A lot of success in life and business comes from knowing what you want to avoid ―Charlie Munger Our fall 2024 Outsourced Chief Investment Officer (OCIO) update features one-hundred-four service providers with pertinent particulars on each. We include names, numbers, emails, and titles of business executives at each firm ready to take your call. Our goal is to help families and institutions locate, review, and connect with full-service discretionary outsource investment managers. Our directory makes it easy for prospective clients to reach them. No ads, no paywall, no charge. A solid six months For the six months ending June 30th, 2024, total OCIO AUM hit a record $4.456 trillion dollars on about $432 billion in new business, an impressive 10.73 percent gain. But it’s not quite what it seems. – June 30, 2024 Change in OCIO AUM December 31, 2023 OCIOs Firms per group AUM per group % of total AUM per group 6-months ending June 30, 2024 Firms per group AUM per group % of total AUM per group $ bn # $ bn % $ bn % # $ bn % over $100bn 13 $3.046 68% $430 16.4% 12 $2.616 65% 50 – 99 9 656 15 -91 -12.2 10 747 18 20 – 49 13 345 8 95 38 10 250 6 10 – 19 14 205 5 -2 -1 14 207 5 5 – 9.9 19 136 3 -9 -6.2 20 145 4 1 – 4.9 25 57 1 2 3.6 24 55 2 under $1bn 11 6.5 0.1 1 4.7 10 5.9 0.1 – 104 $4.46tn – $426bn 10.73% 100 $4.02tn – * See complete company listings by group in the appendix below OCIOs and the multiverse The OCIO business operates in two distinct realms, the mega-buck land of corporate pensions and a parallel universe…

OCIOs: reconnecting the dots

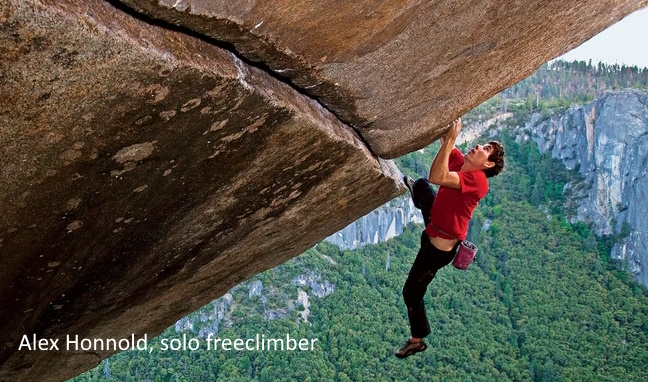

“The true sign of intelligence is not knowledge, but imagination” —Albert Einstein You don’t have to reinvent the wheel to build a successful outsourced chief investment officer (OCIO) business, but it sure helps to connect the dots. Despite countless paeans to AI these days, when it comes to OCIOs, there is very little new under the sun, and as most wide-eyed newcomers eventually come to admit, discretionary service providers are notoriously hard to scale. Jon Hirtle of Hirtle Callaghan launched the first conflict-free, independent investment office managing family and institutional money in 1988. Forty years later, the OCIO industry is bifurcated, highly diverse, and intensely competitive with hundreds of OCIOs, RIAs, banks, brokers, and asset managers competing for discretionary customers. It’s a jungle out there. But with the formidable forty-year swell in private equity, venture capital, credit, and infrastructure investing, OCIOs are matching capabilities with clients in creative new ways. Dean Keith Simonton, Professor Emeritus of Psychology at the University of California, Davis, posits that “genius hunts widely—almost blindly—for a solution to a problem, exploring dead ends and backtracking repeatedly before arriving at the ideal answer.” Boutique providers – that’s pretty much everyone under about one-hundred billion in AUM – such as Hirtle Callaghan, Commonfund, Makena, and McMorgan & Company, have spent years polishing their services and honing their competitive advantage. As the market grew and providers proliferated, firms adapted, combining traditional prix fixe solutions with selective a la carte services. According to Cerulli Associates, “Amidst inflation, interest rate hikes, market volatility, and the changing implications of geopolitical conditions, asset owners are increasingly drawn to the OCIO model for the management of sleeves for alternatives and private asset classes for which they do not think they have the appropriate level of expertise.” It’s all about access Access to the crème de…

