives and private asset classes for which they do not think they have the appropriate level of expertise.”

It’s all about access

Access to the crème de la crème of alternative managers challenges most tax-exempt institutions and family offices, but OCIOs, with the diversified endowment model as their template, have spent years sourcing and cementing relationships with top private equity and venture capital professionals. Providers now offer a variety of alternative sleeves for those who prefer specialized participation.

A few prescient firms have gotten even more creative. McMorgan & Company, for example, has an infrastructure fund not common in boutique outsourcers.

A few years ago, the company established a relationship with OMERS Infrastructure, the infrastructure investment arm of OMERS, a large Canadian pension plan that has been investing directly in infrastructure since 1999. This relationship has led McMorgan to create a fund which co-invests in certain deals alongside OMERS Infrastructure.

There’s nothing new about infrastructure funds, plenty of firms in the mix, but few boutiques take the time to build something special. The McMorgan Infrastructure Fund hews a path for prudent tax-exempt and family office investors.

Final thoughts

We’re in the executive search business, for those that haven’t already guessed, along with OCIO search and selection and the occasional consulting assignment, so job seekers send us resumes and call almost every day.

Most candidates hammer on about what they’ve got and what they want. Surprisingly few spend much time asking about what our clients want, the folks we care most about.

But now and then someone applies that “second level thinking” Howard Marks talks about. They surprise us by connecting the dots, by carefully researching a potential employer and asking, what does this company need and how can I give it to them, rather than ramble on about what they, the job seeker, wants.

Here’s an example, a story we heard some while back.

Read More »