OCIOs: the price of impatience

by charles | Comments are closed09/18/2024

“The thing that never happens just happened again” – Viktor Chernomyrdin, former Prime Minister of Russia

Our latest Outsourced Chief Investment Officer spot-check notes a steady stream of RFPs, mostly under eighty million AUM, Obama Foundation excepted.

Some client institutions are looking to change providers, unhappy with recent returns. But if better performance is what they’re after, a word of caution: their current OCIO’s best years might be just beginning.

Even Berkshire Hathaway, with one of the best runs ever, “has had 10 negative return years, four years where it has fallen greater than -20% and six years where it underperformed the S&P500 by more than -20%.”

Apples and oranges

How should one compare OCIO returns? Commonfund considers comparisons “a complex apples-to-oranges exercise because there are so many variables to consider. Performance outcomes are as unique as the institutions themselves.”

We keep track of over one hundred OCIOs. Each has its own culture, client mix, investment style, and biases. Some firms focus on indexing and liquid markets, others on alternatives, still others on ESG. Some customize portfolios for clients, others don’t.

When we speak of past performance we are referring to history. But forecasting what’s to come is mostly an expression of hope. And hope is not a strategy, or reason to change providers.

According to Business Insider, “the S&P 500 average return over the past decade has come in at around 10.2%, just under the long-term historic average of 10.7%.”

Does this mean all OCIOs or clients should have indexed and gone home? Are they sure these public market returns are baked in for the next ten to twenty years? As Brad Conger at Hirtle Callaghan wrote a while back, “not even the most insightful among us can see around corners.”

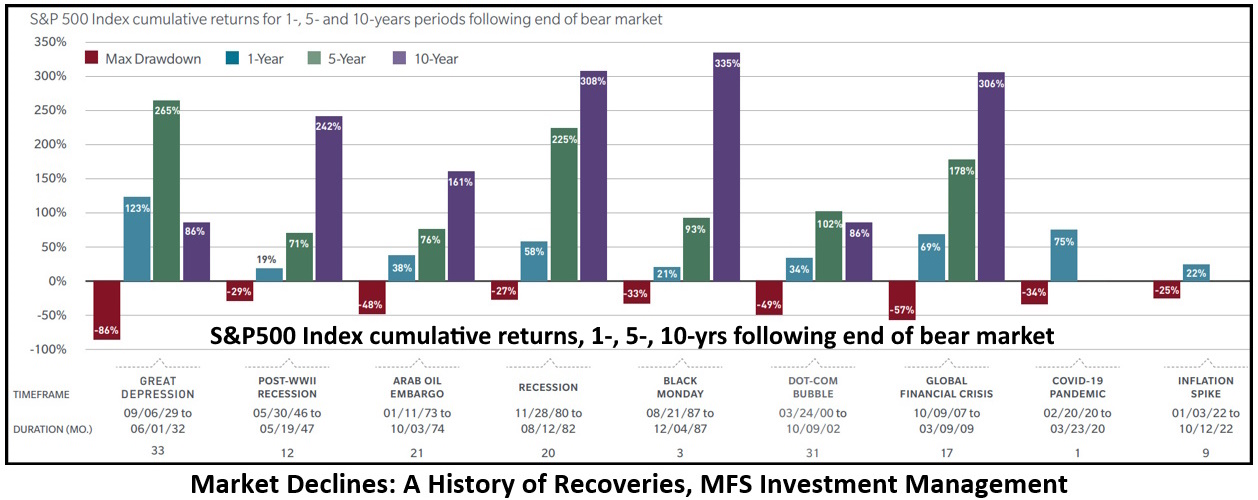

“Historically, markets have posted strong long-term gains following declines,” but that’s over ten years and more. For most investors, or board members, patience is not their strong suit. Unfortunately, there’s usually a price to pay for impatience.

People come first

We begin an OCIO search and selection assignment by looking at the talent. Who are they, what is the turnover, how long has the firm been in business, and what’s their plan for staying on top? Then investment philosophy, process, and incentives. Then performance.

In the end it’s the ability to adapt, revitalize, and deliver over time that’s key. Brown Brothers Harriman, Goldman Sachs, J.P. Morgan, and Morgan Stanley have been around for more than a century and they keep signing up clients.

But how about the eighty or so OCIO firms in our last directory under fifty billion AUM? Hirtle Callaghan, Commonfund, and a few others have engineered smooth successions. Yet most still have first-gen founders in place or soon to retire. What comes next?

There’s a related issue. What happens when outside money enters the picture? Will the passion and focus remain? Or will the firm lose the founder’s intensity and become one more commodity in a collection of disposables?

Final thoughts

As we’ve said many times before, given the talent and resources in this country, the chances of building top-ranked, enduring investment teams capable of vaulting over the competition are slim to none without superior technology, blockbuster products, or a relentless M&A machine.

If the goal is to deliver exceptional performance, service and solutions and be there for the client over decades, forget about reinventing the wheel. Talk to your competitors. Some might make fine partners.

———————————————–

Time to update our OCIO directory

It’s time once again to update Skorina’s Outsourced Chief Investment Officer (OCIO) directory. So please send us any changes in contact information (name, phone, email) and AUM as of June 30, 2024.

Prospective clients can’t reach you if they don’t know how to find you.

—Charles Skorina

Read More »