OCIOs: the price of impatience

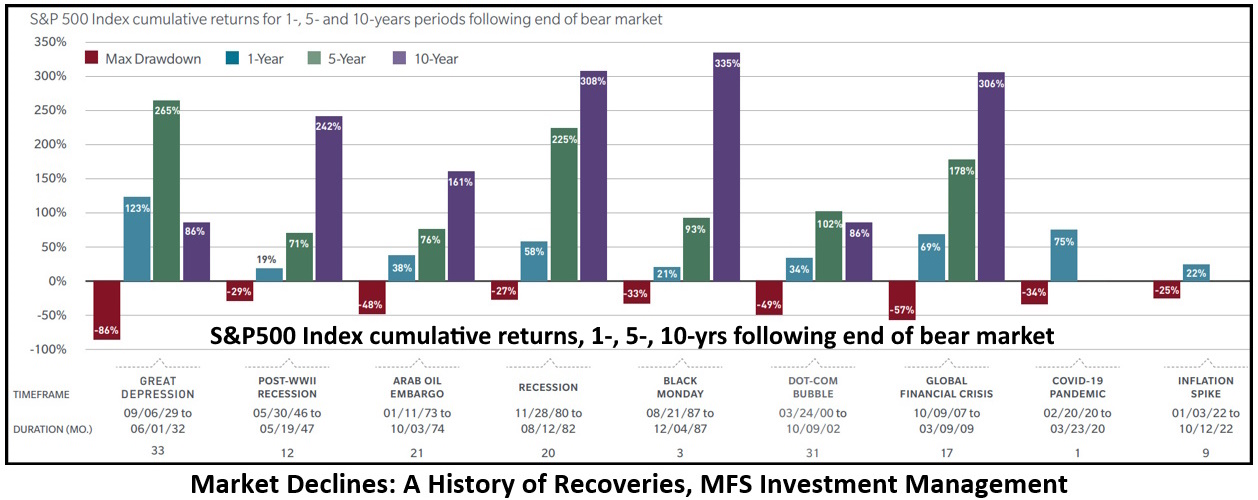

“The thing that never happens just happened again” – Viktor Chernomyrdin, former Prime Minister of Russia Our latest Outsourced Chief Investment Officer spot-check notes a steady stream of RFPs, mostly under eighty million AUM, Obama Foundation excepted. Some client institutions are looking to change providers, unhappy with recent returns. But if better performance is what they’re after, a word of caution: their current OCIO’s best years might be just beginning. Even Berkshire Hathaway, with one of the best runs ever, “has had 10 negative return years, four years where it has fallen greater than -20% and six years where it underperformed the S&P500 by more than -20%.” Apples and oranges How should one compare OCIO returns? Commonfund considers comparisons “a complex apples-to-oranges exercise because there are so many variables to consider. Performance outcomes are as unique as the institutions themselves.” We keep track of over one hundred OCIOs. Each has its own culture, client mix, investment style, and biases. Some firms focus on indexing and liquid markets, others on alternatives, still others on ESG. Some customize portfolios for clients, others don’t. When we speak of past performance we are referring to history. But forecasting what’s to come is mostly an expression of hope. And hope is not a strategy, or reason to change providers. According to Business Insider, “the S&P 500 average return over the past decade has come in at around 10.2%, just under the long-term historic average of 10.7%.” Does this mean all OCIOs or clients should have indexed and gone home? Are they sure these public market returns are baked in for the next ten to twenty years? As Brad Conger at Hirtle Callaghan wrote a while back, “not even the most insightful among us can see around corners.” “Historically, markets have posted strong long-term gains following declines,”…

OCIO update, spring 2024, a Record Run

4400 registered foals, and only 16 or 18 of them make it to the Derby ― John Sosby, Claiborne Farm What a year. For the twelve months ending December 31st, 2023, total outsourced AUM managed by the one-hundred-two firms in our latest OCIO Directory reached a record $4.1 trillion dollars thanks to $686 billion in new business, a whopping twenty percent increase. This chart shows which OCIOs gained the most AUM for the year. We grouped the firms by size, numbers per group, and growth in dollars and percentage. OCIO firms grouped by AUM No. of firms AUM % increase $ increase % of $4.1tn AUM Over $100bn 12 $2.616bn 24.44% $514bn 64% $50 – $100bn 11 809 12.72 91 20 $20 – $50bn 10 250 12.16 27 6 $10 – $20bn 15 223 16.82 32 5 $5 – $10bn 20 145 12.64 16 3 $1 – $5bn 24 57 15.07 7.5 1 Under $1bn 10 5.9 4.74 14mm 1 – 102 $4.1tn – $686bn – * See complete company listings by group in the appendix below Winner takes all Here’s what caught our attention. Less than a quarter of the firms on our list manage most of the money, about $3.4tn, while the other seventy-nine outsourcers divvied up the remaining $681bn. The twelve largest OCIOs alone control over $2.6tn or sixty-four percent of the outsourced total. As for new business in 2023? Almost three-quarters of last year’s gain accrued to these twelve largest providers, thirteen percent went to the next eleven, and those dogged seventy-nine fought for the remaining twelve percent, roughly $83bn. The Twelve $420,000,000,000 – Mercer $329,400,000,000 – Goldman Sachs $319,000,000,000 – BlackRock $243,200,000,000 – Russell $193,500,000,000 – SEIC $182,100,000,000 – MS Graystone $169,800,000,000 – CAPTRUST $164,200,000,000 – J.P. Morgan $163,000,000,000 – WTW $157,000,000,000 – State Street…

The OCIO Mirage

The outlook wasn’t brilliant for the Mudville nine that day: The score stood four to two, with but one inning more to play … Casey at the Bat, Ernest Lawrence Thayer Hope springs eternal in the OCIO space. Each year confident investment officers and ardent marketeers announce their brand-new best-in-class discretionary outsourced solution. But for most of these eager rookies, few customers will come or care. Looking back over the last four decades, the best time to pitch an outsourced chief investment officer (OCIO) proposition was probably about thirty years ago when prospects were plentiful, competitors few, and margins were healthy. In today’s hyper-competitive wealth management arena, fielding a full-service institutional grade asset management team is expensive and costs are soaring for compensation, cyber-security, audits, and compliance, to say nothing of rampant regulatory hurdles and those nasty unknown unknowns. (See our charts below for detailed office cost breakdowns.) We recently completed an OCIO search and selection engagement for a sizable east coast nonprofit and found all the responding providers to be consummate professionals and serious competitors. Firms such as Hirtle Callaghan, Blackrock, J.P. Morgan, and Brown Brothers Harriman, among the stalwarts in our directory, have had years to hone their systems, service, succession, and investment capabilities. But it’s never easy. In an interview with Jon Hirtle for our 2020 OCIO review he reminisced on the firm’s early efforts to win clients. Debby [Jon’s wife] and I often talk about the financial low point when our checking account had dropped to $17. What kept us going was that everyone loved the OCIO concept. The idea of powerful, informed, energetic advocacy without the conflicts of interest that define the traditional investment industry. This Cold Cruel World It’s tough for newbies and niche players to keep up with the veterans. This year kicked…